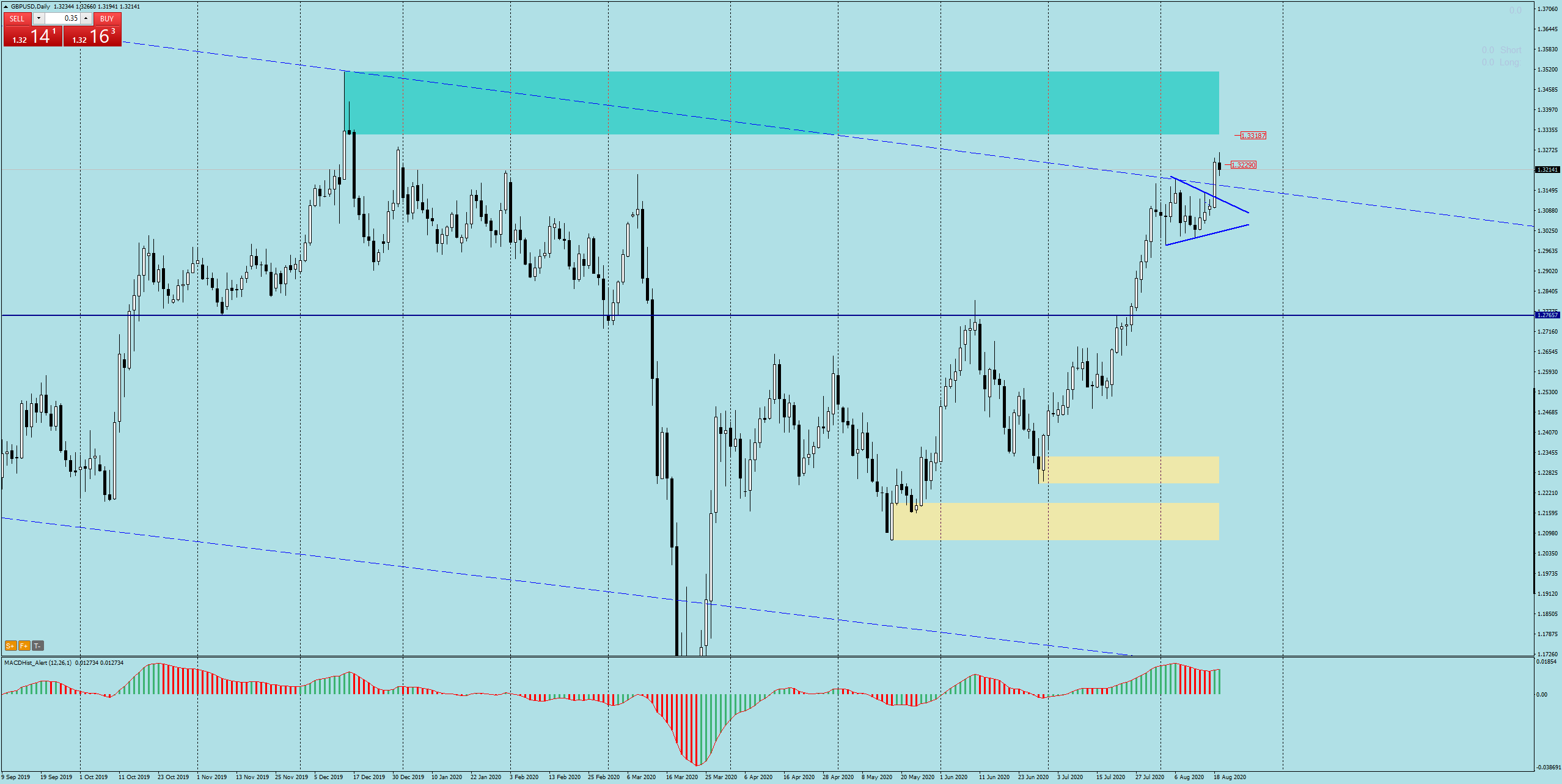

The GBPUSD pair has been in a strong upward trend since early July. The target of demand seems to be a supply zone starting at 1.3320. But before this target is reached, we can expect a correction of recent strong growths.

The first two weeks of August saw the price remaining in the consolidation, which took the shape of a triangle.

Visit my channel where I post trading ideas: https://t.me/TradewithDargo

Yesterday, 18.08, the price hit the resistance of the triangle with great impetus, reaching 1.3250. This morning, after quite positive data from the UK, it was also upwards, but by noon there appeared declines.

On the H4 chart appeared Outside Bar, from which the GBPUSD broke down thru the bottom. According to the assumptions of the PA+MACD strategy, if the break-out from the formation is accompanied by a change of direction on MACD – this is a signal to continue the declines and start the correction.

The MACD currently “lights up” in red, which makes it more likely that the downward scenario is in play. A good place to take a short position can be around the lower limit of outside bar 1.3230-10. The supply target can be the lately broken resistance of the triangle (blue line).

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo