Please introduce yourself briefly to our readers. Who are you? Where you come from? What do you do for a living?

My name is Nestor Armstrong, I am a business owner in healthcare sector, I am a popular investor on the E-Toro platform, and I am a writer. I come from Monterrey, México, a northern, industrial city.

Wow, that’s an example of broad interests. We can easily check how you invest by looking on your eToro profile. But can we buy any of your books?

You’ll have to wait a year or two before reading any of my books. Other than a couple of published stories and articles in magazines here and there, I’ve yet to find a reliable publisher and find time to get myself into writing a fully fledged book.

Why did you start trading/investing on financial markets? How did it all begin?

I have a degree as a Biomedical Engineer, so I thought that I would always work for someone at a hospital. After reading a book called: Rich Dad, Poor Dad by Robert Kiyosaki, I started wondering how could I get out of the rat race. I wanted to be able to start making my own calls and start investing like the rich did. I decided I wouldn’t settle for anything less than having control for my own destiny: reach financial security and then financial freedom.

Robert Kiyosaki’s book is one of the “must read” positions. Would you recommend any other book which helped you during your journey into the financial world? Also, do you think that books can create a profitable trader?

Of all the many great books about trading and investing I’ve read, a few comes to mind: Money, Master the Game by Anthony Robbins, Rich Dad’s Guide to Investing by Mr. Kiyosaki, You Can if You Think You Can by Norman Vincent Peale Think and Grow Rich by Napoleon Hill and Trading Habits by Holly Burns.

Risk in trading can be mitigated by knowledge. Knowledge can come from many different sources, including books. I believe that the more information one can possess, the less risk you will take when making a decision, and that’ll make you a more profitable trader.

