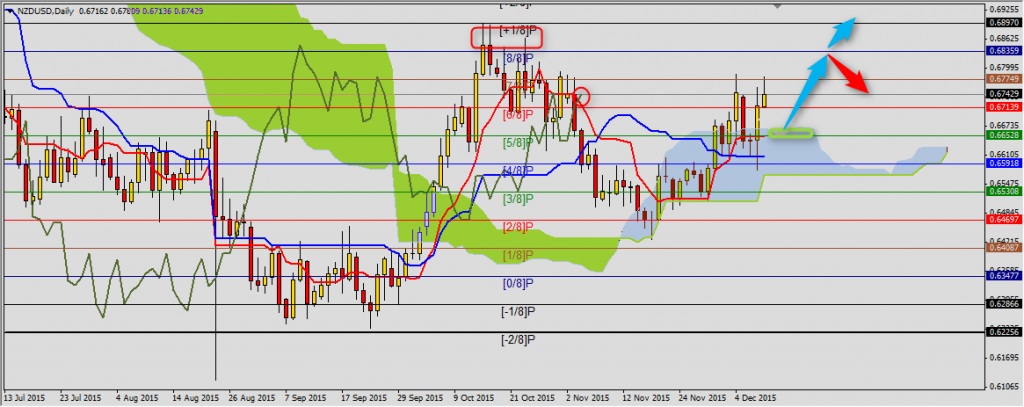

NZDUSD

Yesterday, after RBNZ decision about interest rates cut NZDUSD gained quick to resistance at 0.6775. Markets reacted like this because everyone expect that this is last cut in this cycle. First support is set by (6/8)P 0.6714 line and then Kumo top and Tenkan-sen 0.6668-0.6653. Next resistance is at (8/8)P 0.6836 and Senkou Span B from weekly chart 0.7005.

You can read Ichimoku strategy description here.

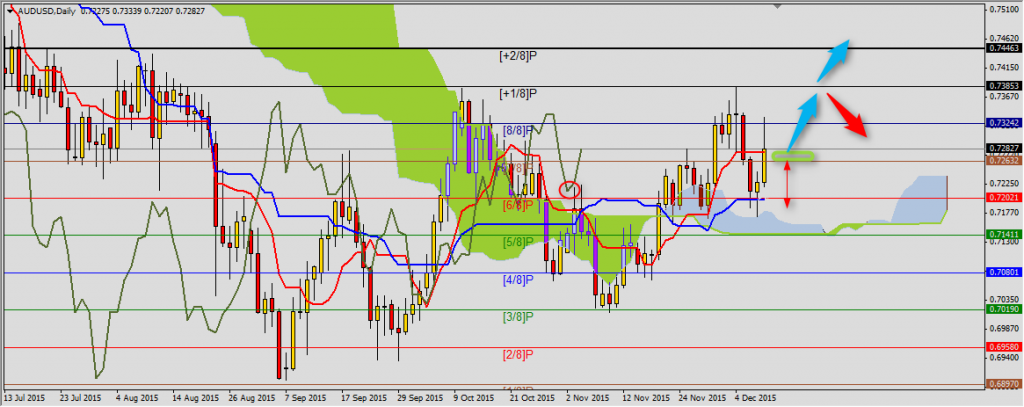

AUDUSD

Then there were incredibly good news from Australia. Here buy signal is also generated after breaking Tenkan-sen 0.7277. Now this level in pair with 0.7263 is a new support area. Kijun-sen from weekly chart 0.7376 is now resistance. Breaking it is a condition of further gains to Senkou Span B 0.7600 on this time frame. In the other case AUDUSD will come back to Kijun-sen 0.7200 support.

YOU CAN TRADE USING ICHIMOKU STRATEGY WITH FREE FXGROW ACCOUNT.

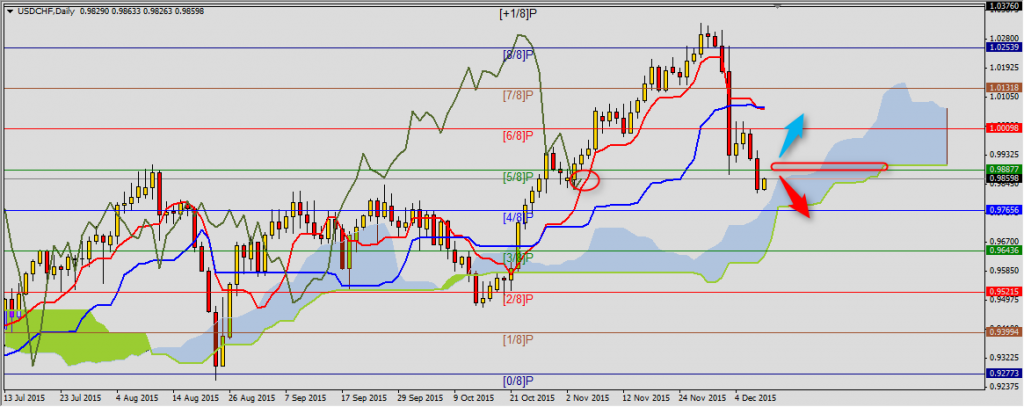

USDCHF

Now we wait for Swiss decision about interest rates. Lately Swiss franc was getting stronger and USDCHF fell below support area 0.9901-0.9888. It is Senkou Span B and (5/8)P line. Breaking this area is a condition of going back to (6/8)P 1.0010 and then Kijun-sen 1.0073. There is also possibility of going back to pivot (4/8)P 0.9766 and Kijun-sen from weekly chart 0.9738.

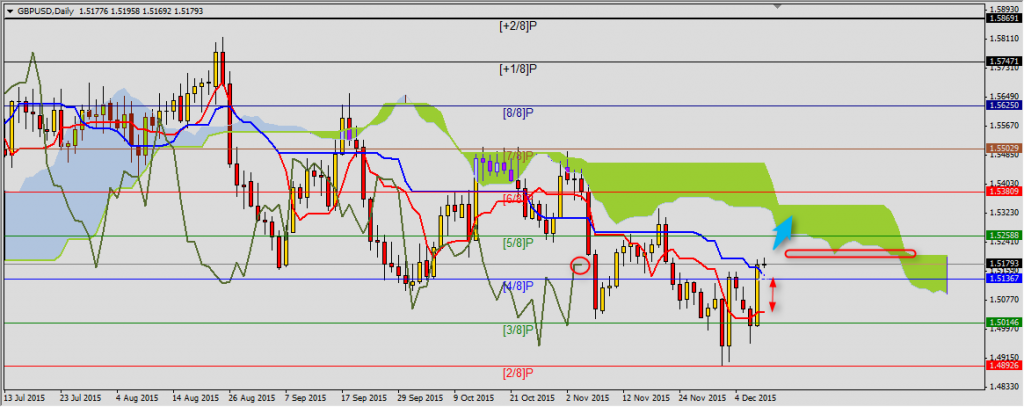

GBPUSD

Another data coming today – interest rates decision. This time more important will be BoE statement, because no one expects hike. In this situation it is much harder to make decision with smaller risk. Price is next to Senkou Span B 1.5200 resistance and close to 1.5145/37 support set by Kijun-sen and (4/8)P. Another support is set by Tenkan-sen 1.5044 and the resistance is at (5/8)P 1.5257.