The GBPJPY pair has been moving in a strong uptrend since March last year.

On the way from the level of 124.00 to 150 .70 there were two big corrections in June and September. Since October, the trend has become more dynamic, with an increase of over 750p last month.

- strong trend

- inside bar at the peaks

Currently, the price is in an inside bar formation. The quotes from Friday are completely within the range of the daily candle from Thursday.

For the time being, as long as the price does not go beyond the IB it is difficult to predict the direction of the quotations.

However, it is worth paying more attention to this pair if there is a breakout from the formation. Breakout of the top will be a signal to return to the trend and continuation of growths. The demand target may be the supply zone at 152.15.

However, if the price leaves the inside bar by the bottom, and MACD enters a downward phase – it could be a signal to start the correction. The nearest demand zone is at 148.40.

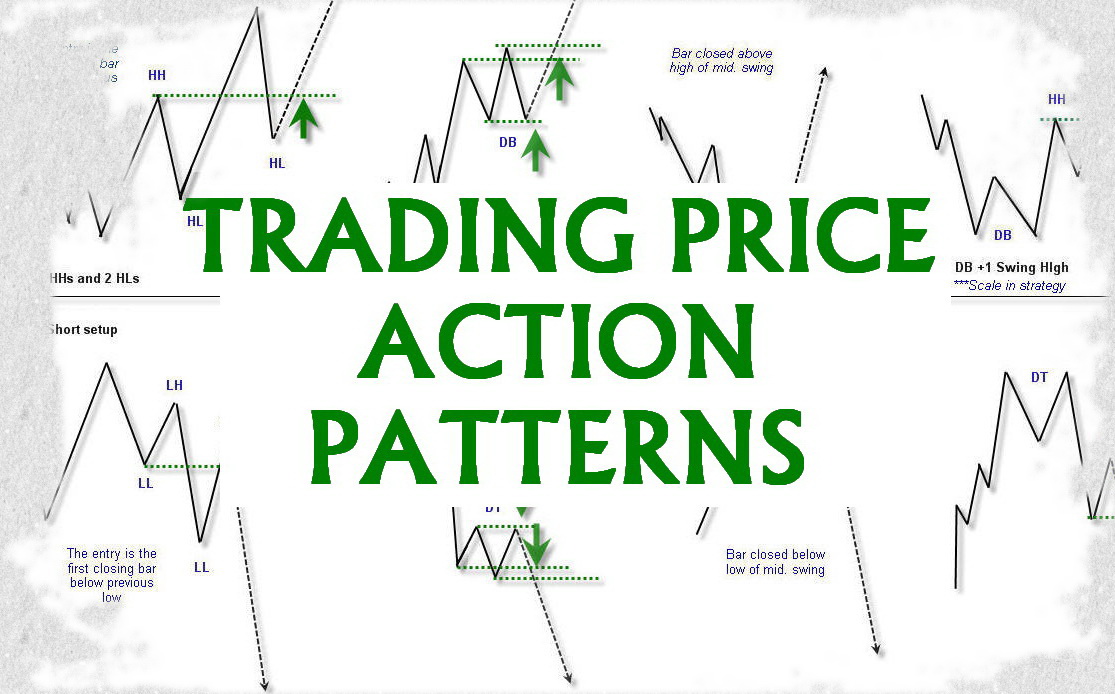

I recommend the description of the strategy used for this analysis:

ongoing analysis https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo