Leverage, Deposit – How Does It Work?

Many traders choose Forex market because of possibility of using leverage. The most popular leverage on Forex market is 1:100. What does it mean...

Ten Reasons to Keep Track of Volume

What is volume? Volume is the number of shares or contracts that exchange hand in a given period. The data is most often presented in the...

Vanilla Options – Trade Like a Pro

A vanilla option is just an expression meaning a basic formula. An ice cream that is vanilla contains just one simple flavour.

Definition

A vanilla option...

Cognitive Biases in Trading – Part 2

This is second part of the article about cognitive biases. When any professional sportsman is interviewed, the first thing he talks about is often eradicating...

Cognitive Biases in Trading – Part 1

Although it is a sweeping generalization, it li likely that every trader at every level of knowledge and experience suffers from cognitive bias. That is...

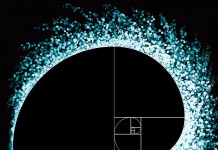

Box Theory in Trading Pt 2 – Price Action & Fibonacci

Recently we published first article about box theory. It gave a definition of box theory. In this one we can see practical uses in trading.

Box theory...

India’s Stock Market: Nothing “Random” About It

See how beautifully India's 8-year long bull market follows a clear Elliott wave fractal pattern

By Elliott Wave International

Every day, the mainstream financial experts...

Box Theory in Trading

In a previous article ‘Supports and Resistances are Crucial to Read the Markets’ in which we described how to set levels and areas with influence...

Support & Resistance: Vital indicators for reading the market

When looking at a chart we try to disseminate levels at which the price has a tendency to change direction, to react somehow. Spotting...

Harmonic Trading: Most Efficient Patterns

Harmonic trading is another strategy presented on Comparic.com. Below we present details of the system used by Peter Drabik. He uses these patterns to...