Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

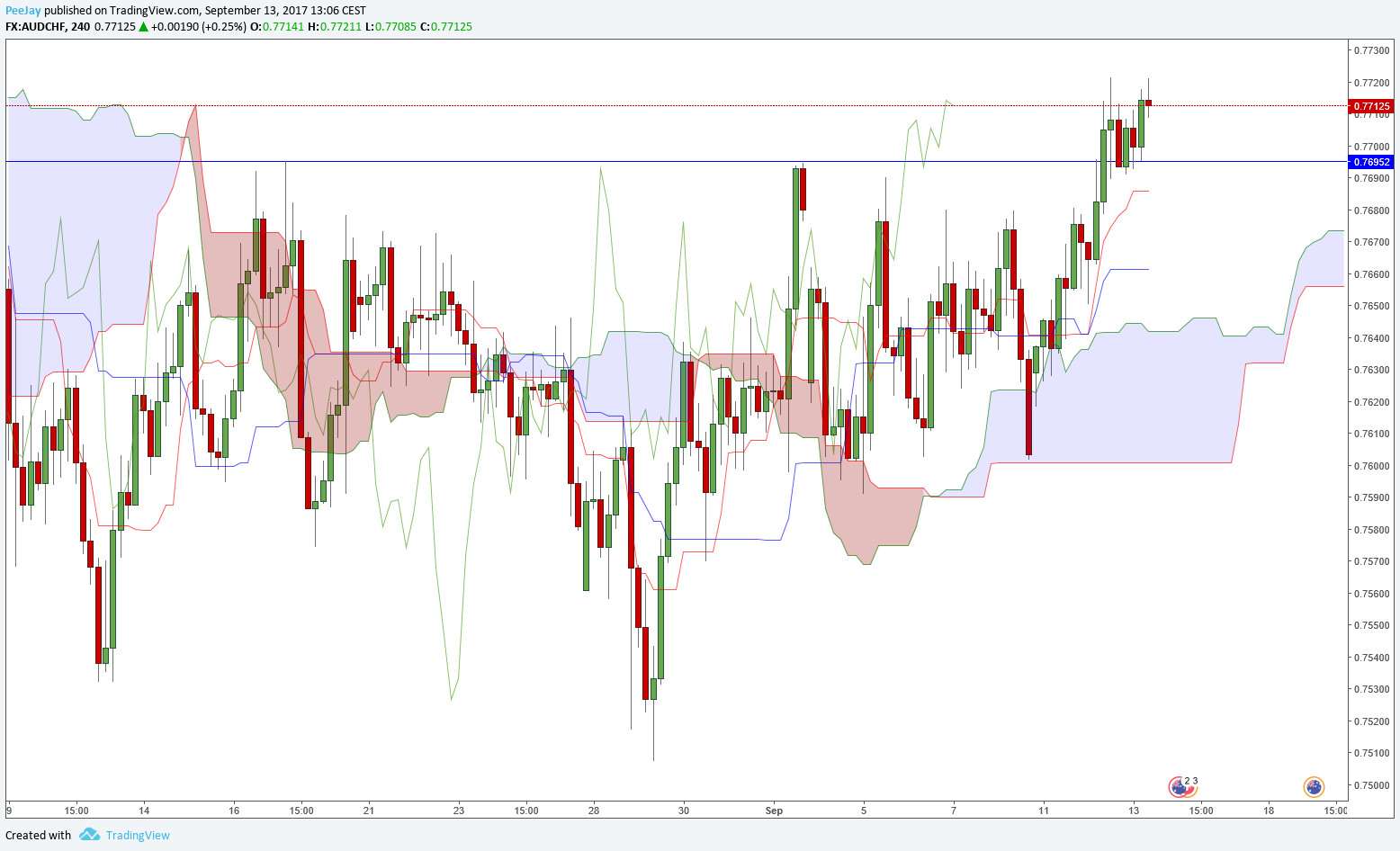

AUDCHF

Price on the H4 chart for a longer time moved in the consolidation. Lately we could see bigger gains, bulls managed to break resistance at 0.7695. It is a great place to open long position. You should place SL below broken level. Tenkan is above Kijun and the cloud is bullish.