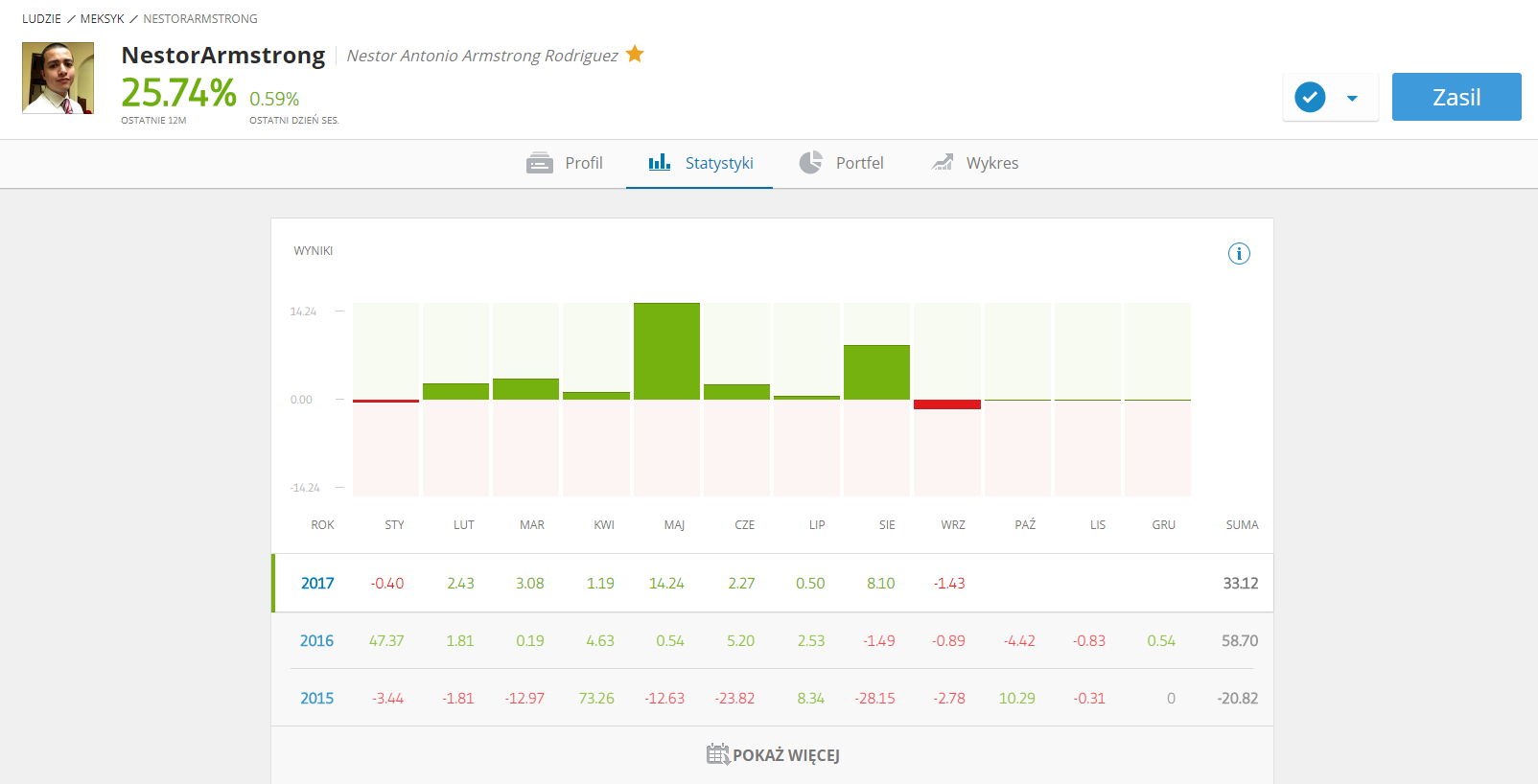

Can you please describe your trading strategy? As we can see, you had only one losing month in this year. How do you pick your trades?

