Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

AUDJPY

On H4 chart we can see that AUDJPY just broke out of bullish Kumo cloud. Recently Tenkan crossed Kijun. WE can think about opening long position with the target on the 87.55 resistance. We should consider that soon cloud will change colour to bearish and price for some time moves without clear trend.

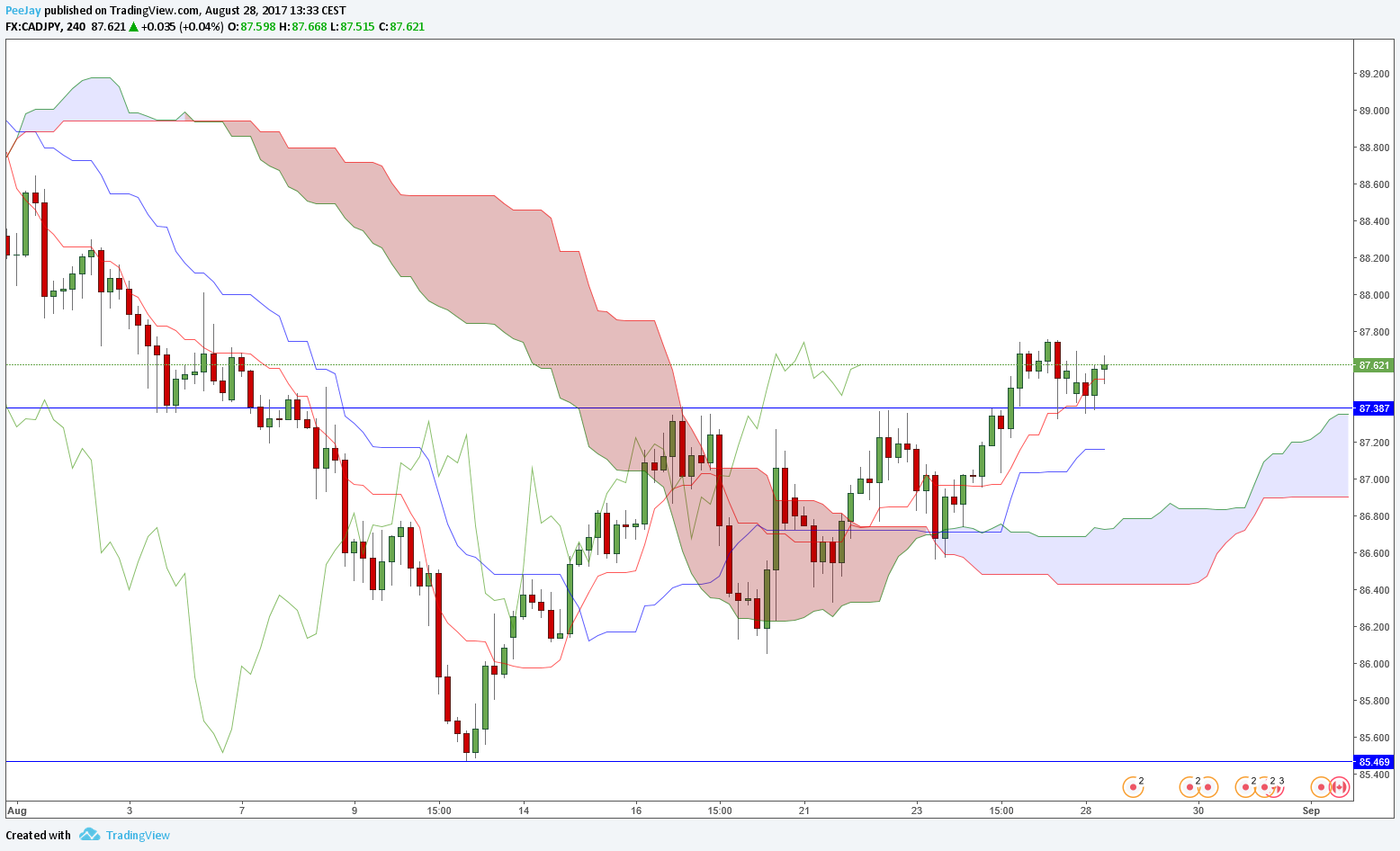

CADJPY

On Friday I described signal on CADJPY, I opened long position with quite small Stop Loss just below Tenkan and support. The same day I was really close to lose this position – price was just 0.9 pips from the Stop Loss! Fortunately there was a bullish rebound and now position is still losing, but less. Late traders can still open long position with the target at 89.50.

