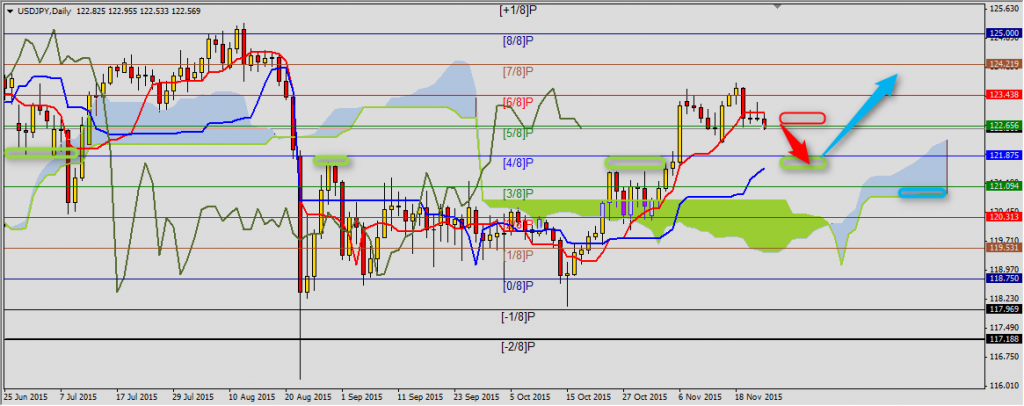

USDJPY

This pair after two sessions of consolidation stays below Tenkan-sen 122.98 increased correction and is below (5/8)P 122.56 line. If USDJPY will stay below this area we have high probability of decreases to 121.88-121.57 area created by (4/8)P and Kijun-sen. In this place we should look for signals of going back to bullish trend. Trend is not in danger unless price stays above Senkou Span B 120.90.

You can read Ichimoku strategy description here.

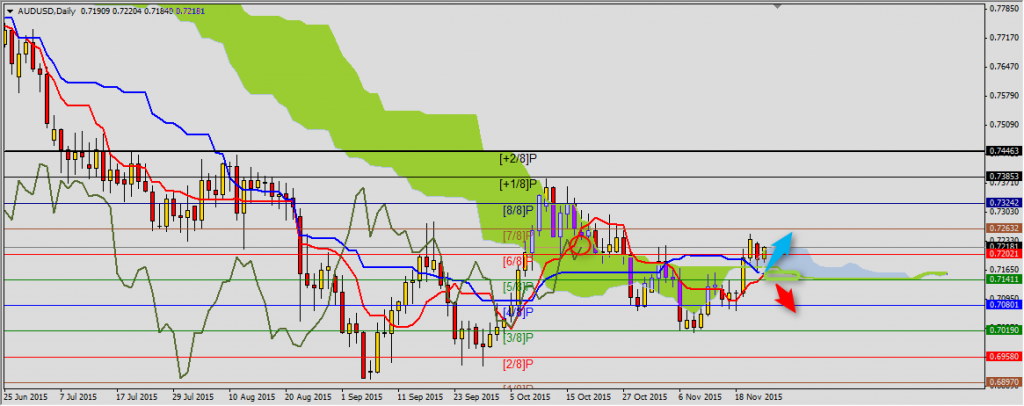

AUDUSD

Yesterday AUDUSD found support on 0.7160-0.7141 area where Kijun-sen and Tenkan-sen is. We should consider especially (7/8)P 0.7263 resistance. In the same time Senkou Span B will reach price candles, which are now in strong barrier for continuation of bullish sentiment on Aussie. Decrease below (5/8)P 0.7141 will be a signal of continuation decreases on AUDUSD.

YOU CAN TRADE USING ICHIMOKU STRATEGY WITH FREE FXGROW ACCOUNT.

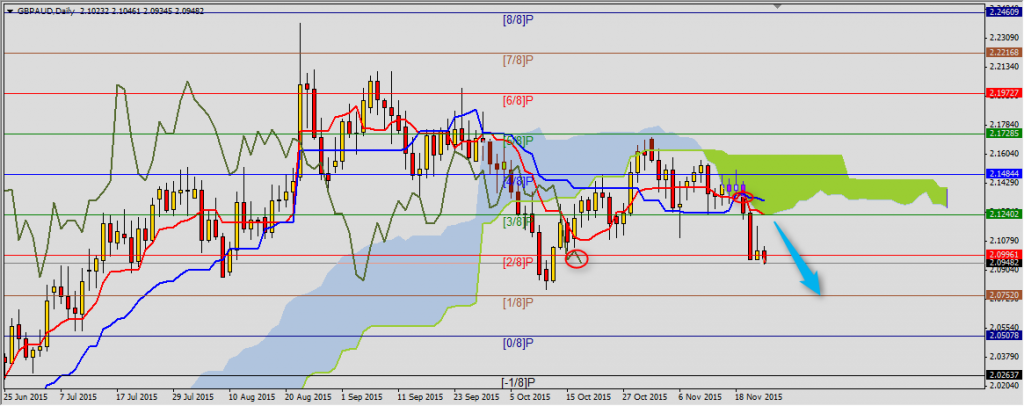

GBPAUD

For four sessions we have sell signal on GBPAUD. Tenkan-sen crossed Kijun-sen, price broke below Kumo and it is also confirmed by Chikou Span. After yesterday’s consolidation, price broke last minimum at 2.0967 and is getting to another Murrey lines 2.0752-2.0508.