In the currency markets – contrary to appearances – there is not happening too much. Panic in the Polish or Russian stock markets does not go hand in hand with the largest instruments. It is seen even in the Polish Stock Exchange that mainly small investors starts to panic – the smaller the company, the less big players in their shareholding structure and the greater declines. It does not change the fact it “helps” to find some interesting occasions on FX:

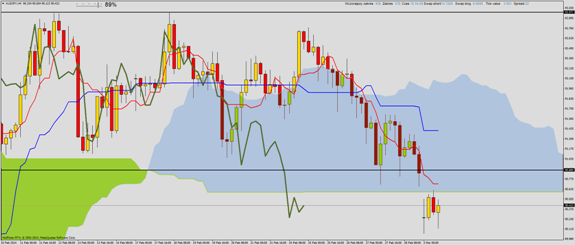

AUD/JPY H4:

Australian Dollar to Yen almost closed the weekend gap, rebounding from the lower limit of the Kumo. It was a confirmation of the downward trend and an opportunity to open shorts. Now you can open there even with high efficiency than before.

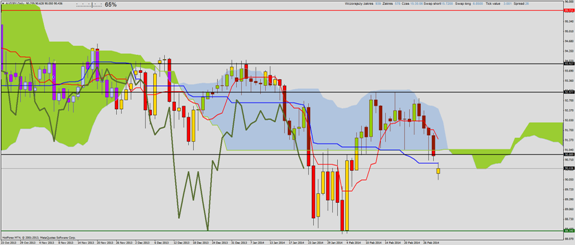

AUD/JPY D1:

The situation on the daily chart shows declines with the 200 pips range to the first target. Given that the SL for the position is a little over 20, we get a great profit-to-risk ratio.

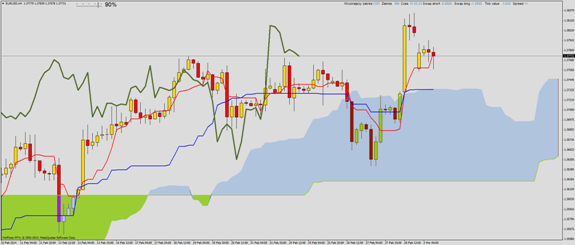

EUR/USD:

It is worth to wait for a Eurodollar correction. Kijun line coincides with the upper limit of the cloud. The rebound from that level will be an opportunity to open new long positions.

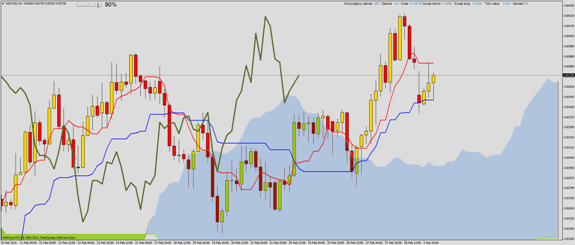

NZD/USD:

When the market opened we saw a decrease, but it stopped at Kijun line. The next candle gave a buy signal. Currently, we have confirmation, that support works due to the price’s clearly reaction and forming pin bar candle. Such closure would indicate a demand and a possible resistance challenge.