Markets emotion induced by Ukraine situation lessened. Currency pairs which on Friday and Monday have chosen a clear direction are currently undergoing corrections. That gives number of potential Price Action setups:

AUD/JPY:

Support – repeatedly challenged in 2014 – was broken last week and now should act as resistance. Price just approached it and we can already see the first signs of strong demand. Each sell signal from Price Action should be used to open short positions.

AUD/NZD:

Australian dollar to New Zealand dollar show similar situation. Support (now resistance) has been broken and return to the long-term downward trend is very likely. Sell signals may also be used to enter shorts.

GBP/CHF:

Currency pair stopped at the support, where candles long lower shadows indicate demand. You can consider opening long positions, e.g. after a breakout of yesterday’s maximum. Bull should have an advantage all the time.

USD/CHF:

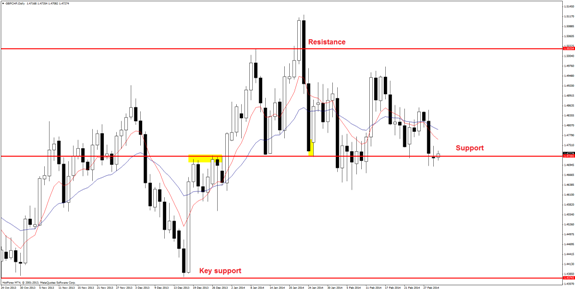

Last Friday brought the lowest level for the USD/CHF since 2011. Price has closed below the key support and momentum is clearly downward. Currently, this level is tested from the bottom and every PA sale signal may be used to open short positions. But if there is a clear increase, the breakout may prove to be false.