![]() From Investor to Scalper – series of studies created in cooperation with broker BDSwiss, in which we take a financial instrument and the analysis includes a detailed look at the value from the monthly chart and ending with H4/H1.

From Investor to Scalper – series of studies created in cooperation with broker BDSwiss, in which we take a financial instrument and the analysis includes a detailed look at the value from the monthly chart and ending with H4/H1.

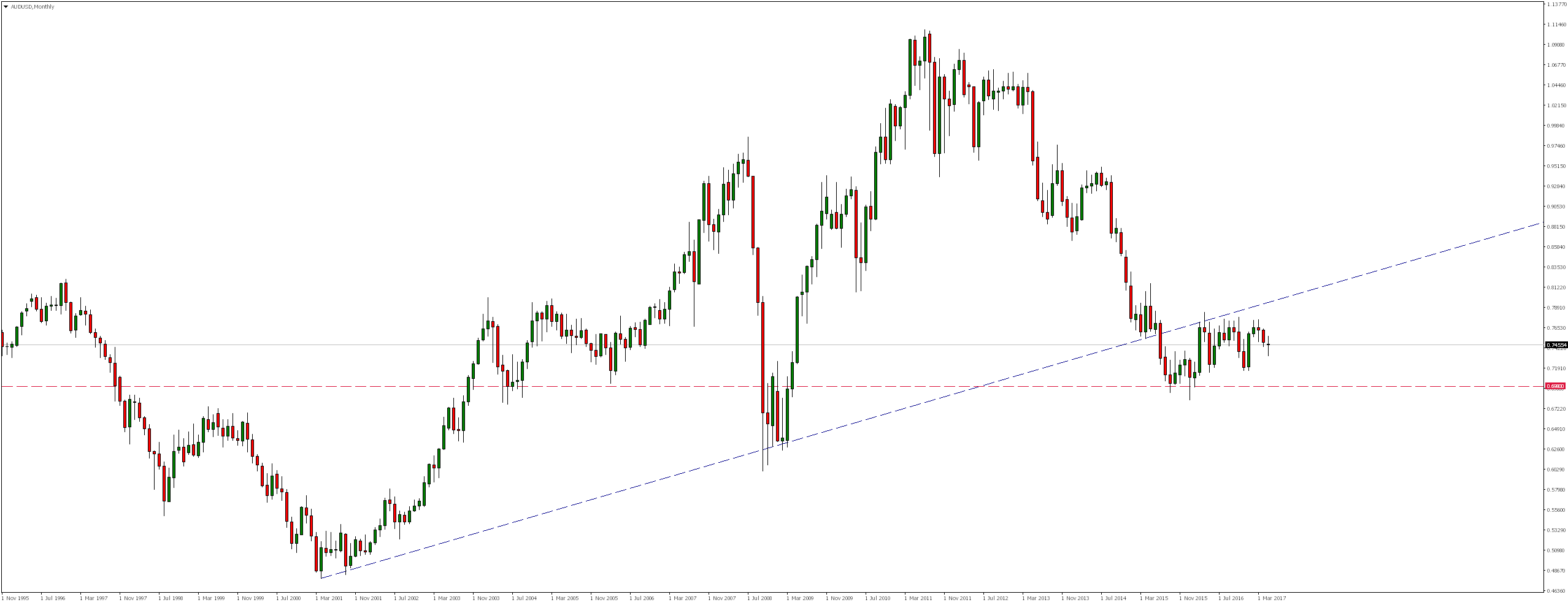

AUDUSD since August 2011 moves south. As a result of these falls, in September 2015 market reached level 0.6980 and since then has been moving in consolidation. It is also worth noting that market has beaten and after re-testing has already rejected the bullish trend line.

