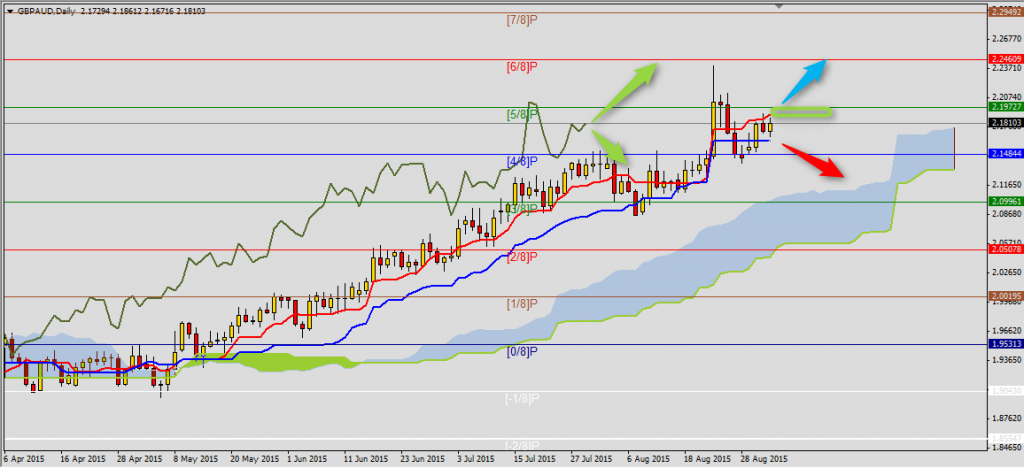

GBPAUD

GBPAUD is in the consolidation between Kijun-sen at 2.1630 and Tenkan-sen at 2,1899. Because the price is above upper Kumo, we should look for continuation of uptrend scenario after breaching Tenkan-sen and (5/8)P line at 2.1973. Target levels are created by (6/8)P and (7/8)P Murrey levels. Descent below Kijun-sen will mean continuation of correction on GBPAUD and re-test of Senkou Span B at 2.1322. This is why it is better to wait for clear situation and breaching price above resistance level if we are interested in buy order.

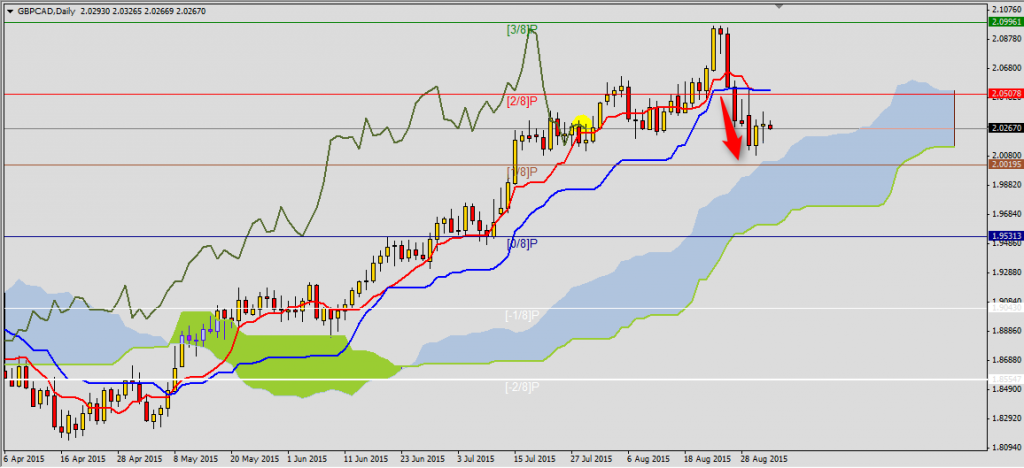

GBPCAD

On GBPCAD there is Chokou Span on very important support level and if the price won’t be defended, there will be continuation of strong correction starded on August 25th. Resistance is made by horizontally Kijun-sen at 2.053 and only breaching above this mean will decrease dwon pressure on GBPCAD. Another support levels are Senkou Span B at 2.01435 and Kumo bottom at 2.00454.

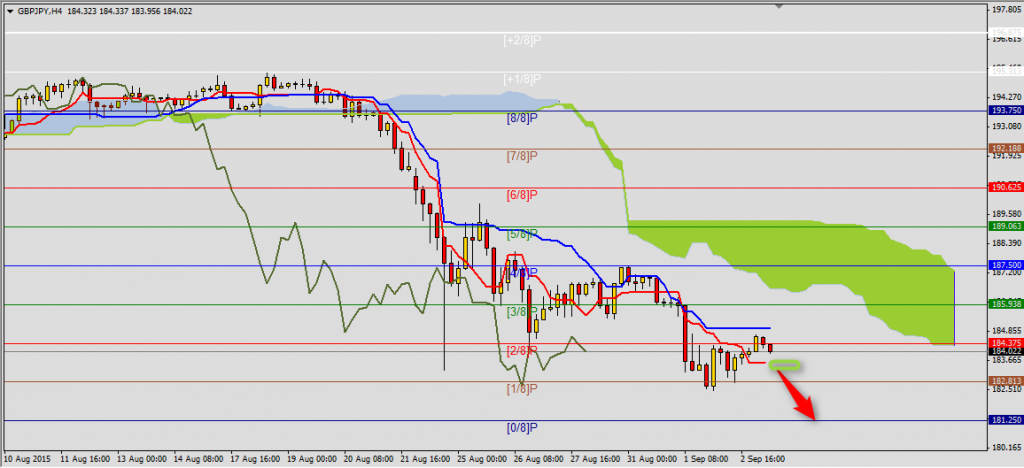

GBPJPY

GBPJPY is clearly in downtrend and to find best level you have to take a look at H4 TF. Descent below Tenkan-sen at 185.59 will be atoher sell signal and range of this move is (0/8)P line at 181.25. If GBPJPY will breach Kijun-sen resistance at 184.98 first, it will mean correction to Senkou Span B at 187.26.

You can read Ichimoku strategy description here.