John Hardy

Head of FX Strategy, SaxoGroup

Summary: The US dollar has traded on the weak side over the last few sessions, although USDJPY has had a hard time maintaining direction on the coming and going of trade headlines. We look at key levels there as well as in NZDUSD, which is at a key technical crossroads. Also coverage of the traditional risk appetite proxy, AUDJPY, and EURNOK.

FX volatility has picked up ever so slightly after we noted the record lows in FX implied options volatility in our most recent posts, mostly as US-China trade deal headlines have buffeted the market action. THE USD has gone from strength to a few sessions of weakness, though not yet taking key broader measures of the USD over the edge, even if isolate pairs like NZDUSD and GBPUSD have broken major chart levels. Today we look at two USD pairs with conflicting directional potential and have a look at the risk appetite proxy AUDJPY. Also, over year-end we are curious how the action in EURNOK shapes up from here, both as a bellwether for global growth hopes, but also as we have seen episodes of extreme seasonal weakness in NOK into year end in recent years.

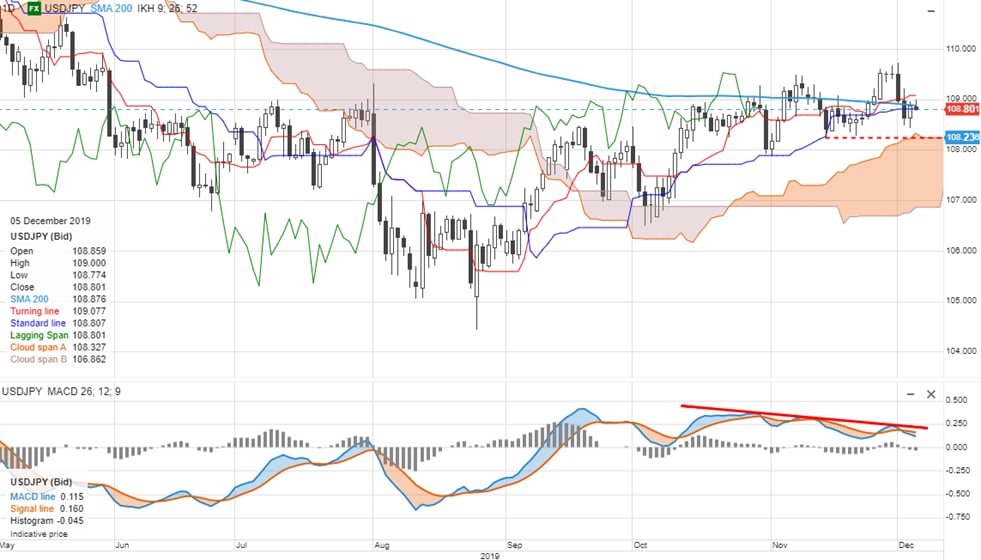

USDJPY – triple divergence, but where is follow through?

USDJPY

has experienced a second sharp rejection of new highs, creating a

“triple divergence” setup in a momentum indicator like the MACD (higher

price highs with lower momentum readings). The confirmation for this

setup starts to come in with a break below the 108.25 area marked with

the red dashed line, which is coincidentally near the top of the daily

Ichimoku cloud. Note that the recent highs were all grouped near the

very thin weekly Ichimoku cloud (not shown here). We should see

resolution one way or another in the comingg few sessions – though

USDJPY has been a treacherous one as volatility has reached historic

lows.

NZDUSD – bouncing off key technical point

NZDUSD

has reversed sharply intraday and from a very interesting technical

level – the 61.8% retracement of the last large sell-off wave from

mid-summer. Today’s action also straddled the 200-day moving average.

Note that the prior choppy rally wave into this summer was checked by

each of he first major three Fibo retracements. Also note that the

latest rally broke through a fairly well defined head and shoulders

formation neckline (the blue line). If bears are set to make a stand –

this looks like the place to do it, although we won’t have signs of a

bearish reversal unless we see a quick retreat to perhaps 0.6400-25.

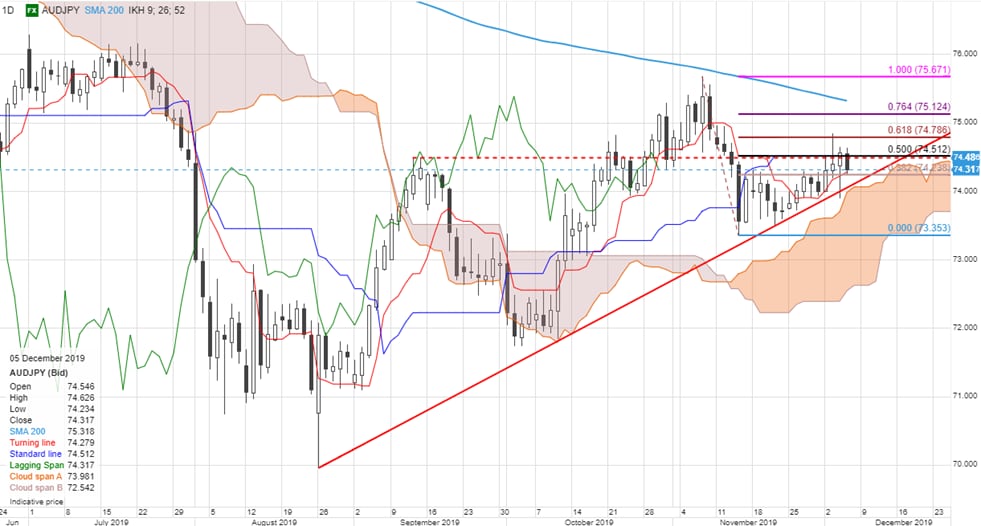

AUDJPY – the good old risk proxy, or what?

The

Aussie has suffered disproportionately to some other traditional

risk-correlated instruments on episodic Australian data weakness and the

loss of so much of its traditional yield advantage relative to other

currencies in recent years. The last couple of days of conflicting

US-China trade deal headlines has whipsawed the action both ways, but

the pair has yet to take out the 61.8% retracement of the latest

sell-off rally around 74.80 after rejecting the extension higher. The

chart is in a bit of limbo at these levels, but starts to confirm the

importance of that recent 74.80 top on a solid sell-off bar or two and

break of the trend-line, with more structural bearish implications on a

breakdown through the Ichimoku cloud.

EURNOK – twice rejected, twice shy

The EURNOK recently witness a bullish rejected of an attempted break-down lower, although it never achieved a take-out of the downside swing levels and psychological objective of 10.00 on the downside. Then, on the recent rally, a brief extension higher above the local pivot and 61.8% retracement of the sell-off from the top at around 10.181 in turn was rejected on a whipsaw in US-China trade deal headlines and rally in crude oil. Maximum limbo here for EURNOK trades, with a strong headwind for NOK bulls from seasonality as NOK has been weak into year-end several times in recent years. Clear that EURNOK bears (NOK bulls) need a takeout of the 10.00 level for a structural bearish argument, while EURNOK bulls will look for a solid close above 10.20 for at least a run to the top – something that would likely coincide with risk off/crude down/US-China trade stand-off, etc.