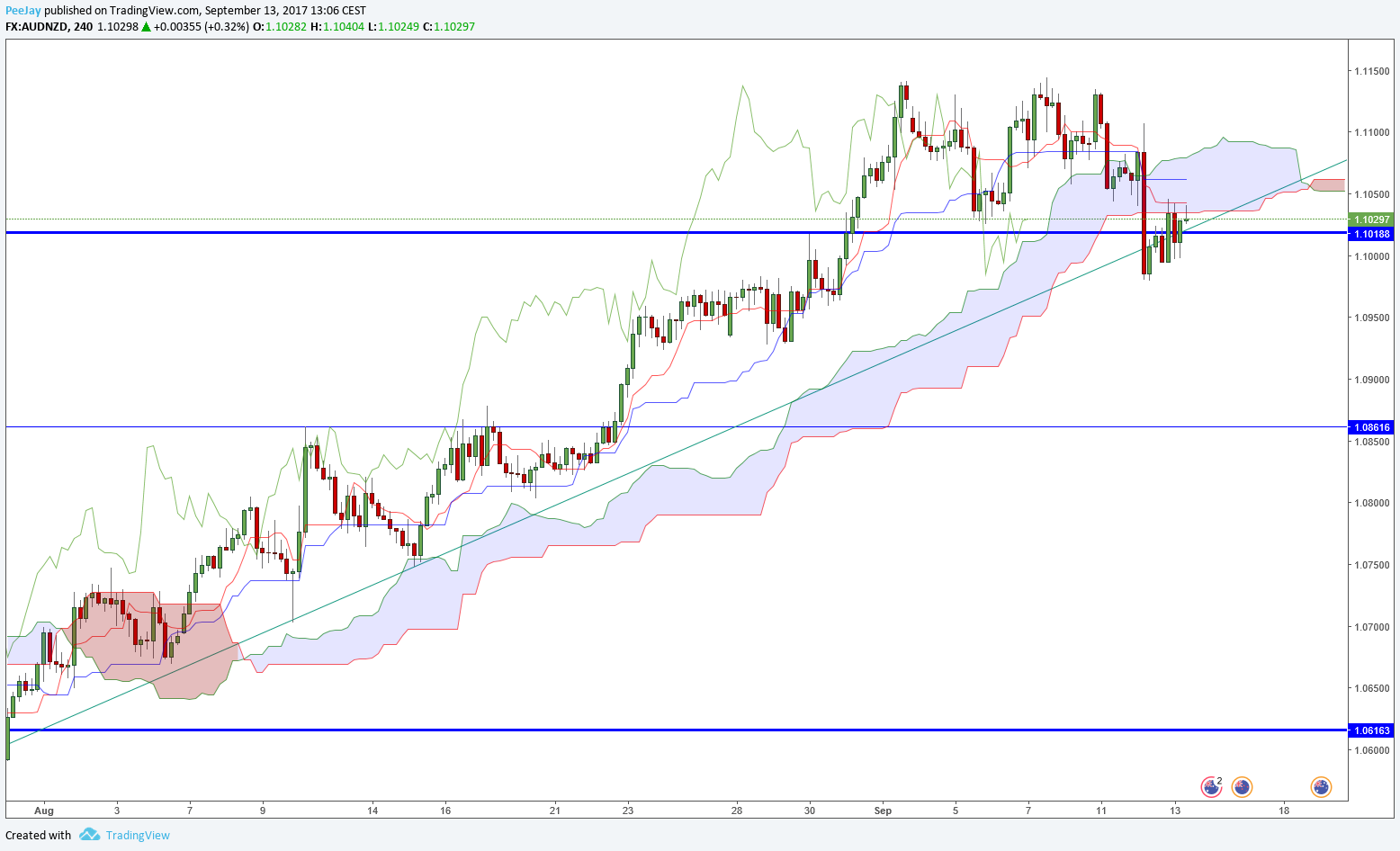

AUDNZD

Position on AUDNZD started to come back inside range of bullish trend line. So far the line is not broken permanently, just a little breached. Currently the price is a little below BE, we will see how the situation will develop.

