The hottest week of December is behind us. For the first time in 9 years, the US Federal Reserve raised interest rates. This means that the crisis officially ended, and the country’s monetary policy will be gradually normalized. By the end of the calendar year only 5 sessions remained (not counting the ongoing Monday’s session). During this period, there is no major macro event planned.

Christmas and New Year’s period for many investors will be an opportunity to rest after a long year. For this reason, I do not expect that this year may bring another significant move, rather during the few next sessions we will see a return to round 11000 level.

IF YOU ARE INTERESTED IN INVESTING ON INDICES LIKE DAX30, TRY FREE FXGROW ACCOUNT

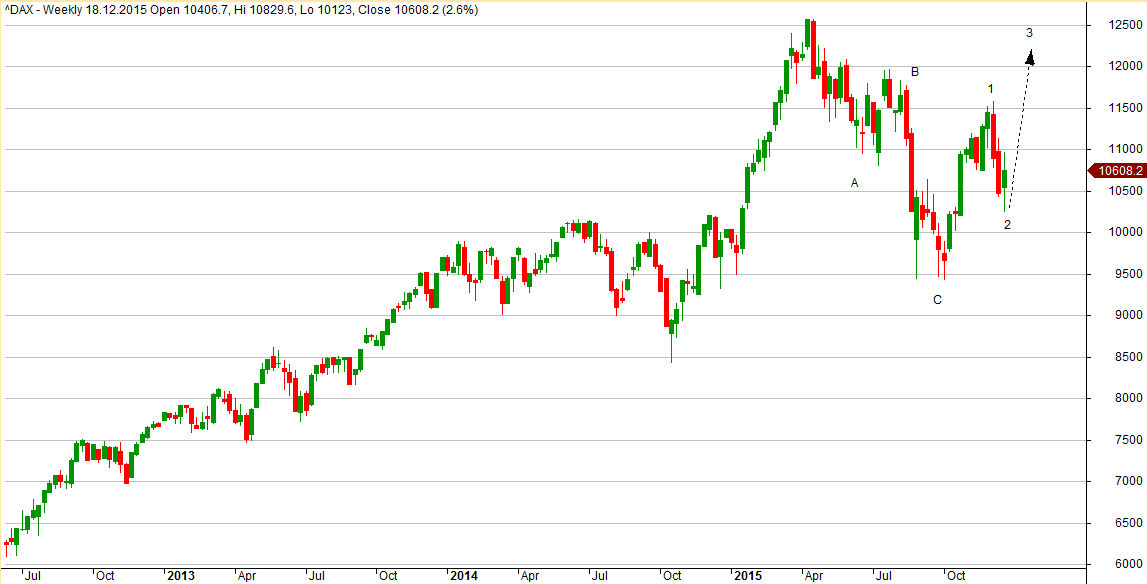

Daily TF looks favorable for the demand-side, because the decline which have occurred since early-December, were stopped by Fibo 61,8% retracement of previous upward move. It is a typical level for correction and what is more the whole downward move took a form of simple ABC correction. What is more, due to the divergent central bank polices (FED and ECB), EUR/USD should decline and this will translate into increases on the German stock market.

Elliott Wave Theory also gives us the confirmation of this thesis. Current upward movement (on Monday morning DAX Future gaining +2,5%) may be a 3rd wave. As the chart below shows, the weekly waves 1 and 2 may already be completed. Let me remind the definition of the 3rd wave – is the most dynamic one, characterized by upward gabs and increases that are really broad. Taking this definition into account we will be able to confirm or to refuse the potential 3rd wave.

As we know however, on the stock market nothing is black nor white and the above forecast also does not have to come true. Opposite assumption is that the DAX is now located inside long downward C-wave.

German and America markets are strongly correlated, so serious sale overseas (if such one appears), eventually lead also to declines in the German stock exchanges. The second scenario is now less likely, but if it comes true, it will break below 2015 lower low.