Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

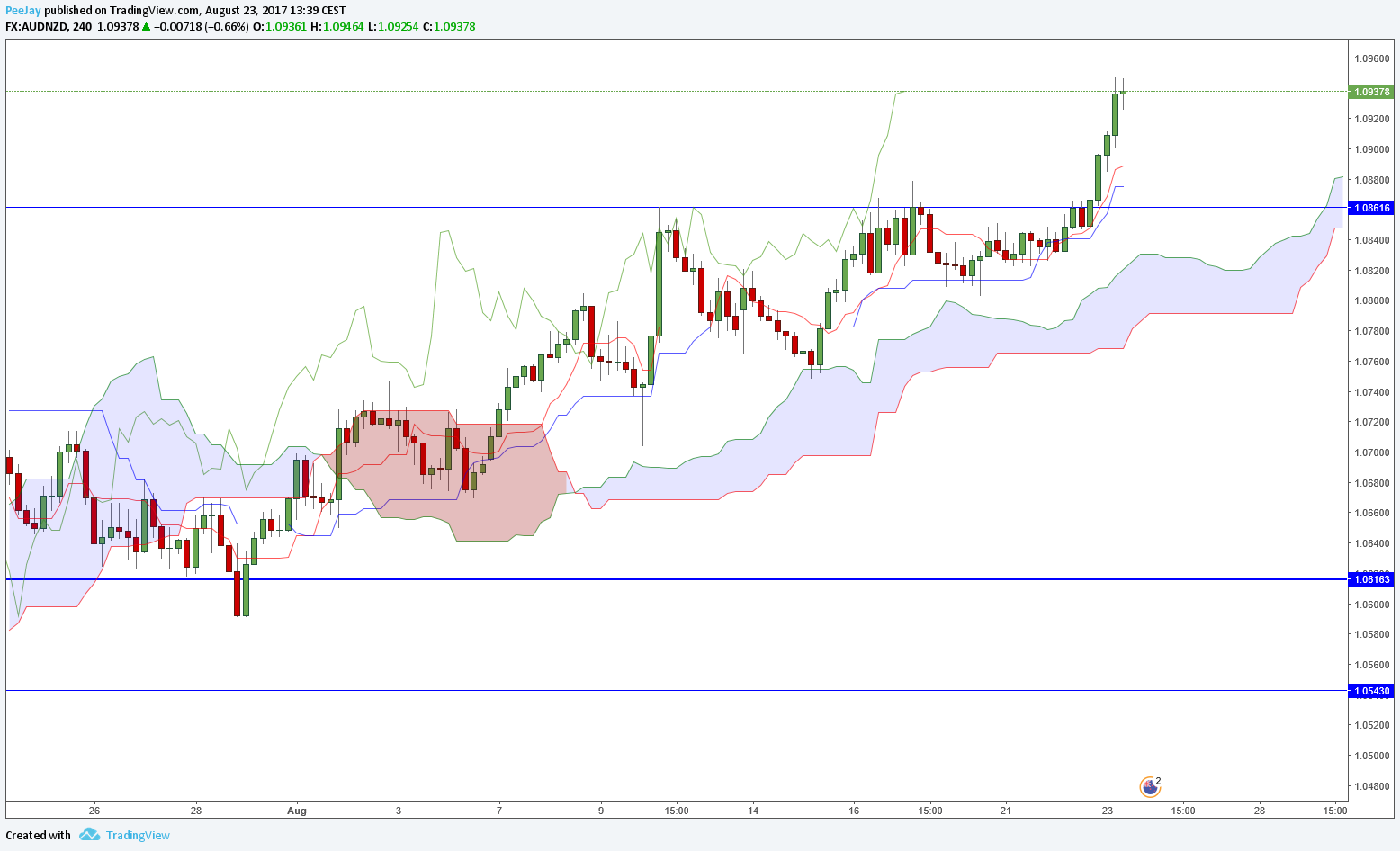

AUDNZD

Unfortunately I missed lately weakening of New Zealand dollar, but there is still an opportunity to make money. AUDNZD after third try managed to break through the resistance in 1.0860 area. Cloud is bullish and Tenkan is above Kijun line, so it indicated upward trend. We can wait for the correction in the area of broken support and in this place open pending order with stop loss below support.

EURGBP

Price is getting close to another important resistance from daily chart. It was this high for the last time on October 7th last year. If it will break above resistance, price will be on levels where we have seen it in 2009. As you can see, it is crucial level, so we can expect stronger reaction of bears. This is why so far I decided not to open long position, even though Ichimoku indicates strong bullish trend.

