ExoticTrading is a series of analyzes, which is created in collaboration with the broker InterTrader and is published on Comparic every Monday, Wednesday and Friday. The theme as the name suggests are so called- exotic currency pairs.

GBPNOK

In line with our previous projection, increases caused as a result of the rejection of the essential areas of support from the weekly chart 9.7600 – 9.9010 defeated already a line of local downward trend and reached as far as the vicinity of the assumed level of 10.5660. If in the near future bears does not negate overcome of this level, we expect to continue moving up at around 11.2680 resistance and downtrend line.

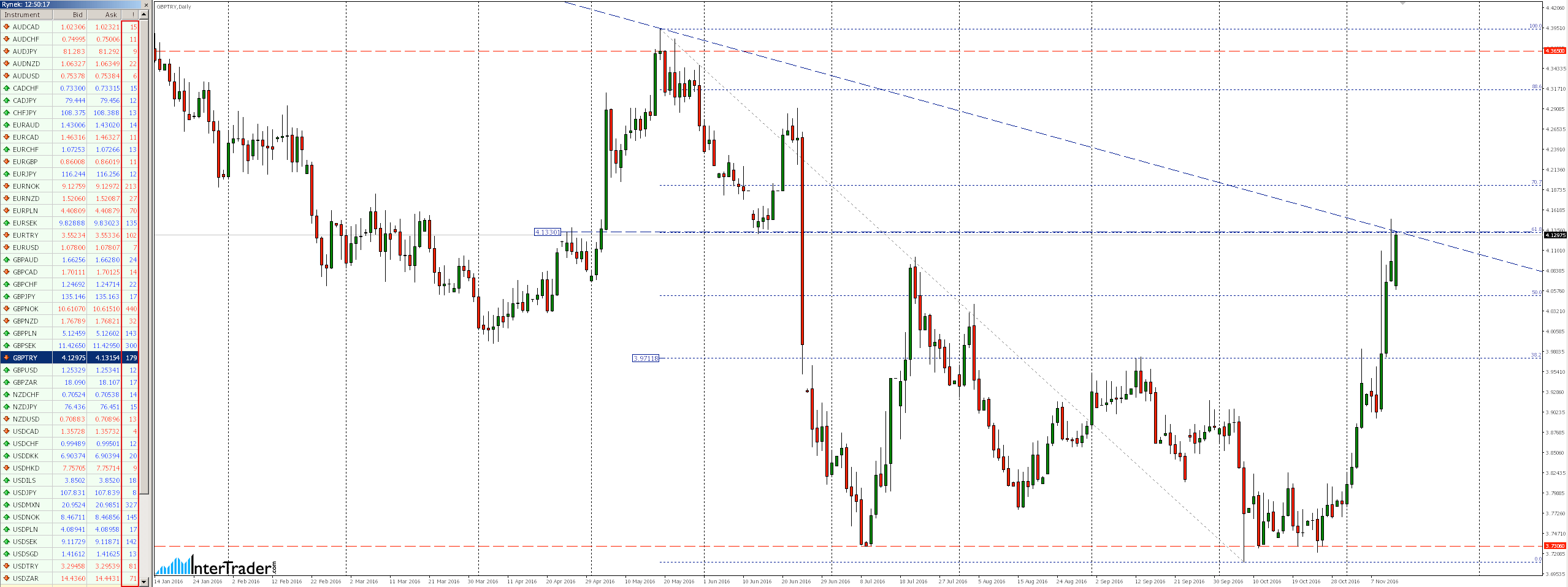

GBPTRY

As a result of ongoing from 26.10.2016r. increases market reached resistance area 4.1330 coinciding perfectly with the gold ratio of 61.8% Fibonacci from the earlier declines and a downtrend line running from September last year .

The emergence of a strong supply response in this place could initiate a downward correction in the vicinity of local support 3.9712. If the current zone will be defeated then we can expect continuation of growth even in the vicinity of the level 4.3650

To invest in exotic pairs you can take advantage of low spreadsfrom the broker InterTrader that at the time of the creation of the analysis for each instrument in turn were 44.0, 17.9 and 1.7 pips.

GBPZAR

After lasting from the second half of last week’s rally price arrived at the resistance around 18,130, breaking that could open the way for further growth even in the vicinity of 19,360 resistance. Given that during the recent increases market did not do any major downward correction and the level of 17,043 after the defeat has not been tested from the top (as support) in the near future we should expect re-testing this support area around the golden ratio 61.8% of Fibonacci correction of last week’s gains.