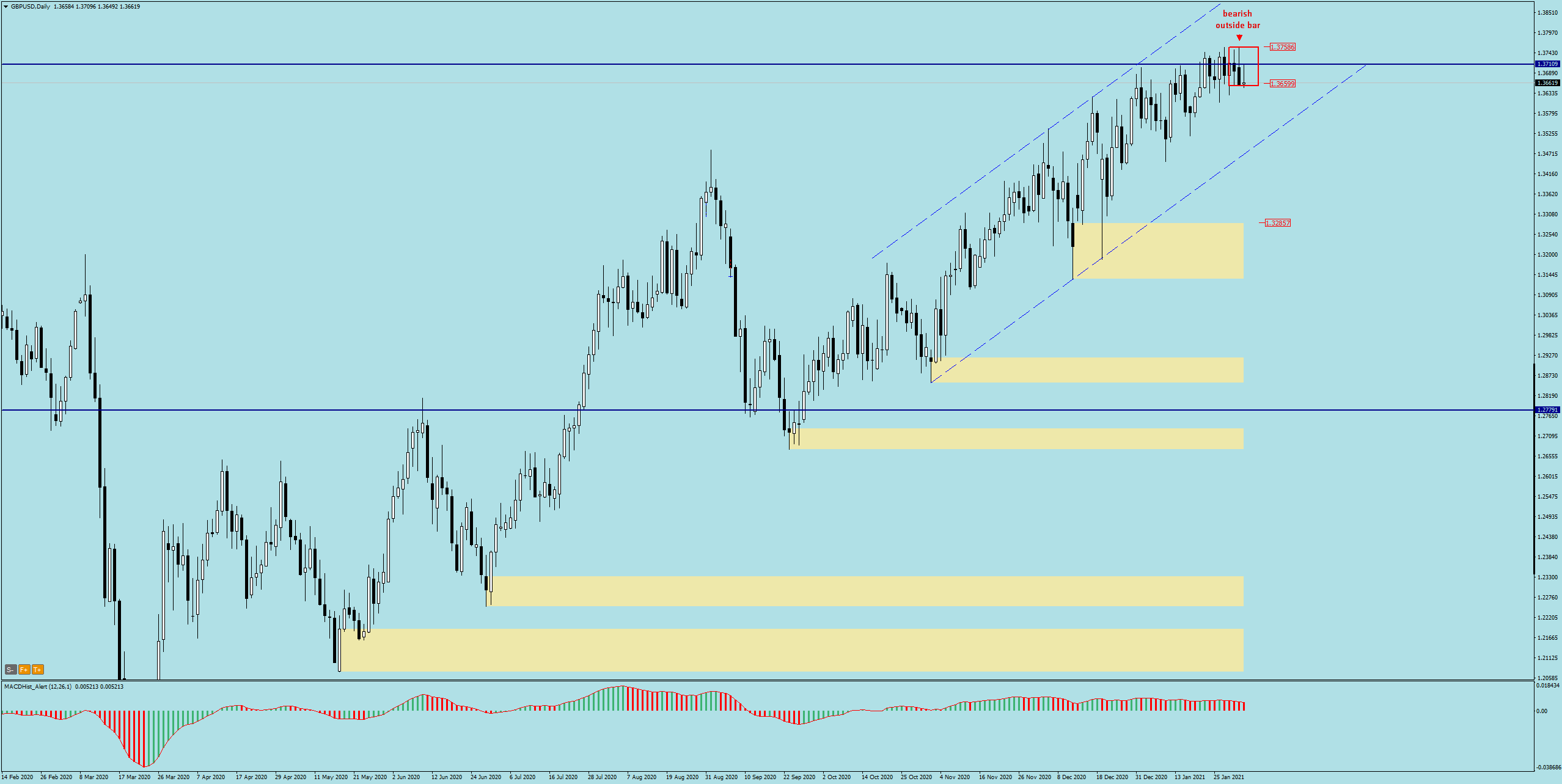

After sharp declines in the first half of March 2020, the British pound is slowly but steadily gaining value against the US dollar.

- bearish outside bar at an important level

- consolidation in the shape of a triangle

In the past week, the price of the popular cable reached the important level of 1.3710. This level in 2018, more precisely in the months of January-April, turned out to be the neckline of the double top formation, the breaking of which led to more than 1100p of declines.

Analyzing the H4 chart, we will notice that the price is currently oscillating around this level, forming a consolidation in the form of a right triangle.

Yesterday’s daily candle formed a two-candle formation – an outside bar.

Breaking the support of the triangle and the minimum of the bearish engulfing (outside bar) may be a signal for the correction of the recent growths.

The situation will be clearer if today’s daily candle closes below 1.3660 and the MACD indicator remains in a downward phase on both the daily and 4-hour charts.

An upward breakout from the triangle will negate the downward scenario and the pound will continue to rise to the nearest 1.3930 supply zone.

ongoing analysis https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo