It will be a quiet day today in terms of major economic data releases. Among other important data releases later this week, the December jobs report in the US is due out on Friday.

It will be a quiet day today in terms of major economic data releases. Among other important data releases later this week, the December jobs report in the US is due out on Friday.

Over the weekend, PMI manufacturing figures in China for December were released. NBS PMI manufacturing December figures came out at 51.4 (slightly below consensus at 51.5) from 51.7 in November, having increased quite a lot in November. PMI from both the official NBS and the private Caixin index have been strong recently. While we look for some slowing of the Chinese economy in 2017, we expect it to remain strong in the short term, as a strong housing market and infrastructure boost in 2016 have yet to peak. There are early signs that the regional tightening towards housing is starting to work. The timing of the peak of the cycle is uncertain but we expect it to be in Q4/Q1.

Commentaries, trading setups and many more are provided by FxWatcher. Try out FxWatcher service for 5 days for free!

On Friday last week, Norges Bank announced daily NOK purchases in January of 1,000m, i.e. an increase from the December pace of NOK900m. The purchases are related to the fiscal rule. The rise in purchases is not a big surprise as the 2017 rise in the fiscal use of petroleum funds together with lower oil revenues require Norges Bank to transfer a larger NOK amount from the petroleum fund and the State’s Direct Financial Interest (denominated in FX). While the NOK purchases are not aimed at strengthening the NOK, the larger use of ‘oil money’ is NOK positive and is one among several factors suggesting EUR/NOK will end 2017 lower than the current spot.

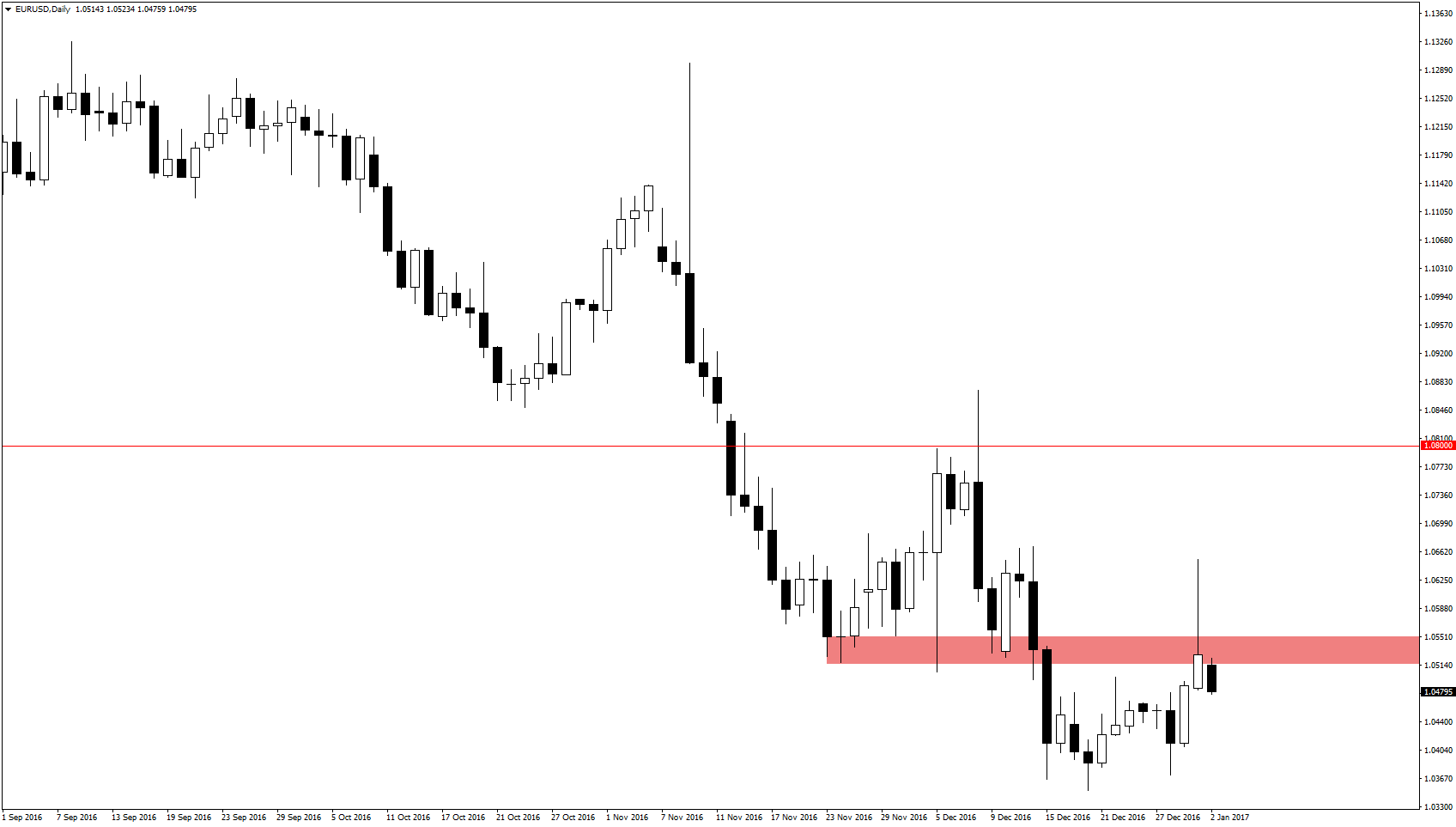

In FX markets, EUR/USD rose slightly in the final weeks of 2016, underlining how speculators covered their shorts bets (see IMM Positioning) from what are extreme levels historically in markets characterised by worsening liquidity and low risk appetite. Near term, we think the greenback (broad) could see another round of support aided by solid US economic releases this week. Yet, we still think EUR/USD downside will prove limited in coming months as valuation, positioning, fundamental flows and the level of the real effective USD will prevent the cross from reaching parity, in our view. As a result, we stick to our ‘v’ forecast profile, expecting the bottom in EUR/USD to be reached before Q2.

In FX markets, EUR/USD rose slightly in the final weeks of 2016, underlining how speculators covered their shorts bets (see IMM Positioning) from what are extreme levels historically in markets characterised by worsening liquidity and low risk appetite. Near term, we think the greenback (broad) could see another round of support aided by solid US economic releases this week. Yet, we still think EUR/USD downside will prove limited in coming months as valuation, positioning, fundamental flows and the level of the real effective USD will prevent the cross from reaching parity, in our view. As a result, we stick to our ‘v’ forecast profile, expecting the bottom in EUR/USD to be reached before Q2.