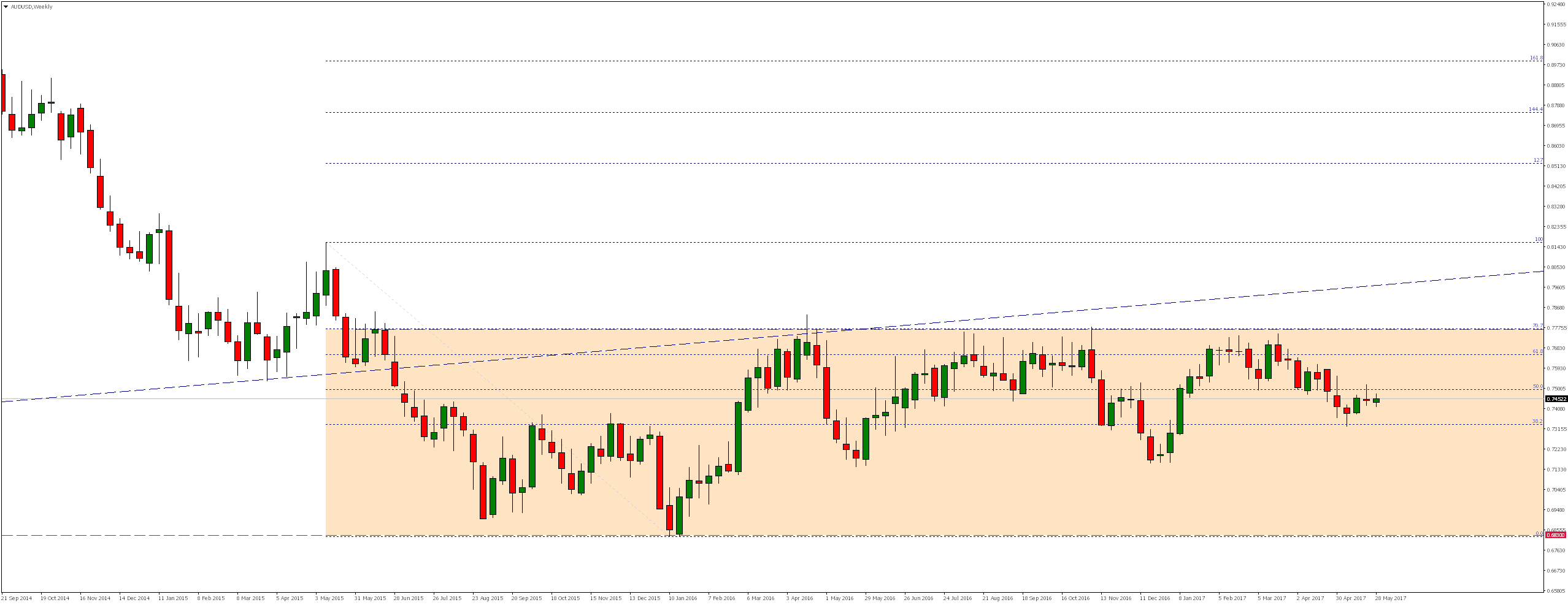

Looking at weekly chart, we will notice that market has been moving in consolidation since May 2015. Upper limit of consolidation coincides with the 70.7% Fibonacci correction from the last downward impulse. For the past few weeks market fluctuated around this resistance, where in second half of March there was a supply reaction.

On daily chart we will notice that if declines were to reach lower limit of the aforementioned consolidation, we would have first to beat support at 0.7160. It constitutes the lower limit of the local box.

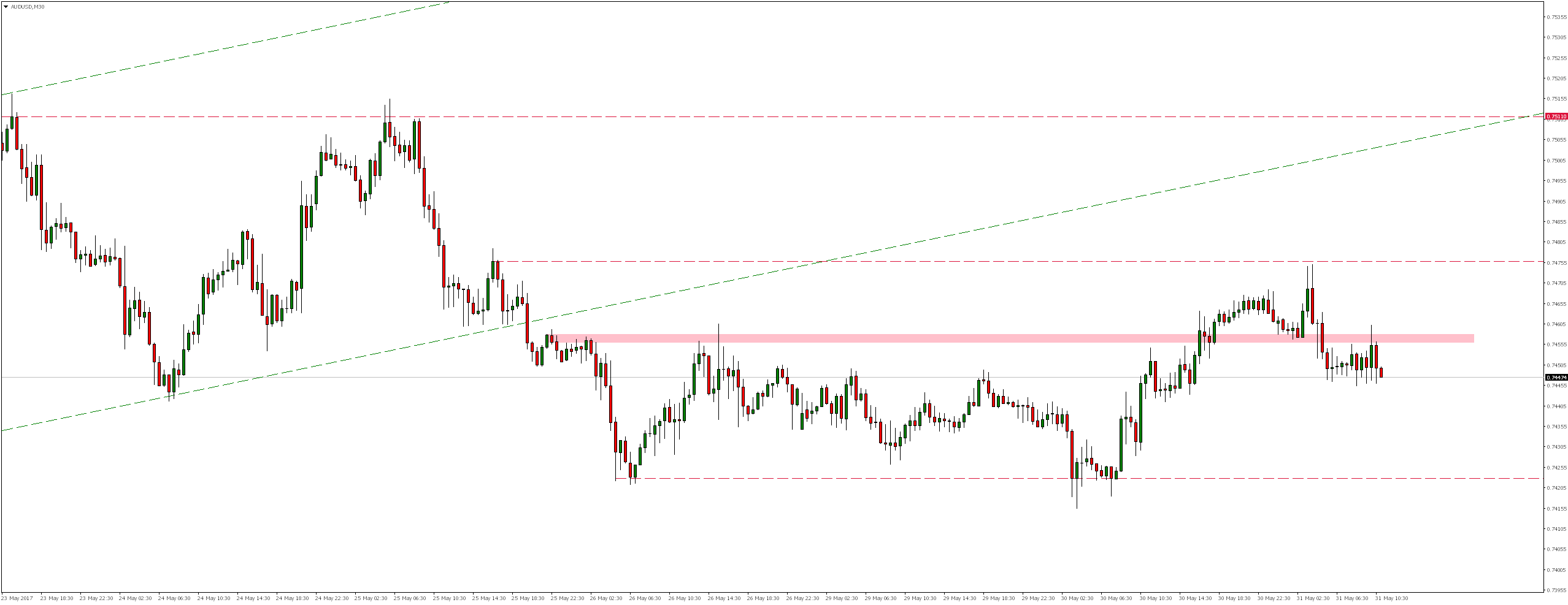

The H4 chart looks very interesting. We see that market has been moving south for a long time, creating a descending channel, which, as a result of three weeks of rather calm growth wase broken thru the top. It is noteworthy that these increases were also within a channel, from which we broke out thru bottom at the end of last week.

Price is currently in zone between the upper limit of the previous bearish channel and the lower limit of the growth channel. These two levels (support and resistance) could determine setting another formation, this time the expansion triangle.

Looking at 30 minute chart, we will notice that market is moving from second half of last week in a consolidation. Today we tested its upper limit where bearish response occurred, and as a result of later declines local support zone was defeated, which was subsequently rejected as a resistance after a re-test. In near future we would expect continuation of declines.