A broader look at the EURJPY currency pair was presented last June 5, when it was heading to the resistance area located above the level of 129.00. Bulls have taken the course over 130.00, however, the quotations are still under the trend line running from this year’s peaks, which means that the attitude remains bearish.

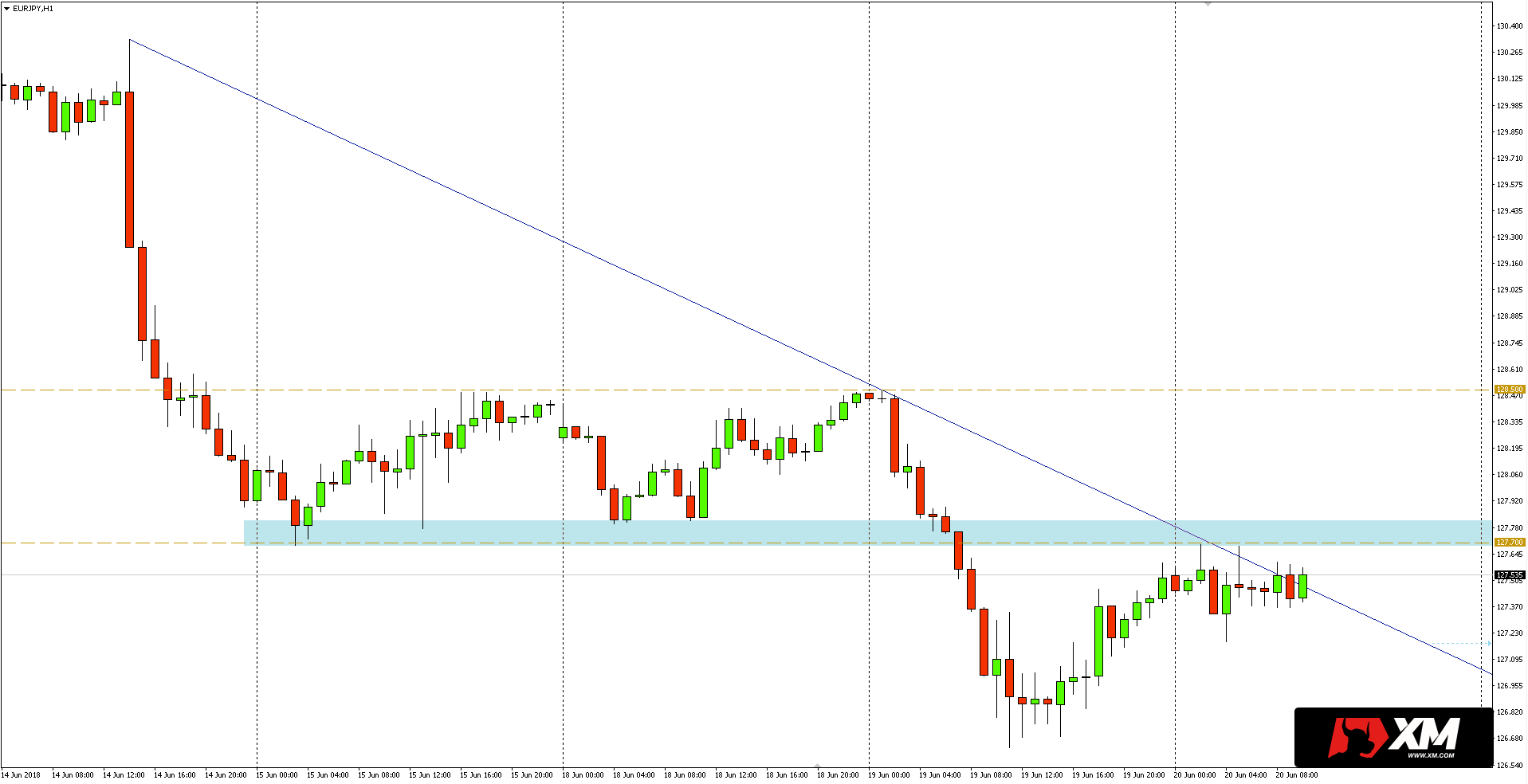

In the short-term, price is dropping from last week’s highs, which allowed to draw the downward trend line, as well as local S/R levels. As can be seen in the H1 graph below, the bears managed to overcome local support yesterday close to 127.70, and today the price has returned to this level, which additionally coincides with the mentioned trend line.

If, therefore, the dynamics of declines are to be maintained, the confluence area, where the horizontal level coincides with the trend line, should be respected. In case of this scenario, the pair after establishment of new lows this week, may go further to the key support zone close to 125.80.

Otherwise, after breaking the resistance confluence, the demand side may continue to take the price to the zone at 128.50, which includes the maximum of Friday and Monday.

Otherwise, after breaking the resistance confluence, the demand side may continue to take the price to the zone at 128.50, which includes the maximum of Friday and Monday.