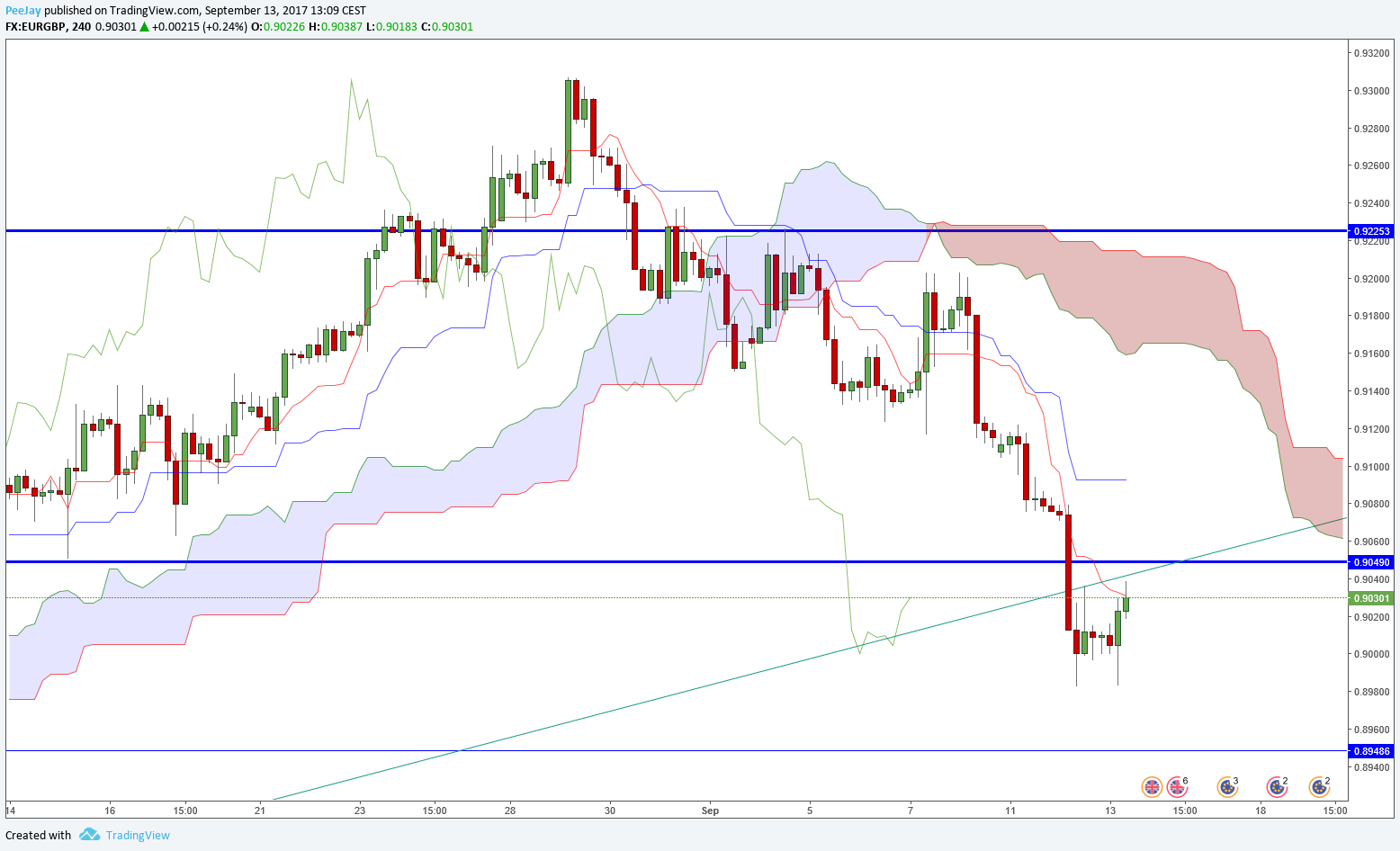

EURGBP

Dynamic bearish candle from yesterday’s morning broke through both daily support (which now should become resistance) and bullish trend line. Ichimoku situation points on continuation of decreases, earlier we can see retest of broken levels. This is why I recommend opening sell limit order in the area of resistance, with SL above mentioned bearish candle. I will open this position with 24option broker, which offers more than 200 different financial symbols.