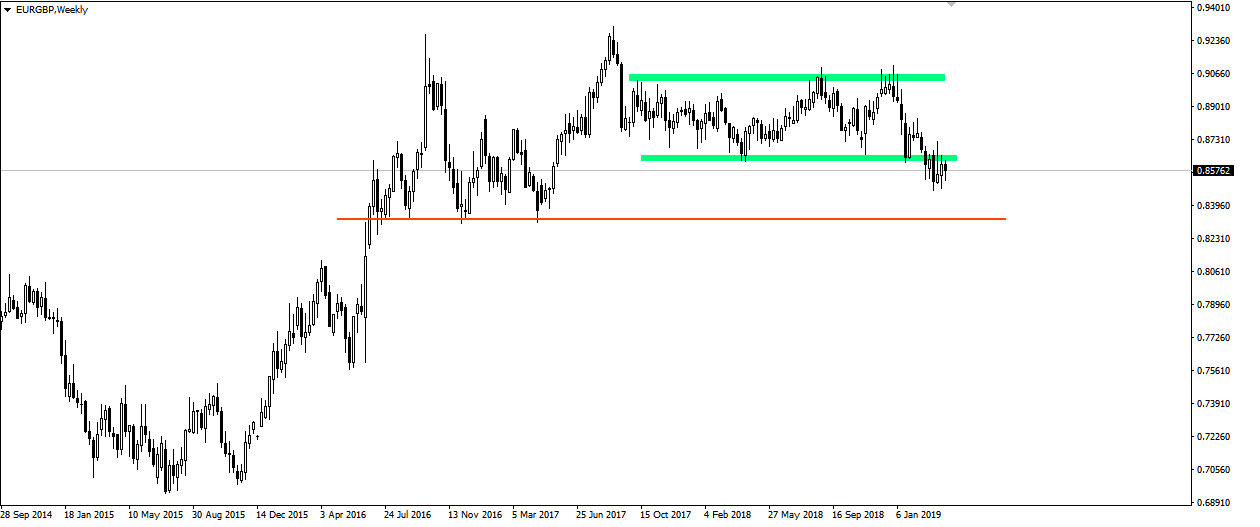

The interesting situation on pound pairs is mainly related to the Brexit saga, although the technique itself on EUR/GBP is also interesting. The price has been oscillating for a long time under the key resistance shown in the weekly chart. We have a way out of the consolidation system and a resistance re-test. Theoretically, such a system gives a better chance to the supply side. It also seems that sentiment on this pair indicates an advantage on the side of sellers. The pound is not particularly affected by the subsequent losses in voting in the British Parliament and it seems that the markets are playing for the extension of the Brexit. Yesterday’s data on the British industrial PMI were surprisingly strong. The indicator scored a strong rebound, while a fall was expected. Economic data for the Eurozone and Germany are still pale. The industrial PMI for both Germany and the zone was below forecasts. So it seems that over time the exchange rate may rebound more strongly from the resistance.

Join us in our new group for serious traders, get fresh analyses and educational stuff here: https://www.facebook.com/groups/328412937935363/

Join us in our new group for serious traders, get fresh analyses and educational stuff here: https://www.facebook.com/groups/328412937935363/