Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

This is the last overview this year. On holiday season there will be nothing going on, I will close my last position and will enjoy Christmas 🙂 However, if you want to trade in near time, I will show two interesting pairs to watch. Merry Christmas!

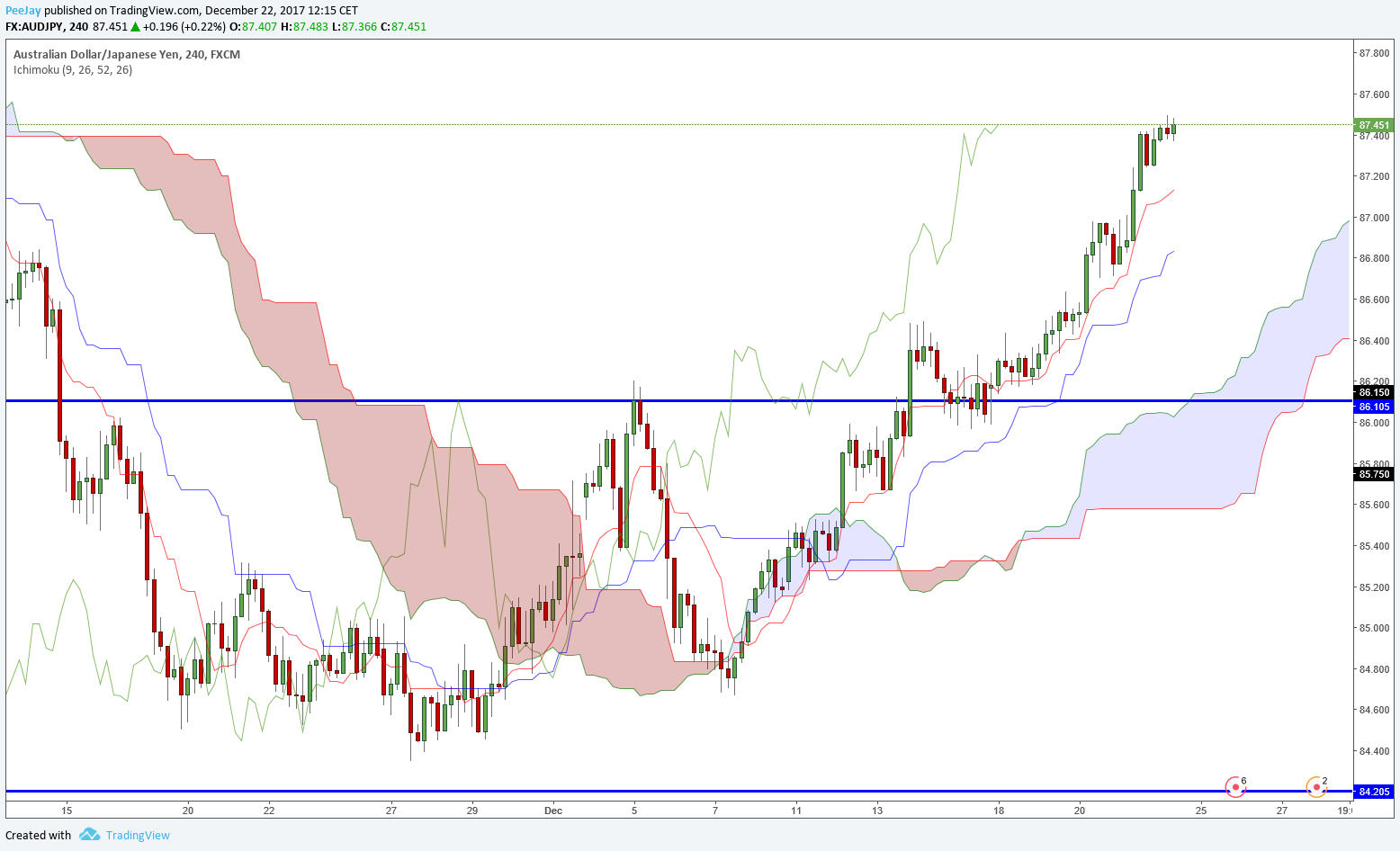

AUDJPY

The opened position is still appreciating. At this moment it brings 10% profit. There is still a little less then 50 pips to reach Take Profit, but there is no hope to gain that much during holidays. Therefore, I’m going to close this position in the end of today’s session and finish trading year with a strong gain.

GBPAUD

On the H4 chart we can see, that Tenkan line is below Kijun, and two candles earlier there was a strong break below Kijun by the price. Two connected sell signals let us open short position. We can think about going short targeting daily support. We just have to be careful about proper reward to risk ratio, it has to be at least 2:1. To open the position I recommend STO broker, which offers spread as low as 0.0 pip.

GBPNZD

Another pair with sterling, where sell signal showed up. Tenkan line dynamically crossed through Kijun, in addition the price is next to bearish Kumo. Currently we cannot open short position, because Chikou Span is above the price, so we have to wait for development of situation.