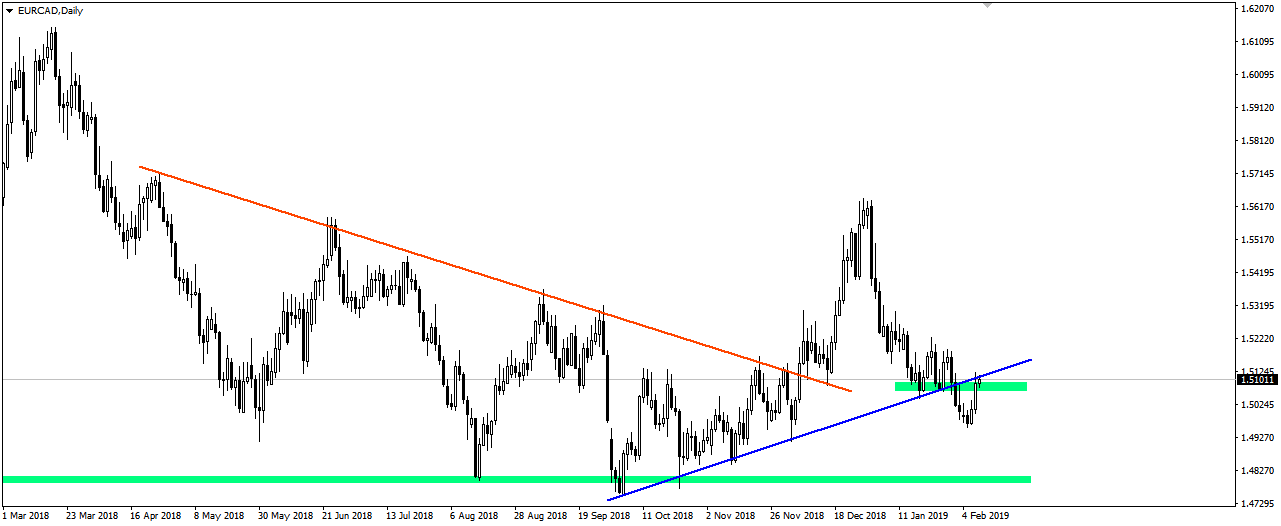

Two days of upward correction for EUR/CAD bring a hesitation at the end of the week. Since the beginning of the year we have had a strong downward trend, and now the price oscillates around the previous low, which may activate the supply side. Earlier, the upward trend line was also broken, and now we have its re-test. Following the technique itself, it is worth remembering that the rise in oil still persists, which supports the Canadian currency.

On the other hand, for the Euro there are almost only weak economic data, especially disastrous from the largest economy, i.e. Germany. Yesterday, the European Commission cut sharply the GDP growth forecasts both for this country and for the entire Eurozone. Oil prices, on the other hand, are supported by production cuts in OPEC countries. Such an arrangement may suggest a continuation of declines after the correction, with the goal around main support at around 1.48.

I trade on this instrument at broker XM, which has in its offer more than 300 other assets >>

Join us in our new group for serious traders, get fresh analyses and educational stuff here: https://www.facebook.com/groups/328412937935363/