Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

Ichimoku charts doesn’t look interesting right now. I don’t have any position opened. However, we should not force entering the market. It is better to watch the charts calmly and look for some chances to open position in near future.

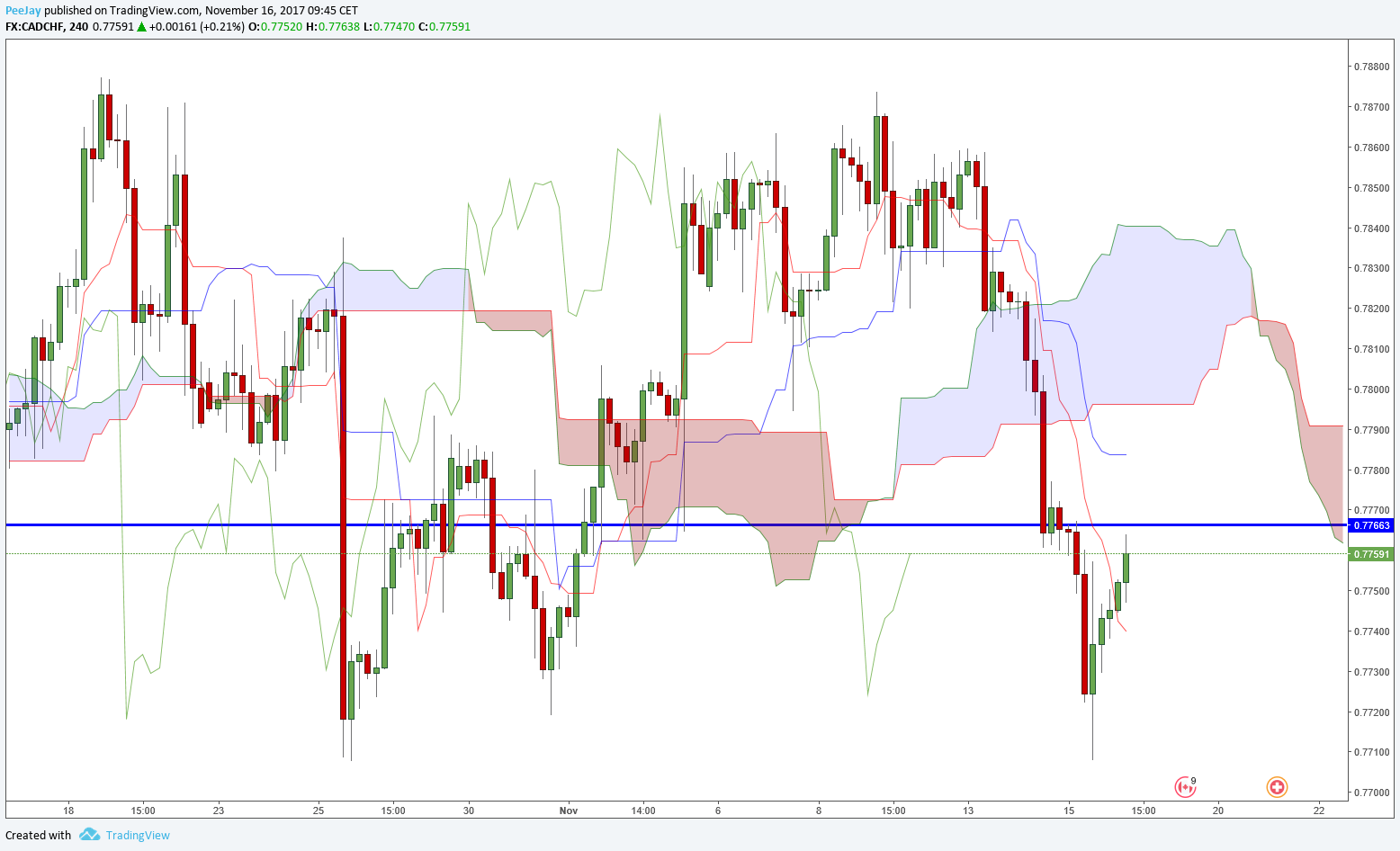

CADCHF

On the H4 chart we can see that price broke through strong support from the daily chart and currently there is bullish correction happening. It is worth to observe price behaviour in the area 0.7760-0.7700. If there will be any sell signal, we can think about opening shorts.

