Exactly at 11:00 we found out the latest November data on changes in the level of prices of goods sold by European manufacturers. Today’s report turned out to be surprisingly positive. Is opinion on the subject shared also by investors?

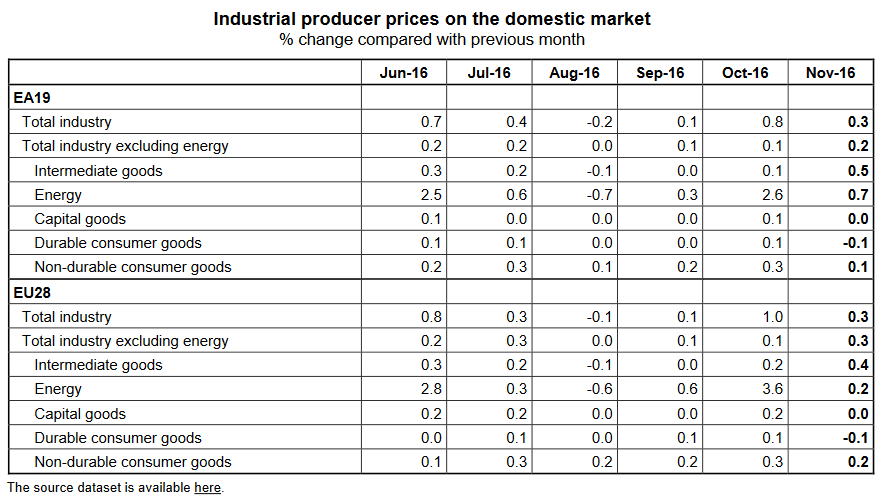

The monthly change of the producer inflation rate in Euro area was 0.3% in November – more than assumed by the market consensus of 0.1%. Despite a more positive reading than expected, the November change in level of prices of goods sold in Europe turns out to be lower than that for October.

Much more important for the market due to showing the actual trend of indicator, are annual data. Those in the case of PPI also proved to be better than expected in November and the index unexpectedly rose by 0.1% compared to the prior drop of 0.4% (projected value of the indicator was -0.1%).

The largest price increase was recorded in (still remaining part of the EU) UK (+4.4%). The highest price drop was recorded in Luxembourg (down -6.5%). Below is a portion of a Eurostat report, including tabular comparison of changes in PPI over the last few months:

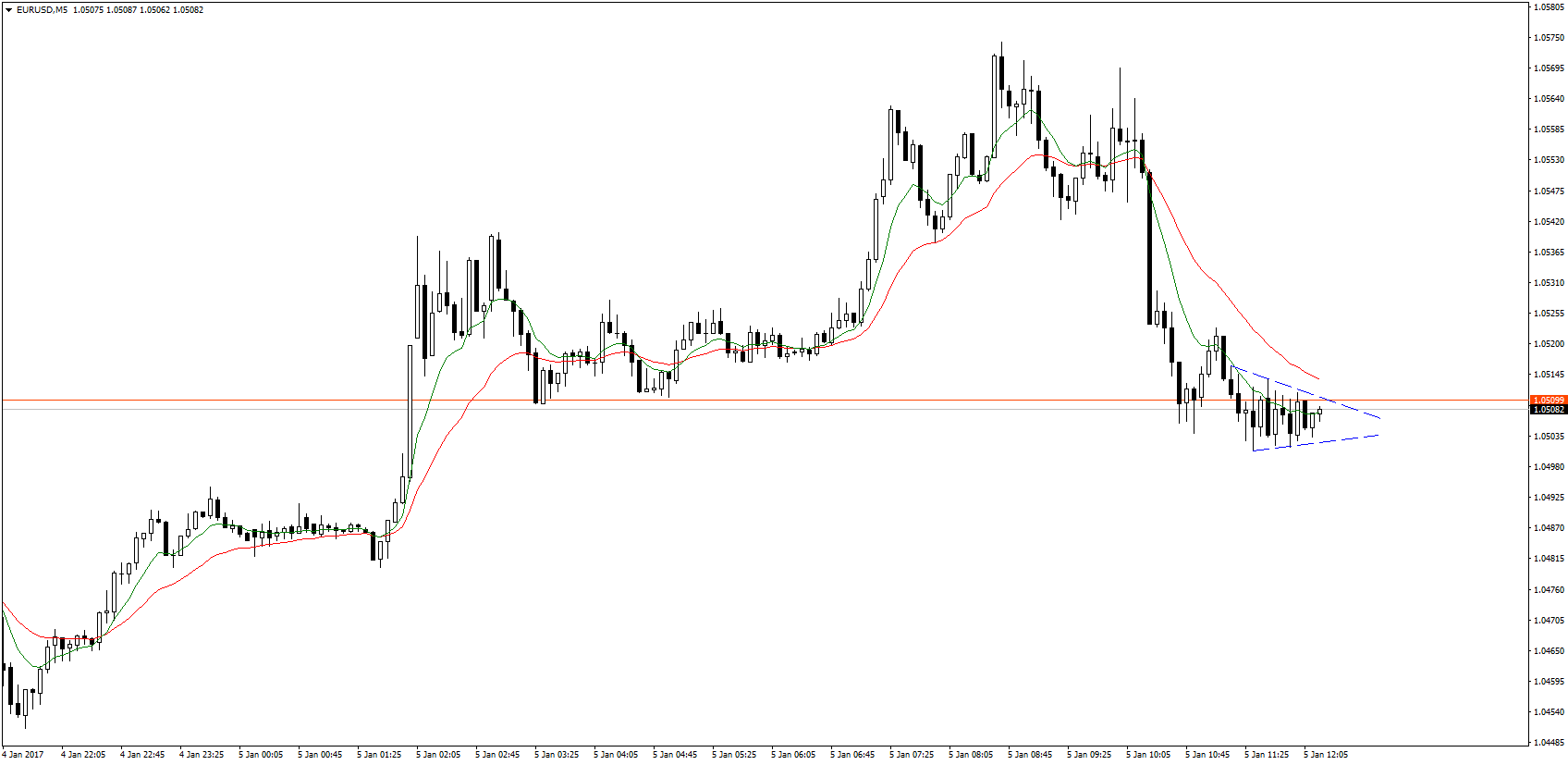

Market reaction

EUR/USD

EUR/GBP