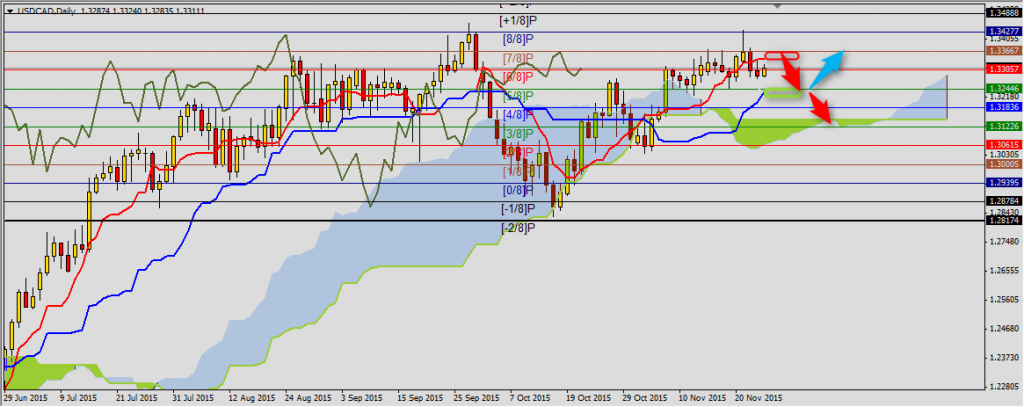

USDCAD

Correction on USDCAD started from (8/8)P 1.3428 level and after breaking Tenkan-sen 1.3340 it is on the way to Kijun-sen 1.3236. Tenkan-sen with (7/8)P 1.3367 is creating resistance, breaking it will be a signal of USDCAD going back to bullish trend. The most important data will be tomorrow after annual OPEC meeting. As we know CAD is strongly correlated with oil price and if there will be cut of production decreases should be faster and should reach at least Senkou Span B 1.3144.

You can read Ichimoku strategy description here.

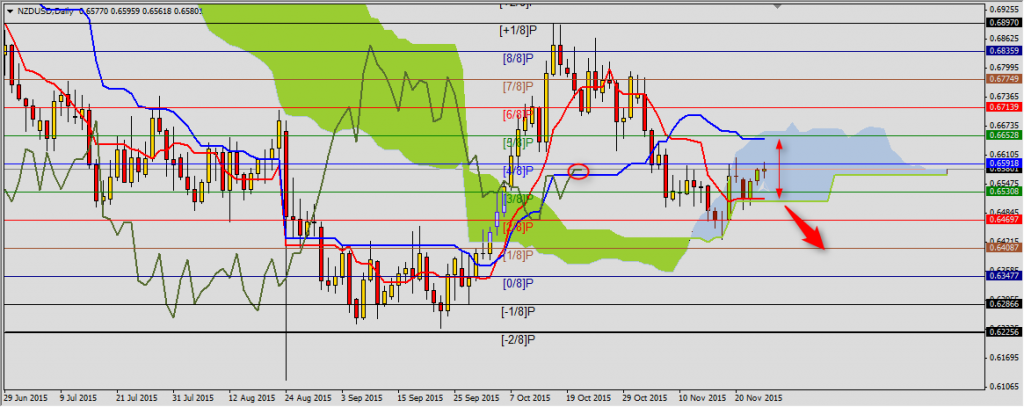

NZDUSD

This pair found support on Kumo bottom 0.6509 and if there will be no problems, it should reach to upper band of cloud, where we can also find Kijun-sen 0.6646-0.6662. Chikou Span is below chart but above Kijun-sen what can predict bigger correction. Another break below Kumo will be a sign of NZDUSD going back to bearish trend.

YOU CAN TRADE USING ICHIMOKU STRATEGY WITH FREE FXGROW ACCOUNT.

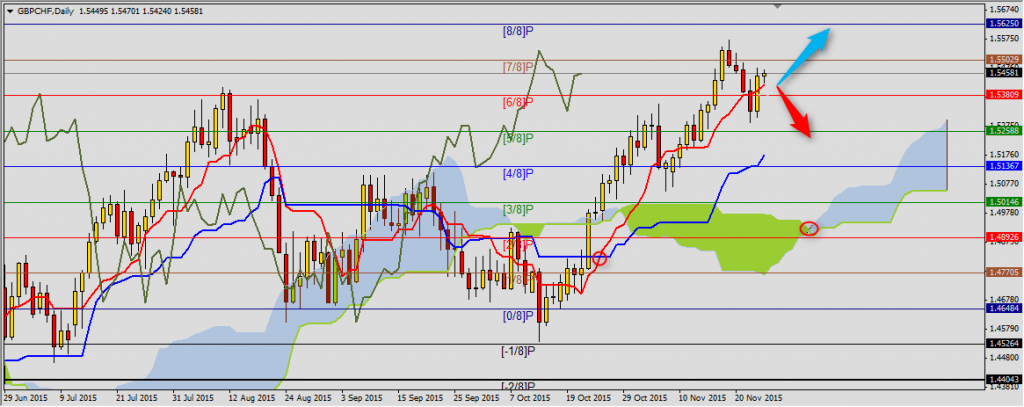

GBPCHF

Another weak buy signal. Despite price breaking above Tenkan-sen it happened above bearish Kumo, so the signal is not strong. GBPCHF will be above bullish Kumo in six sessions and until then we should see side trend. Entil price stays above 1.5416-1.5381 area (Tenkan-sen and (6/8)P), there is still possibility of another try reaching (8/8)P 1.5625. Next support is set by (5/8)P 1.5259.