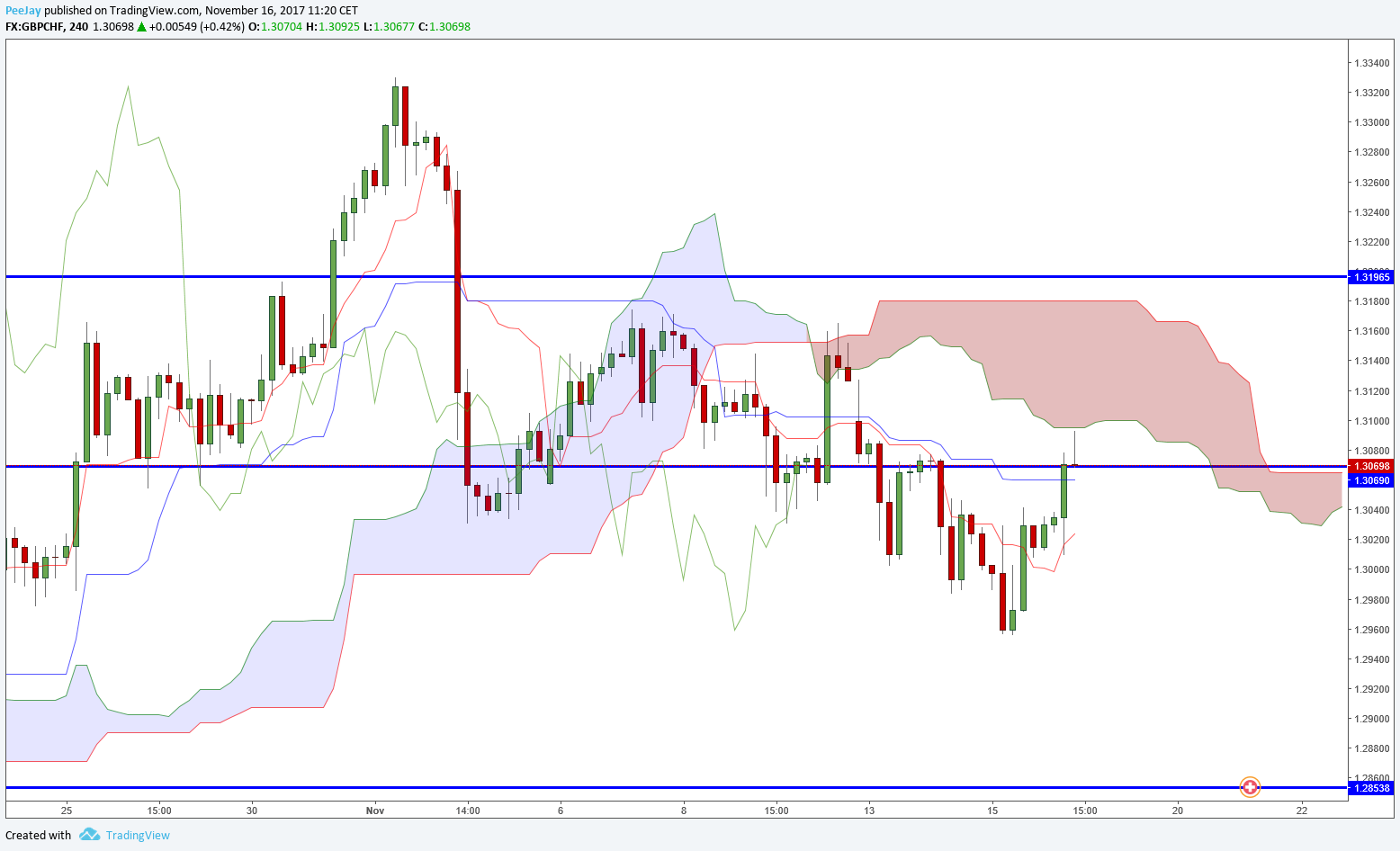

GBPCHF

Another pair with Swiss franc, here situation is even more interesting. Price came back in the area of broken 1.3070 level. It is also close to bearish Kumo cloud. If there will be a rebound from the cloud and going back below resistance, we can look for opportunity to open shorts. Depreciation can even reach support at 1.2850. To open this position I recommend 24options broker, which offers instant order execution.