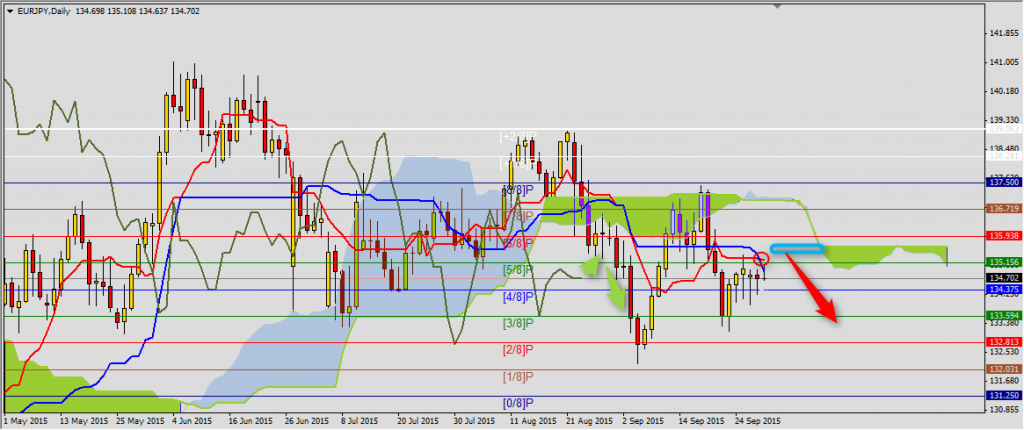

EURJPY

After three bearish sessions on EURJPY we have sixth session of consolidation and despite crossing Kijun-sen by Tenkan-sen bears are dominating right now. Price stays between (5/8)P 135.16 and (3/8)P 133.60 lines. The most important resistance is Senkou Span B 135.61 and only breaking above mentioned resistance will set local low on this pair. Chikou Span is below chart and Kumo stays bearish. Breaking Kijun-sen 133.57 on weekly chart will be a signal of end of consolidation and testing line (0/8)P 131.25 again.

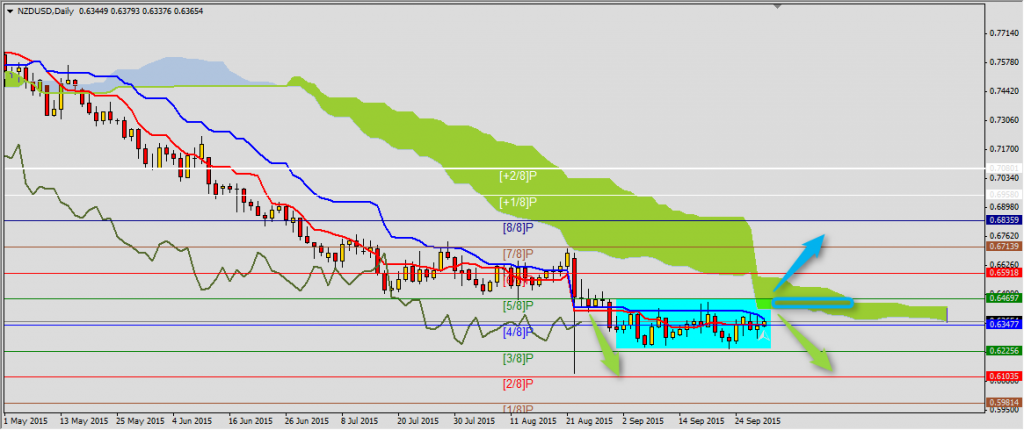

NZDUSD

NZDUSD also stays in consolidation between (5/8)P 0.6470 and (3/8)P 0.6225. Today price reached to Kijun-sen 0.6375 resistance. Next resistance is at Kumo low 0.6422 and Senkou Span B 0.6430. Ichimoku averages setup informs us about bear trend dominating, it will stay like this until NZDUSD will be below mentioned levels. The range is set by Murrey lines 0.6103 and 0.5981. From the other side we cannot rule out second scenario: breaking Senkou Span B and (5/8)P line. Then we should take a look at weekly chart where next resistance will be at horizontal Kijun-sen 0.6933. It could mean almost 450 pips of correctional bullish wave.