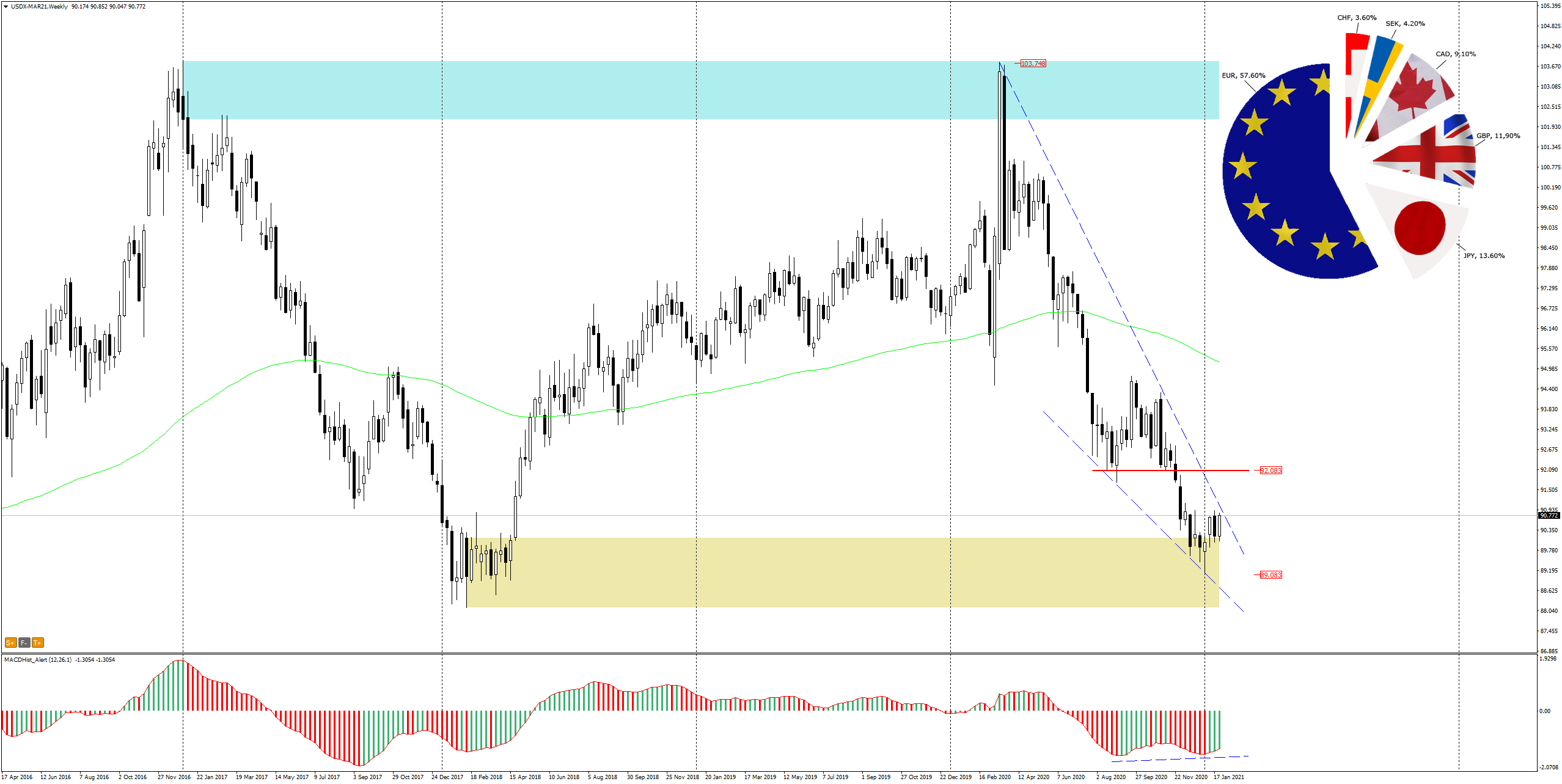

Yesterday’s FOMC meeting and Jerome Powell’s conference did not bring anything new to the Fed’s monetary policy. The dollar has been strengthening slightly since the beginning of the year, the DXY index is in the process of correcting the declines of 2020.

- dollar index up

- GBPCHF is in a downtrend

On the weekly chart after the New Year bullish weekly pin bar DXY value is rising. The index moved all last year in a downward wedge formation. Currently, it is approaching the resistance of the wedge and if it beats it the nearest demand target will be the S/R level of 92.00.

Such a corrective move on DXY would suggest an increase in the value of the dollar against the main currencies included in the index, i.e. EUR, GBP, JPY and CAD. I will write more about the euro next week (I also expect significant declines), but today I turned my attention to another European pair.

Expecting GBP to weaken, I analyzed the situation on the GBPCHF chart.

On the 4-hour chart a bearish engulfing pattern appeared.

The maximum of the “mother” candle of this formation is located in the supply zone, which positively verifies this formation as a downtrend signal. The price has already broken out of the bearish engulfment and is currently testing it from below.

A downward divergence appeared on the MACD which also suggests a downward correction.

As long as the price does not overcome the last high, the downward scenario is valid, the nearest target for supply is at 1.2090.

ongoing analysis https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo