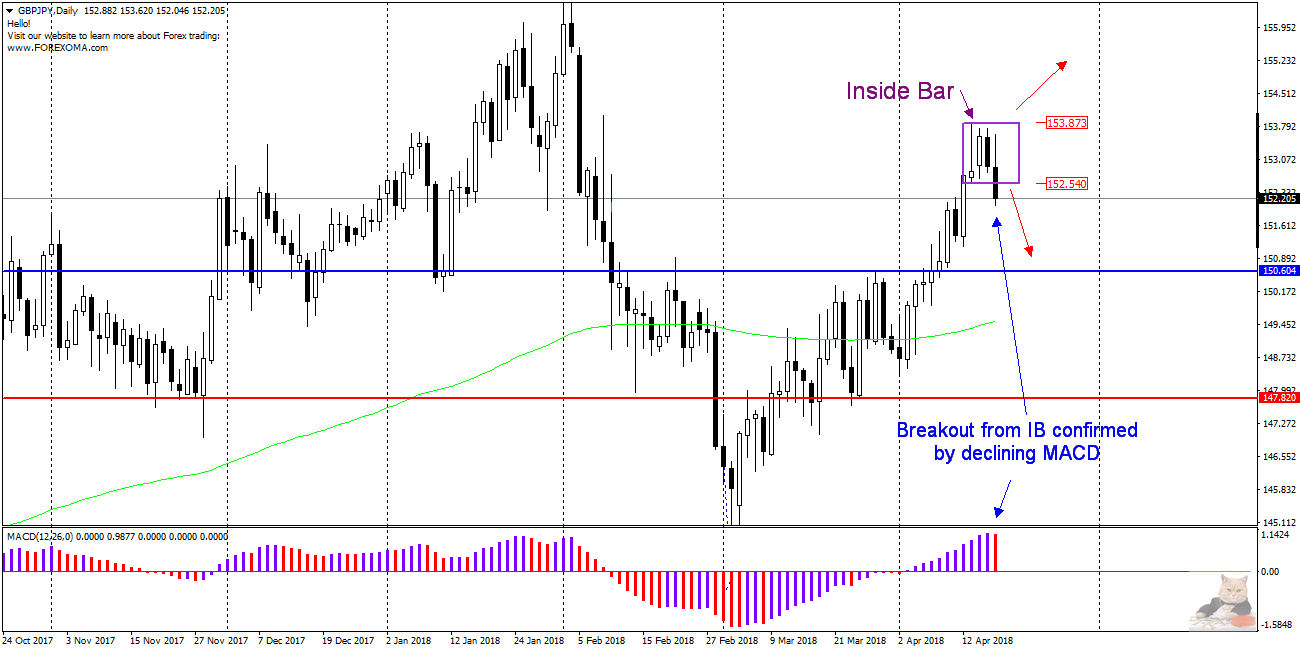

GBPJPY from February this year moved in an uptrend, reaching 900 pips growth during this time. Friday’s (13.04) daily candle formed a pin bar, and the next day’s candles from the current week did not go beyond the range of Friday’s creating a popular formation Inside Bar.

Today, after the release of data unfavourable for GBP (British pound), the pair of GBPJPY clearly lost and the price fell below the bottom edge of the previously mentioned IB formation. If this breakdown is confirmed by the closing of today’s daily candle below 152.54, it may signal the change of the previous bullish attitude on this pair and continuation of declines started yesterday.

An additional incentive to open the short position may be an assumption from the PA + MACD strategy, according to which when a breakout from IB formation is confirmed by a change in sentiment on MACD (in this case, the oscillator started to decrease), such system increases the probability of declines. The nearest level of support is around 150.60.

An additional incentive to open the short position may be an assumption from the PA + MACD strategy, according to which when a breakout from IB formation is confirmed by a change in sentiment on MACD (in this case, the oscillator started to decrease), such system increases the probability of declines. The nearest level of support is around 150.60.