Yesterday in the stock markets was very successful for the bulls. Increases did not miss the trading floor in Germany. It is worth realizing, however, that last week’s drop left negative technical consequences.

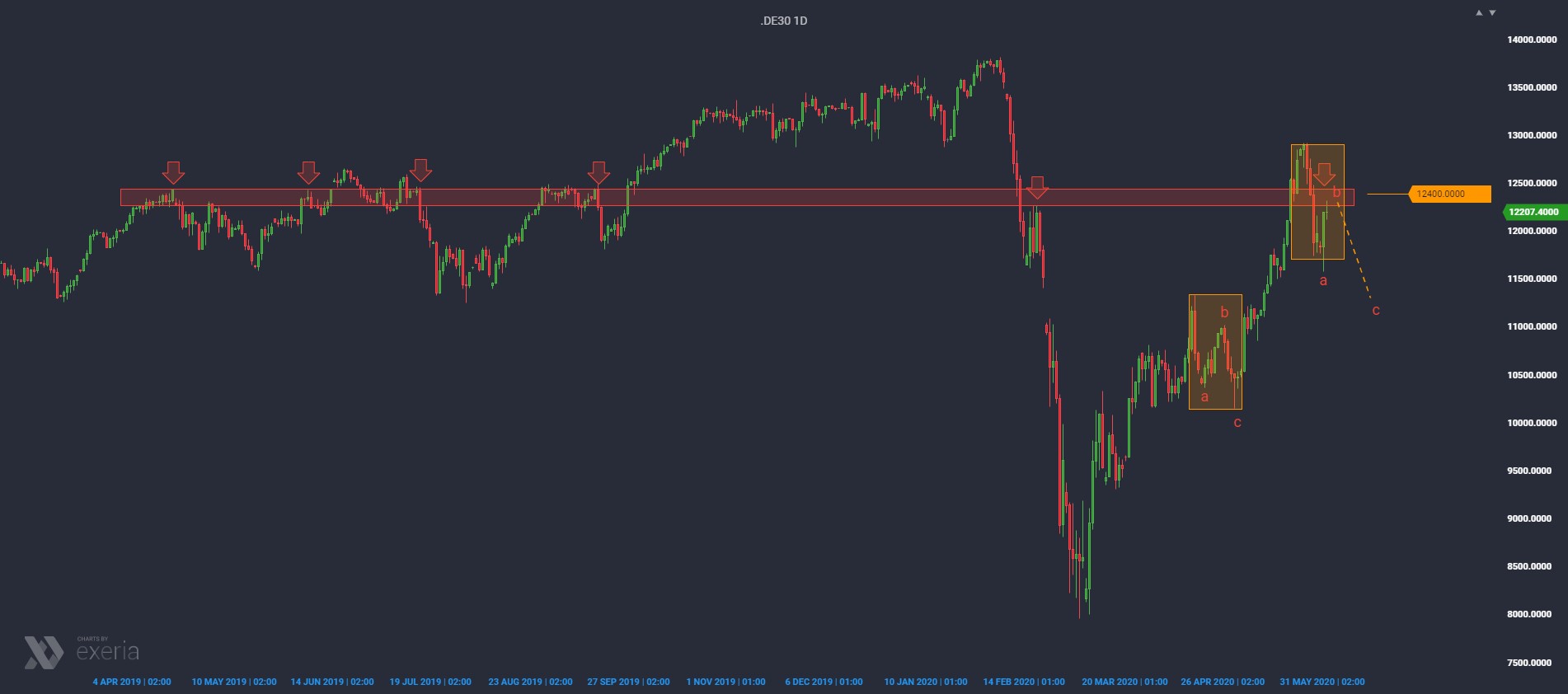

As you can see in the graph above, the area marked in red gave buyers a lot of trouble before. This is the range of approx. 12300-12450 points. DAX definitely returned below it, while yesterday’s rebound in this situation is already classified as a pullback. In other words, resisting again is often a good opportunity for a short position.

Traders using equality adjustments will notice that the current decline is roughly equal to the previous one (yellow rectangles), meaning that buyers have not given up yet. The problem is that this pattern is weakened by at least two elements.

First of all, placing current correction in the trend (returning to higher order resistance) makes the continuation of gaining scenario more risky. On the other hand, it’s worth looking at the waves (in yellow rectangles). Earlier on the same distance, the bears managed to draw a 3-wave straight correction structure.

Now, however, the entire height of the rectangle has been traversed by one downward wave (the seller has achieved more), so the current resistance zone can be a good place to initiate at least C wave.