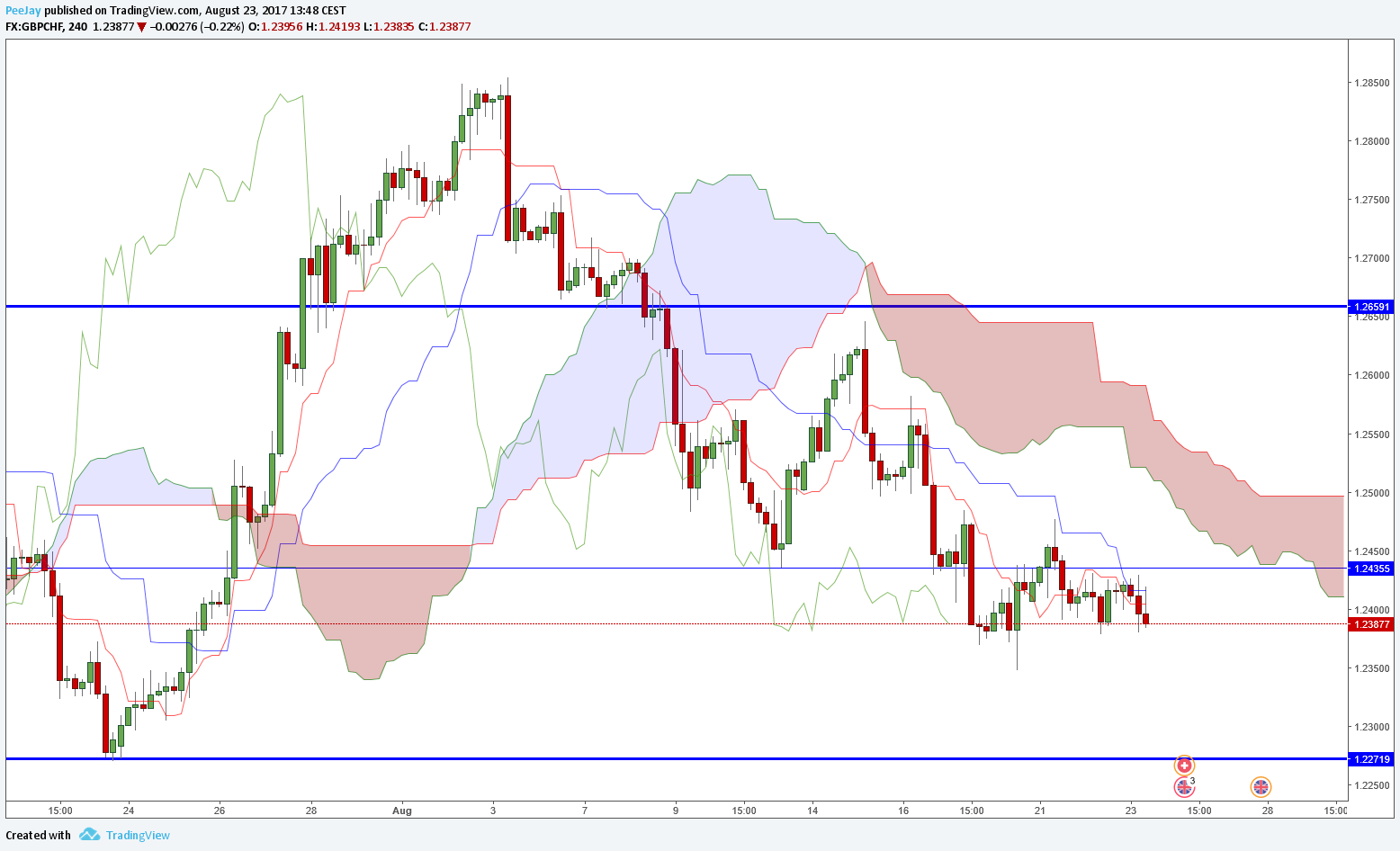

GBPCHF

Price for some time oscillates below broken support in 1.2435 area which should now work as a resistance. It is a good place to open short position with a stop loss above broken level and the target is in the area of daily support at 1.2272. Kumo is bearish and Tenkan line is below Kijun.

NZDJPY

Pair without any problems broke through support from the daily chart. Sentiment is still bearish, it is confirmed both by Kumo cloud and Tenkan/Kijun setting. We can open pending order in the 79.20 area, thanks to small bullish correction we can get better parameters of the position.