The thought seems almost ridiculous but it seems that this is exactly what’s happening.

President Trump’s suggestion that if we’re removing statues we might as well remove the statues of the founding fathers Thomas Jefferson and George Washington both of whom owned slaves.

The comparison to the statue that started all this, that of Confederate General Robert E Lee, seems quite shocking at first glance but once you drill down it seems that many hard line left wingers are already petitioning for the founders names and statues to be removed.

You gotta love this guy. Aside from making everybody upset on “many sides” it seems that Donald has been able to finally get Americans interested in politics again, which in and of itself is a wonderful thing.

@MatiGreenspan

eToro, Senior Market Analyst

Today’s Highlights

- You’re Fired!

- Fed Split & More to Follow

- Cryptos Didn’t Quit – Now they’re on Fire!

Please note: All data, figures & graphs are valid as of August 17th. All trading carries risk. Only risk capital you can afford to lose.

Market Overview

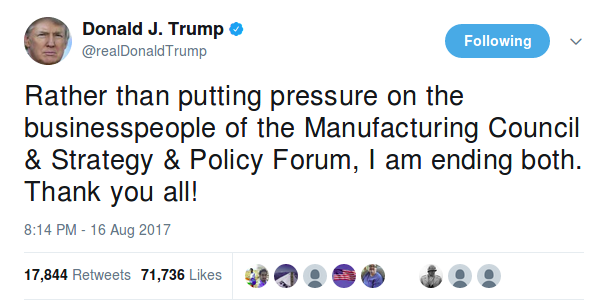

Getting ahead of the news once again, Donald Trump has tweeted that he will be disbanding two of his business advisory councils. This comes after eight members of the manufacturing council quit and there were reports that one of the councils was preparing to disband itself.

It’s not difficult to imagine what type of pressure he’s talking about.

The stocks seemed poised for a very positive day until this message hit the news. The Wall Street Journal reports that many buy orders were cancelled immediately following the tweet.

So instead of having a fantastic day, the US stocks ended with very minor gains.

Asian stocks were rather flat as the US – North Korea conflict has been abruptly shoved to the back burner making investors in China and Japan unsure of how to proceed.

The opening in Europe today is quite telling as the most major indices there are starting out in red.

The Minutes…

…of the FOMC’s last meeting were released with some rather shocking news. It seems that many of the Fed members were in favour of announcing a date to begin unwinding the balance sheet at last months meeting.

The US Federal Reserve is currently holding approximately $4.5 Trillion worth of assets that it bought since the financial crisis in order to sustain markets and bring them where they are today. Over the past few months the Fed has been toying with the idea of gradually selling off some of these assets but nobody really imagined that they are this close.

The US Dollar was already under pressure when the news broke but this sudden shift in reality caused it to fall a bit further…

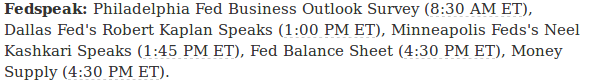

We can expect this debate to be played out further in upcoming fed speeches and events, of which there are many coming right up.

Also keep an eye open for the meeting minutes from the European Central Bank that will be released 13:30 Frankfurt time.

There is a very similar situation happening there. Only here, the debate is when to start reducing the asset buying program, which is still ongoing.

Crypto’s Don’t Quit

After what turned out to be only a miner retracement, crypto markets are back on their feet and forging new record gains. The market cap of all the cryptocurrencies in circulation reached a new high of $142.8 Billion earlier this morning.

The total pullback on bitcoin as seen on this chart was rather sizable but actually really small when we compare it to the amount of gains we’ve been seeing lately.

From peak to trough BTC fell $594 in the span of 11 hours before turning around again.

At the moment we’re seeing some resistance at $4,400. Of course a break of this resistance point would be considered an extremely bullish sign.

Thanking everyone for the amazing feedback. Your comments and questions are my main inspiration for writing.

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)