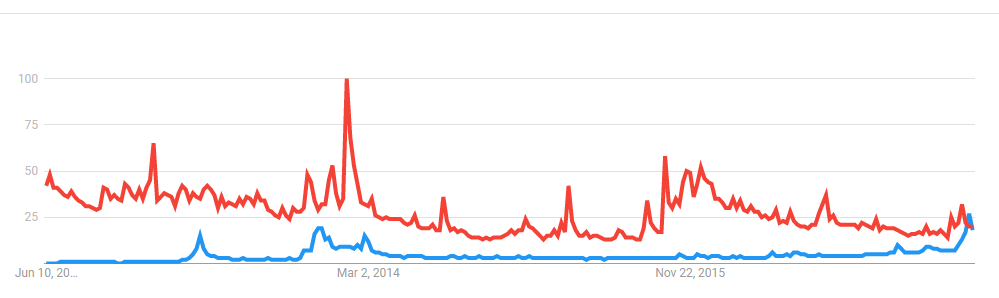

Digital currencies are now even more popular than Pop music.

Here’s a graph from Google Trends showing searches for Bitcoin topping Bieber for the first time.

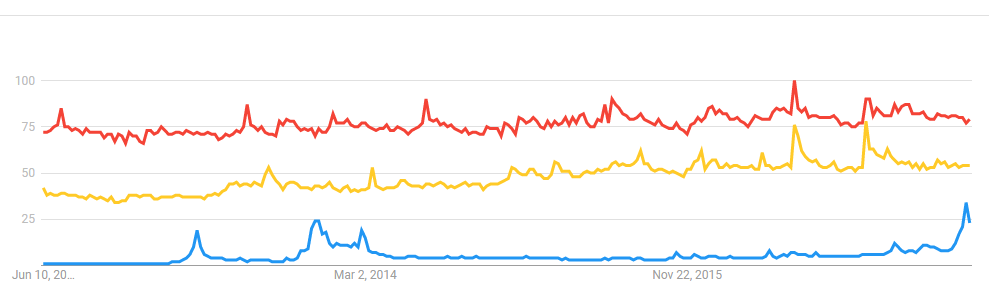

However, in this graph, we can see that there’s still a way to go before Bitcoin is more popular than regular money or the Dollar but the gap is closing fast.

So, though we can certainly celebrate how far we’ve come, let’s continue to focus on how far we have left to go.

–Mati Greenspan

eToro, Senior Market Analyst

Today’s Highlights

- $100 Billion… Yeah!

- What’s Driving it?

- Other important things

Please note: All data, figures & graphs are valid as of June 6th. All trading carries risk. Only risk capital you can afford to lose.

A Huge Milestone for Cryptos

The total market cap for all digital currencies in circulation has now passed $100 Billion for the first time ever. This represents more than 500% growth for this new and exciting industry since the beginning of the year!!

The two most popular digital assets, Bitcoin and Ethereum are currently trading at their all time highest levels.

Somehow, even though the growth has been so rapid, it still seems hardly enough. If Bitcoin is the future of money and Ethereum is the future of the internet we will need to see these numbers rising even faster than they are already.

Asian Drivers

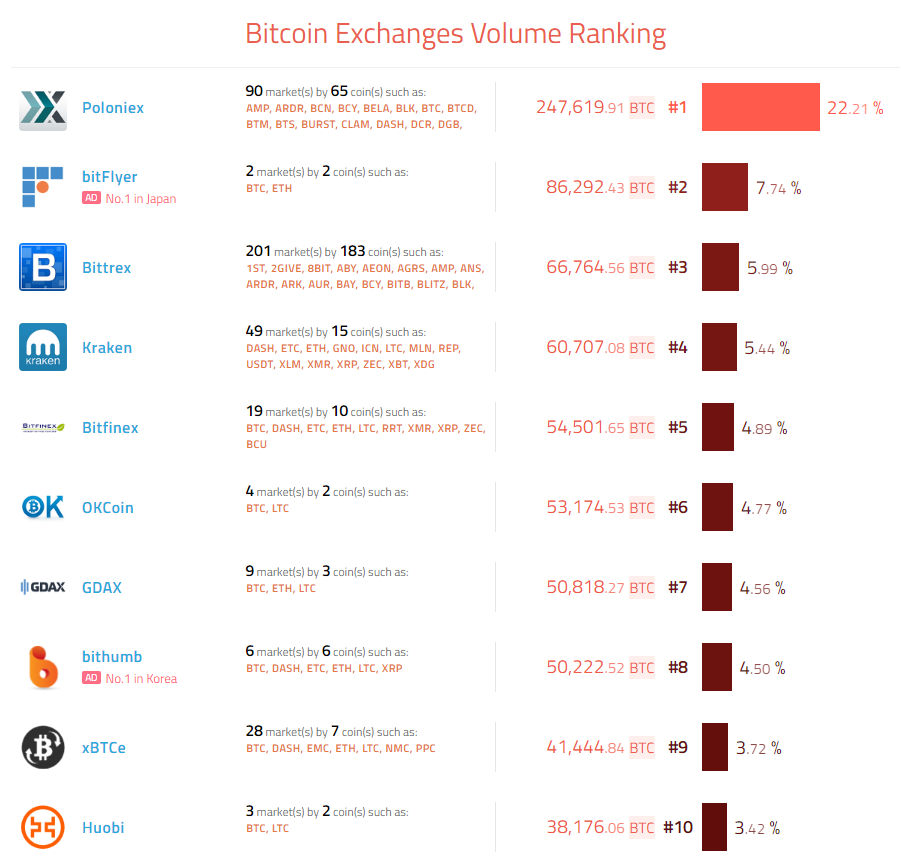

The higher volumes are clearly coming from Korea, China, and Japan. The Japanese buyers had been very timid after the great pullback of May 25th. Over the last three days the Chinese exchanges have been gradually building up their volumes and leverage and last night, Japan finally joined the party.

According to data compiled by coinhills.com the Japanese exchange bitFlyer (the one who is currently working to bring bitcoin to storefronts across the country) is the second largest exchange by volume.

The Korean bithumb is now responsible for 4.5% of bitcoin trading and the three large Chinese exchanges OKCoin, Huobi, and BTCC have a collective 9.92% of the total market share.

What else is happening in the world?

The global stock markets are still on low volatility but have notably ticked down over the past 24 hours.

The weak jobs numbers from the United States published last Friday has some people questioning whether the US Federal Reserve will have the guts to raise their interest rates on June 14th.

According to the Bloomberg Terminal, the implied probability of a rate hike in this coming meeting are still above 90%.

However, there are many analysts who feel there’s a good chance the Fed will disappoint this time and err on the side of caution. Unfortunately, we won’t be able to get any further verbal signals from Janet Yellen and the gang as they have now entered their blackout period with no major speeches from now until the meeting.

Also, keep an eye on Oil and Gold. Oil has been slipping lately on oversupply and gold is surging on safe haven trading. If either of these trends continues it could weigh further on the already gravitational stock market.

Thanks to everybody for reading and thanks for all the excellent feedback about these market updates. Your comments are highly appreciated and serve as my main source of inspiration.

Have a wonderful day!

Best regards,

Mati Greenspan

Senior Market Analyst

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)