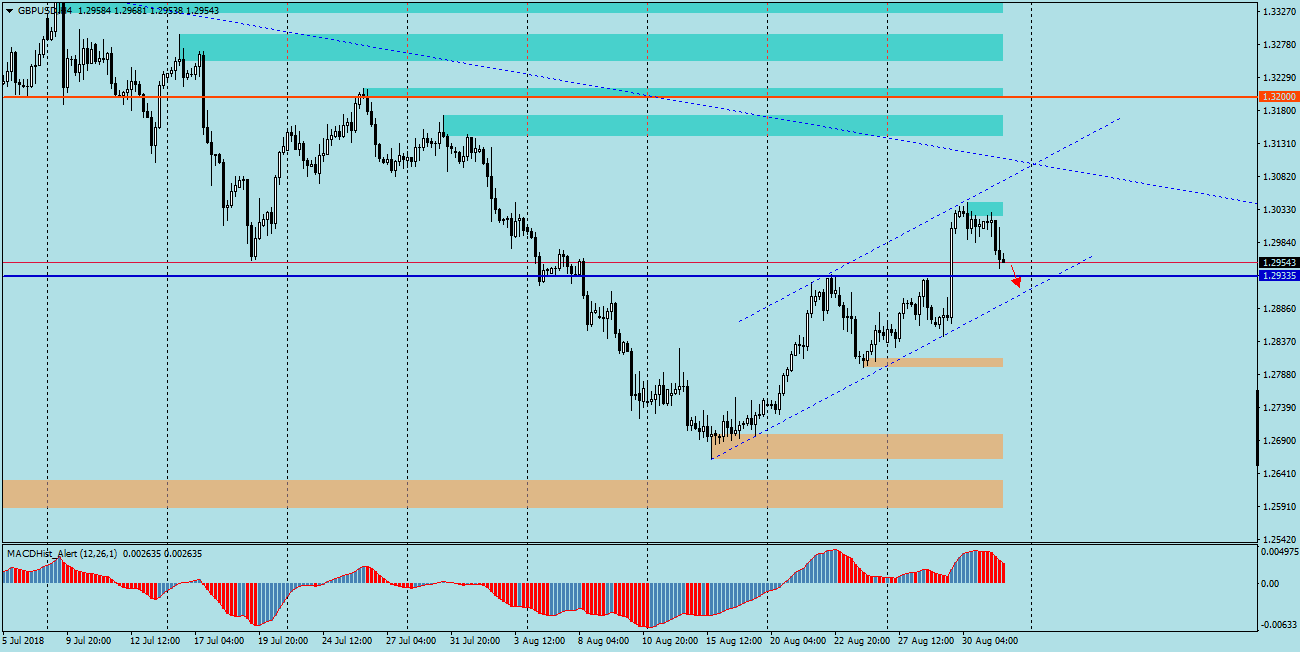

GBPUSD – popular cable, since 15.08 established a minimum of this year at 1.2660, moves in the growth channel and in two weeks increased by 380p. On Thursday, the pair reached the upper limit of the channel but failed to break it and the pair began to turn south. At the same time, a bearish divergence appeared on the H4 chart. The course of Friday quotes indicates respect for the bearish outlook and the price probably goes to the lower channel limit (blue dotted line). Along the way, there is the level of 1.2930, which in August twice fulfilled the role of strong resistance and this time may serve as support, which defeated may give the falls greater dynamics.

If this scenario is met also depends on information from the Brexit UK and the form of agreement with EU. Data published by the Office of National Statistics (ONS) show that gross fixed capital formation – broadly understood business investments – steadily increased by about GBP 2 billion a year in the period from 2010 to 2015 when a law was passed on a referendum deciding whether to stay or not in the European Union. Since then, investments have started to fall due to the fact that companies, uncertain about orders from the EU, have invested £ 20 billion less than they would have done compared to the pre-Brexit trend. The lack of a favorable agreement with the EU (so-called hard brexit) may strongly affect the GBP exchange rate.