Mondays afternoon brings us new technical setups from Lloyds Bank analytics. In todays review we will take a look at GBPUSD and EURUSD in pair with Lloyds Bank:

Mondays afternoon brings us new technical setups from Lloyds Bank analytics. In todays review we will take a look at GBPUSD and EURUSD in pair with Lloyds Bank:

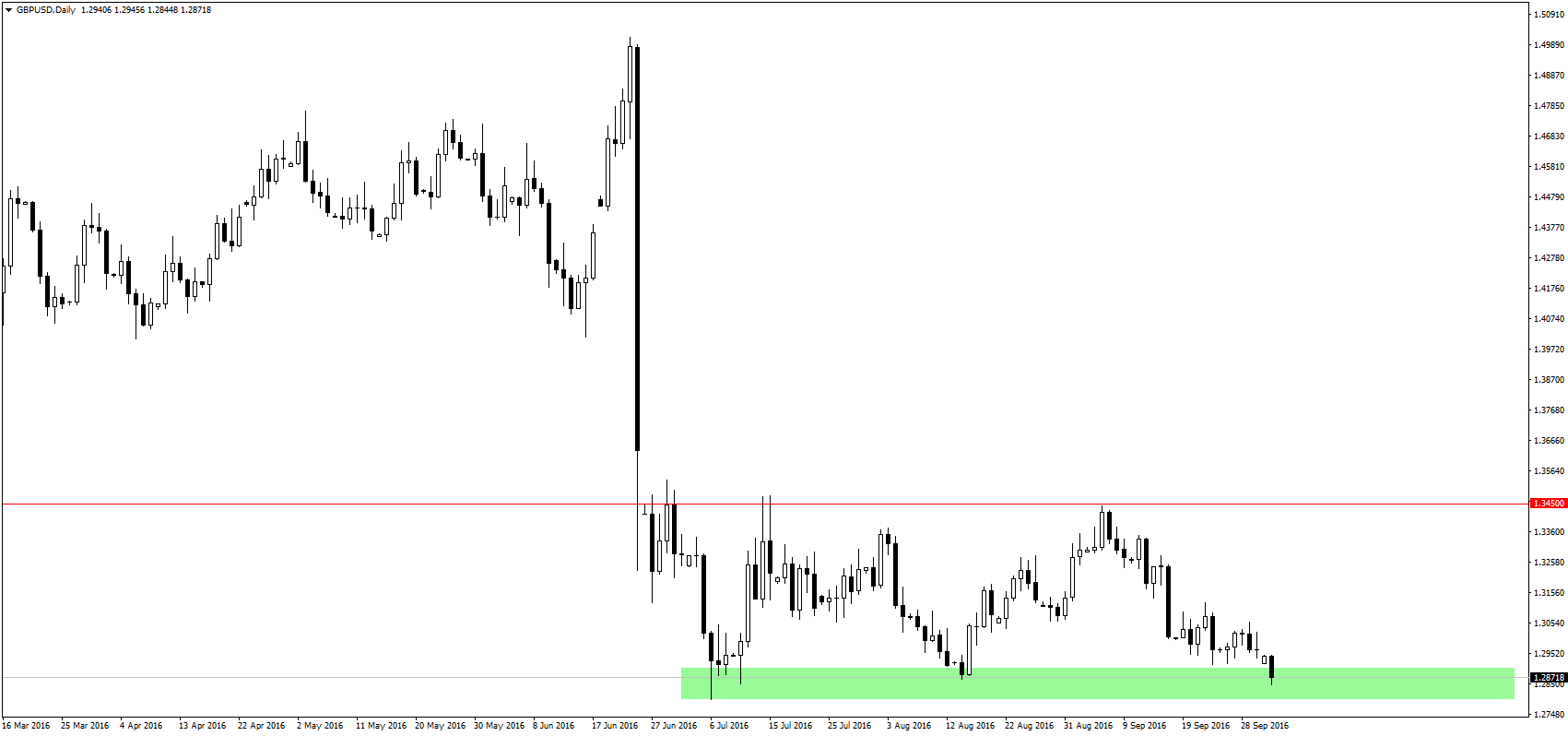

GBPUSD

The GBP is under renewed selling pressure on the back of PM May’s announcement that article 50 will be triggered by Q1 2017. We are back to the key range support region between 1.29 and 1.28, with a clear break here seeing little in the way of meaningful support until the 1.26-1.25 region. Intra-day resistance lies at 1.2940/50 and then 1.3000/1.13010, with a push through these levels needed to alleviate the immediate bear pressure. However, a run back through 1.3125 area is needed to signal a move back towards range highs at 1.3400-1.3500.

Long term, we believe we are in the last phase of the bear trend that started back in 2007 at 2.1160, but it is not clear if we are basing around 1.28 or it will be at lower levels.

EURUSD

EURUSD continues to defy rate spreads and sit in the middle of its ranges. A move through 1.1280/90 would suggest a push back towards 1.1350-1.1450 resistance, but while under this resistance our bias is to the downside. A breakdown through 1.1120/1.1100 support is needed to add conviction to this view, opening the potential for a move to 1.1000-1.0900 support.

Longer term, we are becoming wary that the 1.0450-1.17 range is developing as a “flag” consolidation ahead of a test of key long-term support in the 1.00-0.99 region. We are monitoring this for greater clarity and confidence in this view. For now, further range trading is likely to persist.

Would you like to get more such informations directly on your email? Try out FxWatcher service for 5 days for free!