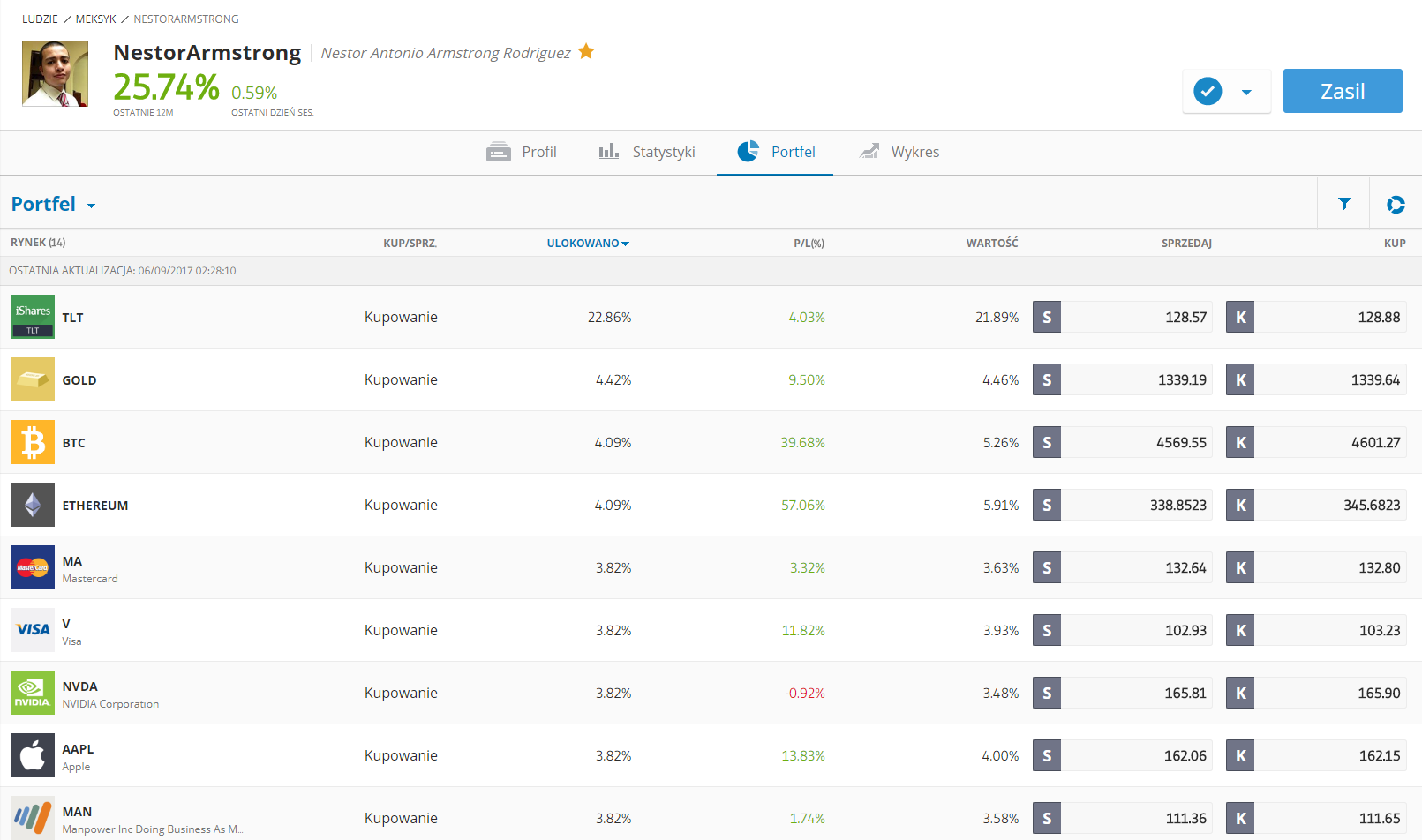

As my Risk Score is 3, that might suggest, I am a conservative trader. I generally pick solid companies with a tendency to consistently beat the SPX500. But as you might already know, stocks right now are not exactly cheap, and most of us feel the fear in the air of another bear market or worse.

Having said this, I also have cryptocurrencies, gold, US Treasury Bonds and cash in order to act when such crash or bear market comes.

You bought JP Morgan’s shares in August. Can you briefly describe why you decided to buy JPM for $91.95 per share?

There are five main branches that my portfolio is divided into. One of them is in the financial sector. It’s a stock with a market cap of 322.69B, it’s a well established institution, a 1-Y Return outperforming on SPX500, and although it’s not exactly cheap at that price level I’m confident it has time to grow before a correction.

At the end of August cryptos are building your portfolio in over 23%. Can you call yourself a Bitcoin fan? Or you’re just using cryptocurrencies for trading because of its extraordinary volatility?

I like what cryptocurrencies stand for, I wouldn’t say I am a fan though. I decided to invest on them because I hate paper money. It’s dangerous to carry it on your person, it’s cumbersome, it’s easy to lose or have it stolen. I like the idea of moving all of our transactions to a digital arena.

I believe it’s a step in the right direction. In a world where we are building upon tech, it’s logical to have digital currencies step up to the challenges we’ll face in the future.

Do you have any favourite type of assets?

I don’t exactly have a favorite asset class. But I do have to admit I always get a warm feeling when I use the service/company that I have invested into. You get that feeling that you’re not only a customer, but also an investor. I guess I like when things go in a full circle.

It’s a lot easier to invest in assets that are not only doing good, but you believe in and use.

I know what are you talking about. Any specific examples?

Being the owner of both Visa and Mastercard credit cards, I feel great using them knowing that some of that money will come back to me. I also am a heavy Apple user (writing this in an Ipad as a matter of fact). And I do have a small project involving importation of certain Alibaba products.  So as you can see, I do use several of the stocks I am currently invested into.

So as you can see, I do use several of the stocks I am currently invested into.

Why did you pick eToro? What makes it so special that you’re trading on this particular platform?

I contacted several local firms in Mexico, and several international investing firms like Schwab and Ameritrade. They all had these requirements and forms and paperwork. It was all a clutter, a maelstrom of bureaucracy.

I am a pretty straight forward guy. I like to get things done, and all of these white collars made every little thing an excruciatingly slow experience.

Check out the eToro platform by registering a free demo account

I then stumbled upon E-Toro while searching for a platform to invest in the market. No hassles, no dumb paperwork, I just had to place a credit card and I was thrown into the fray. The simplicity of use, the helpful and active staff support, and the fact that you can become a manager and get paid for investing was more than enough to win me over.

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)