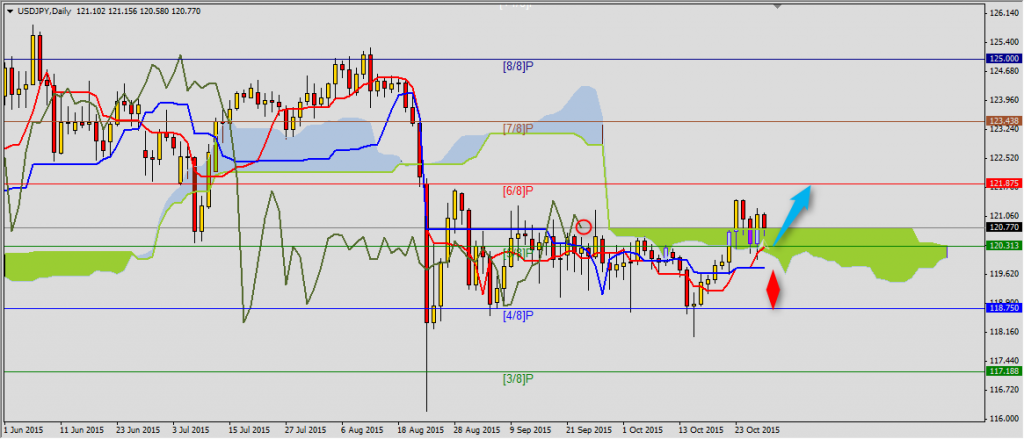

USDJPY

Yesterday’s rebound on USDJPY was not so spectacular but it let to break above Kumo 120.73. Now together with Tenkan-sen and Senkou Span B 120.31 this level will create support area for possible gains on this pair. Chikou Span B stays above chart and averages what promise another try of breaking resistance (6/8)P 121.87. Close of the day below Kijun-sen 119.76 will cancel this scenario.

You can read Ichimoku strategy description here.

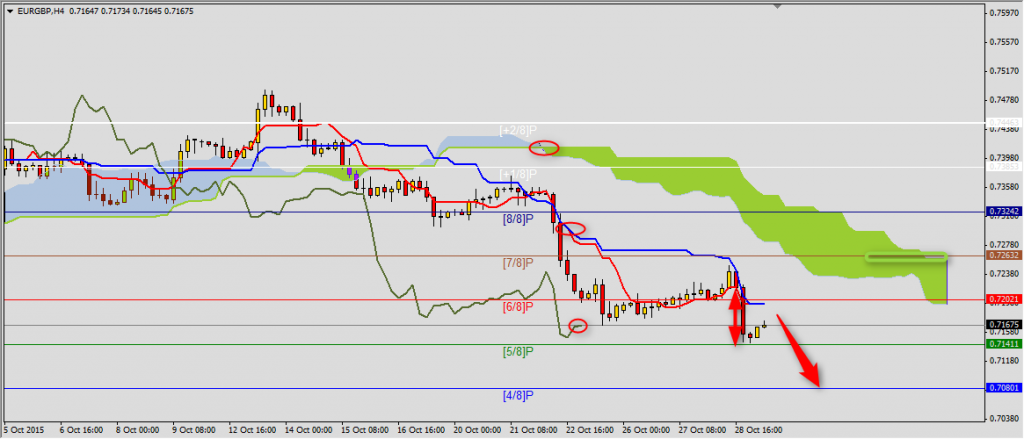

EURGBP

Situation on EURGBP is shown the best on H4 chart. Here we can clearly see that bearish trend correction stopped below third level of balance Senkou Span B 0.7258. Decrease below Tenkan-sen 0.7219 created another sell signal and first range of order 0.7145 was reached. SL should be moved few pips above Kijun-sen 0.7196 and (6/8)P 0.7202 and now we just have to wait for closing order on (4/8)P 0.7080. For now all Ichimoku signal inform about strong bearish trend.

YOU CAN TRADE USING ICHIMOKU STRATEGY WITH FREE FXGROW ACCOUNT.

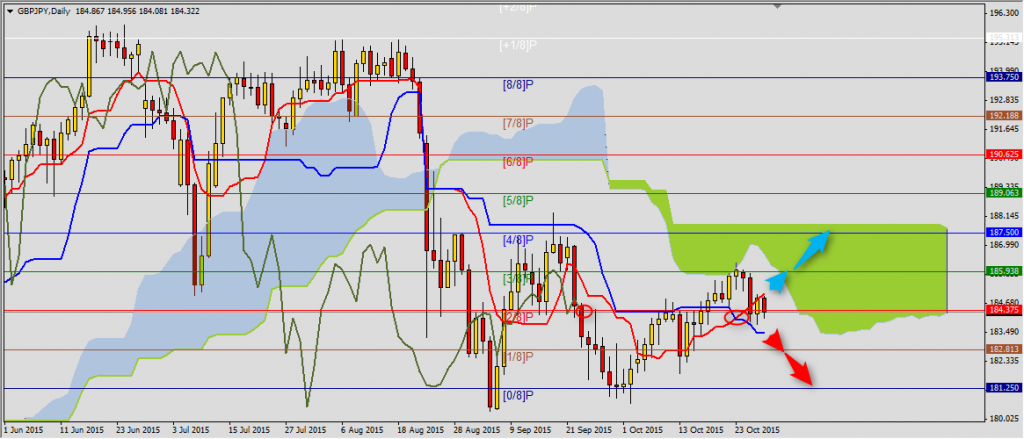

GBPJPY

There is no confidence of investors on GBPJPY. Price stays between Tenkan-sen 185.06 and Kijun-sen 183.46 resistance. Chikou Span stays on support and this is why we should wait for breaking Ichimoku lines. Breaking Tenkan-sen will mean price going back to (3/8)P 185.94 and then Senkou Span B 187.67 and decrease below Kijun-sen is a sign of testing another Murrey levels 182.81 and 181.25.