WTI

Oil again cannot break (8/8) 34.38 resistance and today after decrease below Tenkan-sen 34.04 correction of last gains started. So far price stopped on first support level (7/8) 33.59 and if depreciation should be continued Kijun-sen 32.89 will be tested again. Only breaking (8/8) line will be a signal of going back to bullish trend.

You can read Ichimoku strategy description here.

DAX

Correction on oil means decrease of DAX, these symbols are lately strongly correlated. The chart is getting close to first (6/8) support 9687. However huge distance from this line can force correction to Tenkan-sen 9589. Only if price will come back above (5/8) 9531 there will be a possibility of continuation of appreciation to (8/8) 10000.

YOU CAN TRADE USING ICHIMOKU STRATEGY WITH FREE FXGROW ACCOUNT.

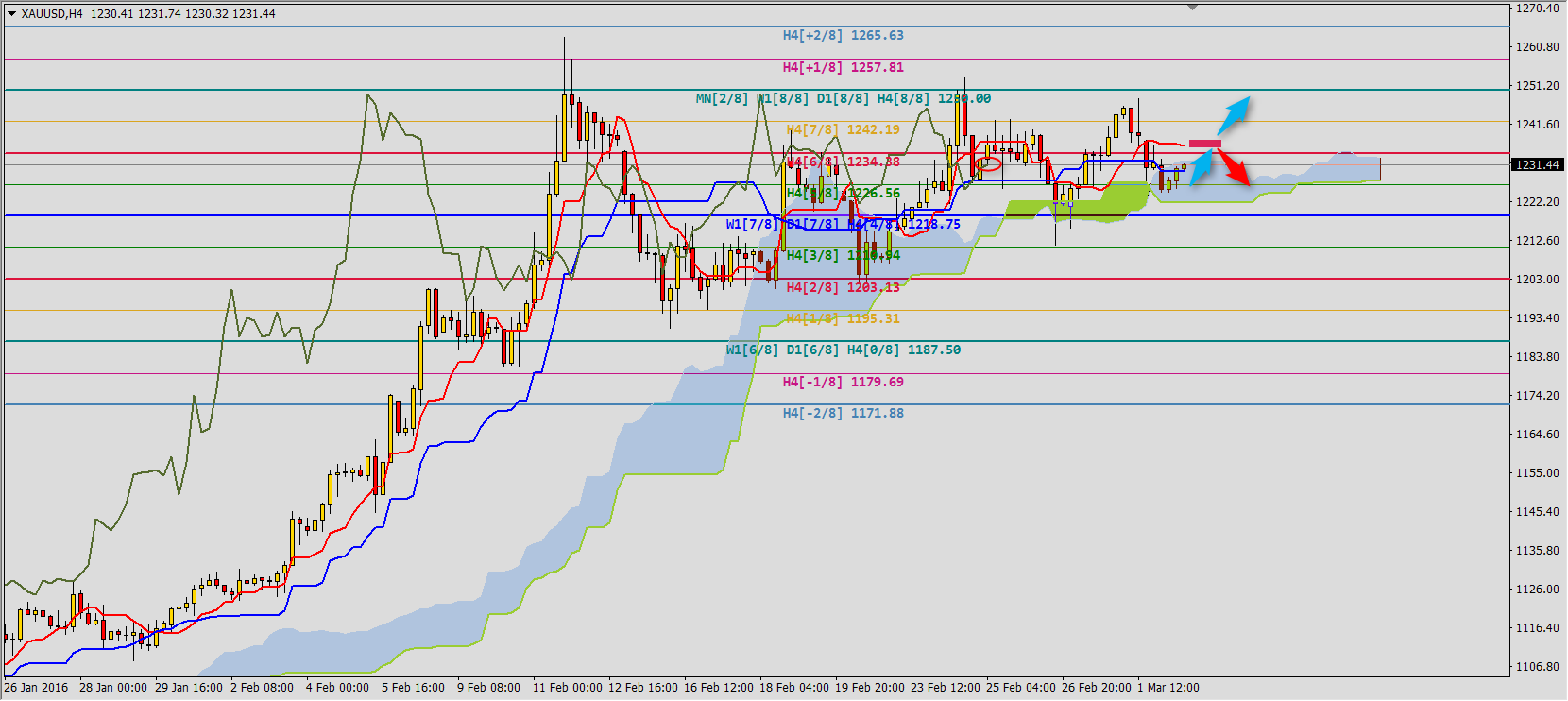

GOLD

Decreases on oil and indices is a sign of gains on gold. On daily chart we still have buy signal: price stays above bullish Kumo, Kijun-sen and Tenkan-sen. On H4 chart situation doesn’t look so good because Chikou Span is below chart. Now we cannot exclude price going back to Tenkan-sen 1236,23 but only close above this level will decrease bearish power on gold.