Hi Everybody,

The records set by Wall Street were not the only all time highs we saw.

Crude Oil stockpiles in the US have hit a record of 520 Million Barrels.

Antartica hit an all-time record of 17.5 degrees celsius yesterday.

Temperatures are rising fast across the globe, metaphorically, politically, spiritually, and now physically.

-Mati

Today’s Highlights

- Record Highs All Around

- Outstanding Euro-flation

- Snap IPO Today

Please note: All data, figures & graphs are valid as of March 2nd. All trading carries risk. Only risk capital you’re prepared to lose.

Market Overview

Investors in New York had barely just recovered from the massive hangover caused by the Dow 20k party and look at that Dow 21K and counting.

The UK100 index also reached a fresh new level of 7,398. Way to go Brexit!!

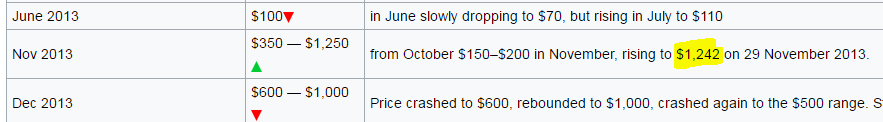

Bitcoin, despite headlines, has not hit any sort of record just yet. It is very high though trading at $1224 at the moment and does seem to be carrying momentum. However, I fear that by the time it finally does reach $1242 a coin, the news item will already be spent.

For those who want to call me on this and point to any charts on coinbase or otherwise. Just check this link: https://en.wikipedia.org/wiki/History_of_bitcoin

I know that it looks really good in a headline but you can’t rewrite history!

The all-time high for Bitcoin is still $20 away.

More Trouble for the EU

As if they didn’t have enough problems with the Brexit, the Grexit, and the potential upcoming Frexit, inflation is rising at an alarming rate.

Today, Eurostat will publish the inflation figure and analysts are expecting to see a rise of 1.8% over the past year.

This is really incredible for an economy that was battling deflation less than a year ago.

The ECB will be very glad to point out that they’re about to hit their target inflation of near 2%, but when it’s rising this fast they run a serious risk of overshooting that target by a long shot.

It’s difficult to slam the breaks on a vehicle that’s printing €60 billion a month and currently has negative interest rates.

The stock of the day

Snap is the largest IPO since Alibaba but many analysts are predicting that it will crash like Twitter.

In eToro @jaynemesis, @valuefund, and @algebraiker can’t wait to short that stuff.

Trade with others. Join eToro community and use experience of other traders!

Still, with the amount of momentum that’s in the stock markets over the last few weeks, I would not be surprised if it does take off.

The company decision to position themselves as a camera company rather than an instant messaging app was a smart move. Will investors buy it though, I guess we’ll find out soon.

Let’s have an awesome day ahead!!

Best regards,

Mati Greenspan

Senior Market Analyst

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)