GBPAUD

Position brought some nice profit on Thursday after opening, but the week was closed on BE. Monday’s session started from strong bullish gap, fortunately the price quickly came back below resistance. Currently I still wait for further development.

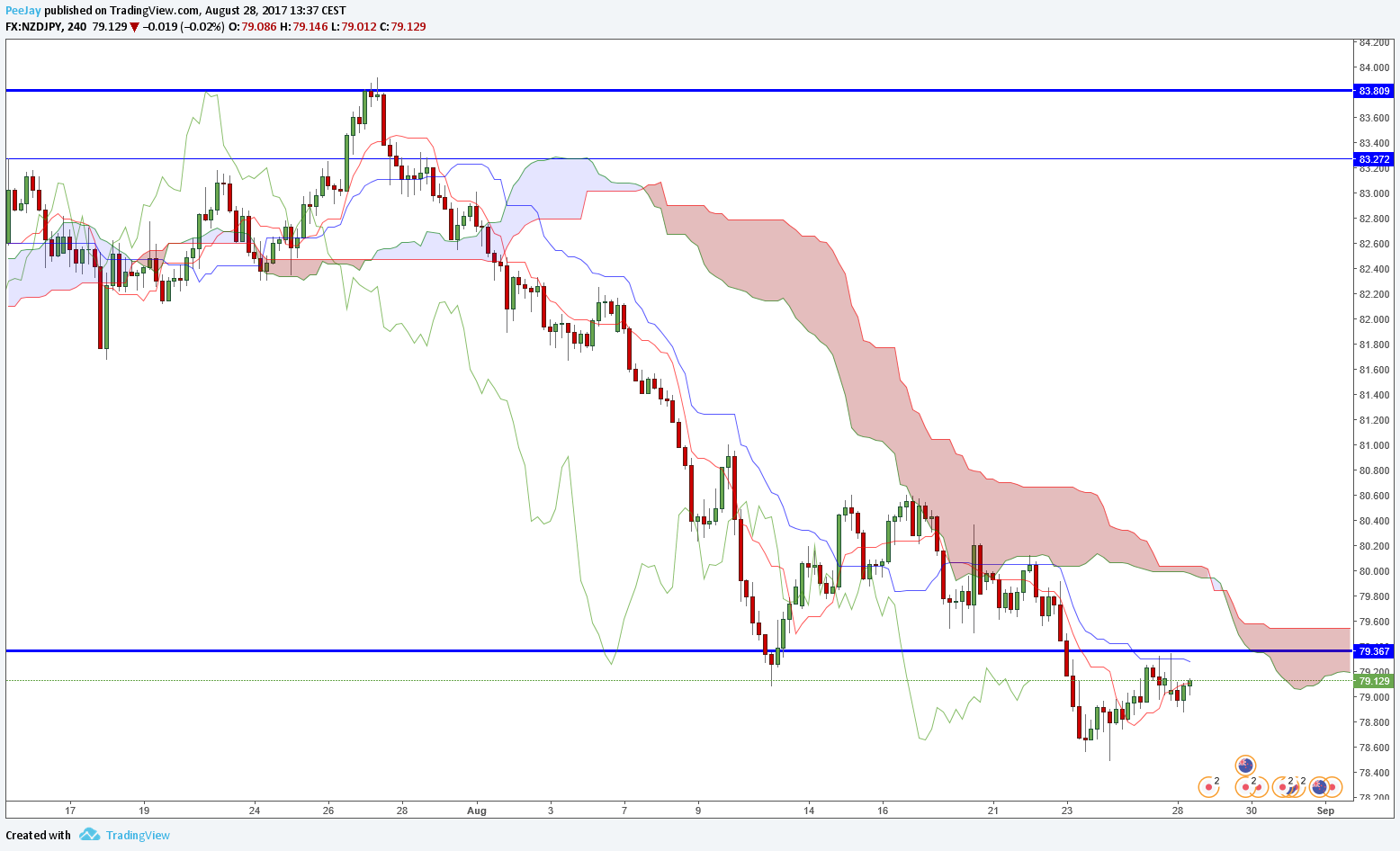

NZDJPY

Price broke through support from the daily chart and currently is getting ready for the re-test from below. If there will be any sell signal we can open the position. Cloud is bearish, and Tenkan line is below Kijun.