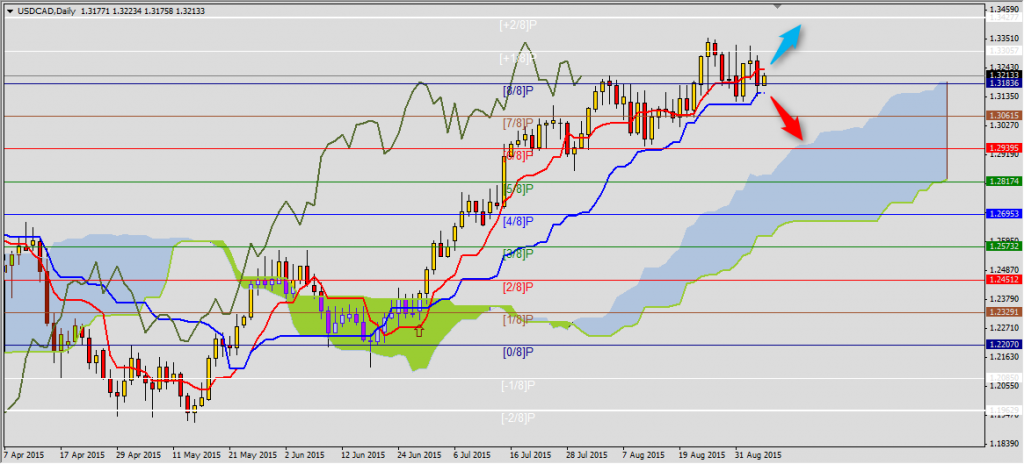

USDCAD

Yesterday USDCAD tested Kijun-sen support at 1.3145 again and today it is below Tenkan-sen resistance at 1.3234. At 2:30 PM there is important data from USA and Canada coming, so we can expect breaking one of these levels. Drop below Kijun-sen will mean bigger correction to Murrey lines (7/8)P 1.3062 and (6/8)P 1.2939. However it is always safer to play with trend, which is breaking Tenkan-sen with range at 1.3306 and then 1.3427.

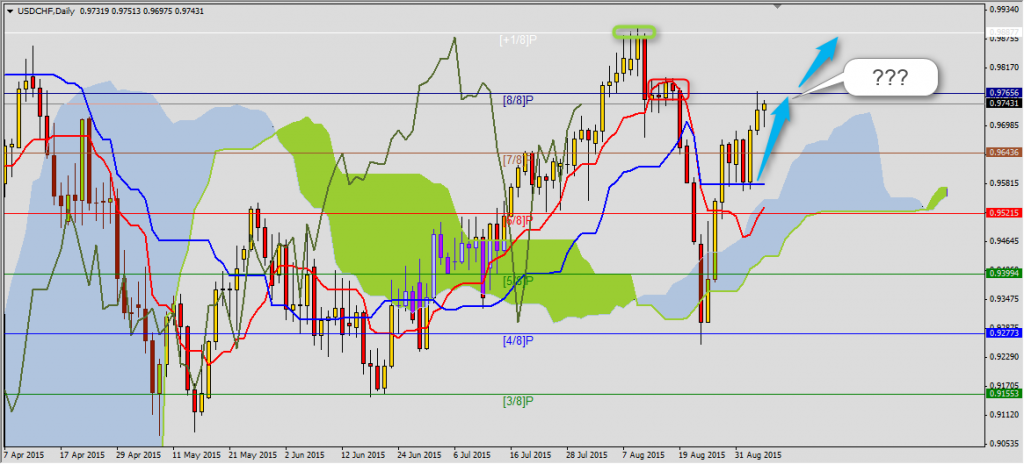

USDCHF

After correction of pivot line (4/8)P 0.9277 USDCHF breached another resistance levels Tenkan-sen and Kijun-sen and for now stopped at (8/8)P 0.9766. Currently Kijun-sen at 0.9668 is a support on H4 chart and breaking yesterday’s maximum will mean continuation of trend to maximums from 7-11 of August and (+1/8)P 0.9888 line.

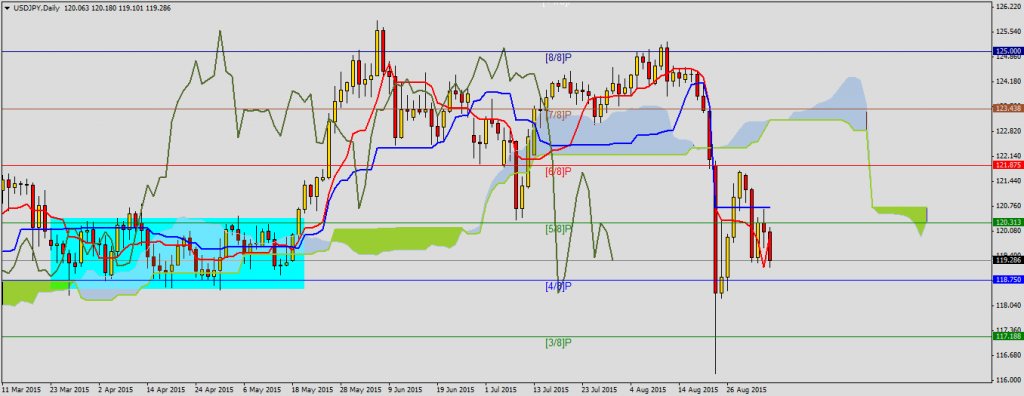

USDJPY

There is uncertain situation also on USDJPY. Yesterday price rebounded from Kijun-sen 120.73 and today it is below Tenkan-sen 119.99 and it generate another sell signal but there is a possibility that this is still horizontal trend with support at (4/8)P 118.75. It is lower bound of consolidation from March-May 2015 and it has big significance for this pair. Breaching this support will mean continuation of downtrend to (3/8)P 117.19. If the price will go above Kijun-sen and Senkou Span B it will mean creating local minimum on USDJPY at 116.18.

You can read Ichimoku strategy description here.