The EUR/USD is trading on a fairly stable note after the rebound in the wake of the Italian referendum. It may be the calm before the storm, as we think that the ECB may come out on the dovish side versus market expectations, which are more mixed about the stance of the ECB. If we are right, we may see a downward move in the EUR/USD, but we should note that the selling pressure may be more limited due to the EUR short-long USD positions in the markets.

The EUR/USD is trading on a fairly stable note after the rebound in the wake of the Italian referendum. It may be the calm before the storm, as we think that the ECB may come out on the dovish side versus market expectations, which are more mixed about the stance of the ECB. If we are right, we may see a downward move in the EUR/USD, but we should note that the selling pressure may be more limited due to the EUR short-long USD positions in the markets.

We expect the ECB to extend its QE purchases by six months to September 2017 and maintain the purchases at EUR80bn at the meeting tomorrow. While this is close to consensus, we consider it most likely that the ECB will extend its QE purchases again next year as we expect the wage and underlying price pressure to remain too low for the ECB to conclude that inflation is on a sustainable path towards the 2% target.

Commentaries, trading setups and many more are provided by FxWatcher. Try out FxWatcher service for 5 days for free!

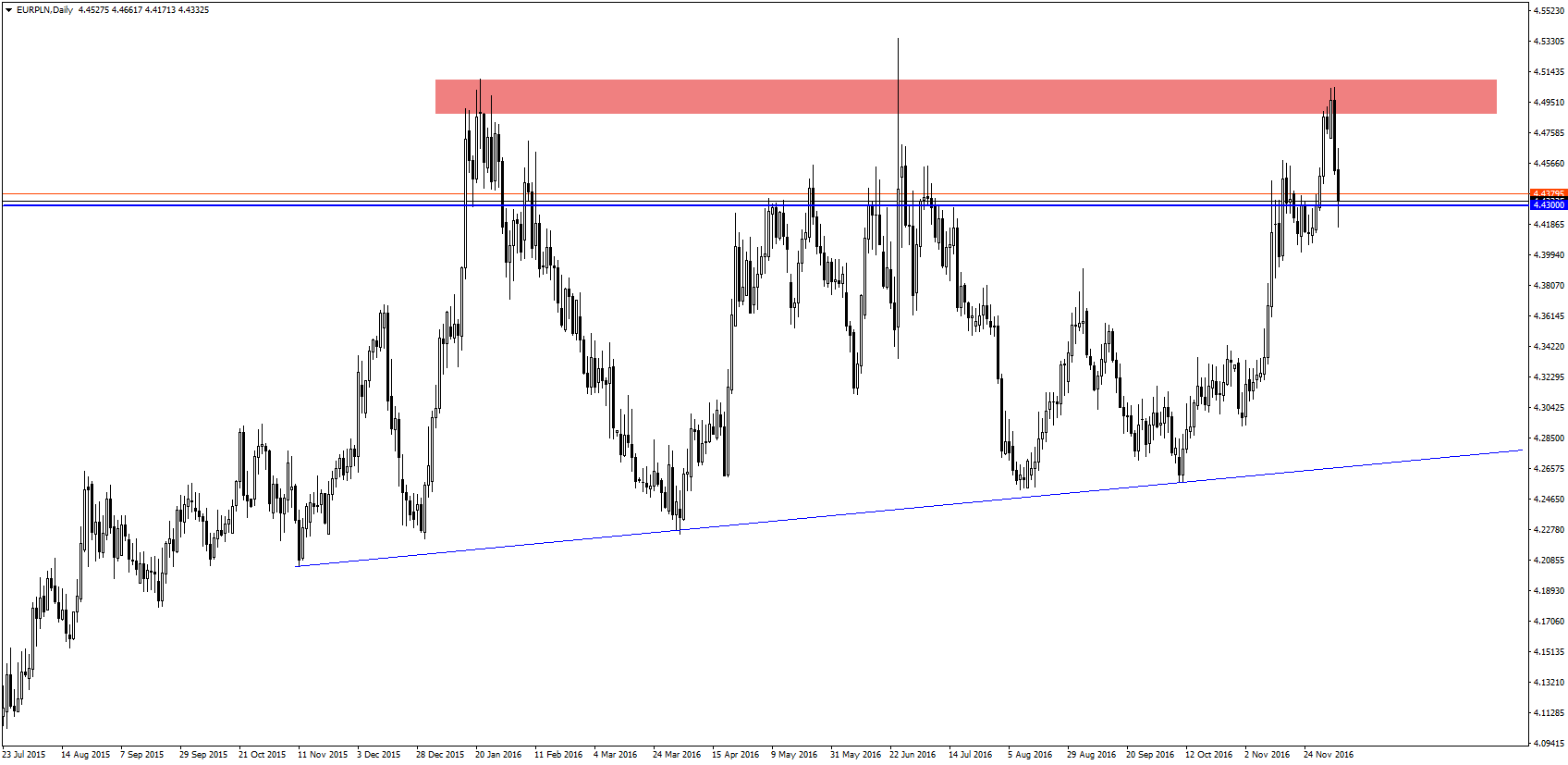

The PLN has experienced a rebound over the past two days. This is in line with our expectation, as the zloty should get support from S&P’s upgrade to the outlook for the rating to stable for Poland on Friday and the quiet market reaction to the Italian referendum result. We think the cross may move further down with our short-term financial model suggesting a fair value for EUR/PLN of around 4.43.

However, one key feature to watch is the US 10-year yield, which can be taken as a proxy for a global bond sell-off, hitting a large fixed income market such as Poland quite significantly, and the zloty in particular given the sizeable foreign ownership.

However, one key feature to watch is the US 10-year yield, which can be taken as a proxy for a global bond sell-off, hitting a large fixed income market such as Poland quite significantly, and the zloty in particular given the sizeable foreign ownership.