Despite a distinct lack of a rally in US yields, the broad USD (BBDXY) moved back to range highs, with important levels in EURUSD (1.0370-1.0350) and GBPUSD (1.2330-1.2300) both being tested. However, the move failed to accelerate, stalling shortly after progressing to these technical levels. This is possibly indicative of the limited appetite from the market to chase price action in the low liquidity environment up to the New Year. The USD clearly has the impetus at this stage, but momentum studies for a number of key currencies are still warning of the potential for short term consolidation.

Despite a distinct lack of a rally in US yields, the broad USD (BBDXY) moved back to range highs, with important levels in EURUSD (1.0370-1.0350) and GBPUSD (1.2330-1.2300) both being tested. However, the move failed to accelerate, stalling shortly after progressing to these technical levels. This is possibly indicative of the limited appetite from the market to chase price action in the low liquidity environment up to the New Year. The USD clearly has the impetus at this stage, but momentum studies for a number of key currencies are still warning of the potential for short term consolidation.

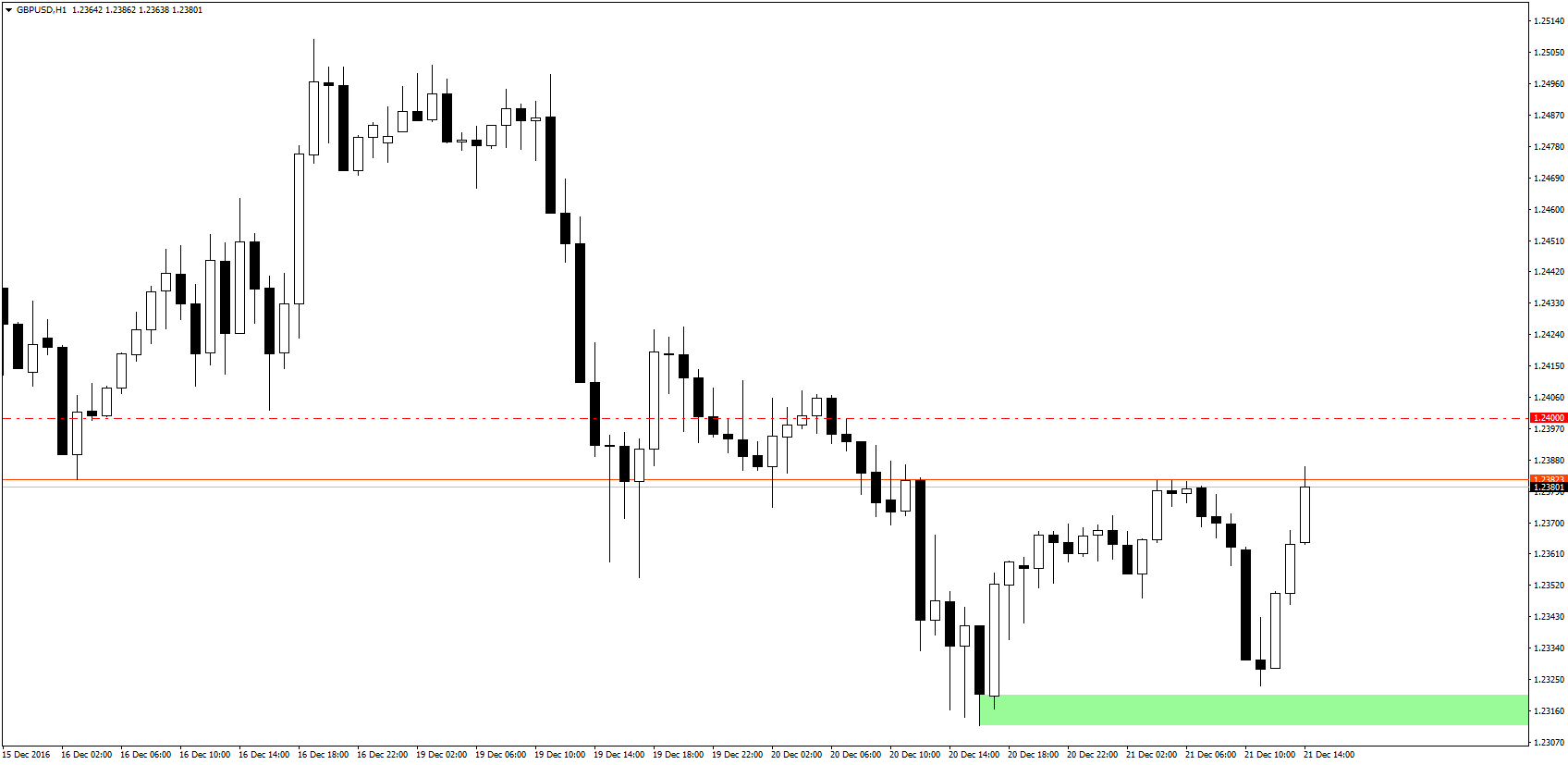

GBPUSD

After failing at trend channel resistance, GBP came under renewed selling pressure, which led the pair to test pivot support at 1.2330-1.2300. For now, this region continues to hold. A break below would re-open a test of the 1.2080 lows.

Our medium-term expectation remains for further consolidation in the 1.2000-1.2080 / 1.2800-1.3000 range. In the prevailing environment, rallies are likely to be quickly capped, with resistance lying at 1.2400-1.2410, followed by 1.2490-1.2540.

Our medium-term expectation remains for further consolidation in the 1.2000-1.2080 / 1.2800-1.3000 range. In the prevailing environment, rallies are likely to be quickly capped, with resistance lying at 1.2400-1.2410, followed by 1.2490-1.2540.

Commentaries, trading setups and many more are provided by FxWatcher. Try out FxWatcher service for 5 days for free!

Long term, while we believe the decline that started back in 2007 at 2.1160 is close to completing with the move under 1.30, at this stage, it is not yet clear to us that 1.1490 was the major base. Our bias is for another downside test after a medium-term range between 1.20 and 1.30 develops further.

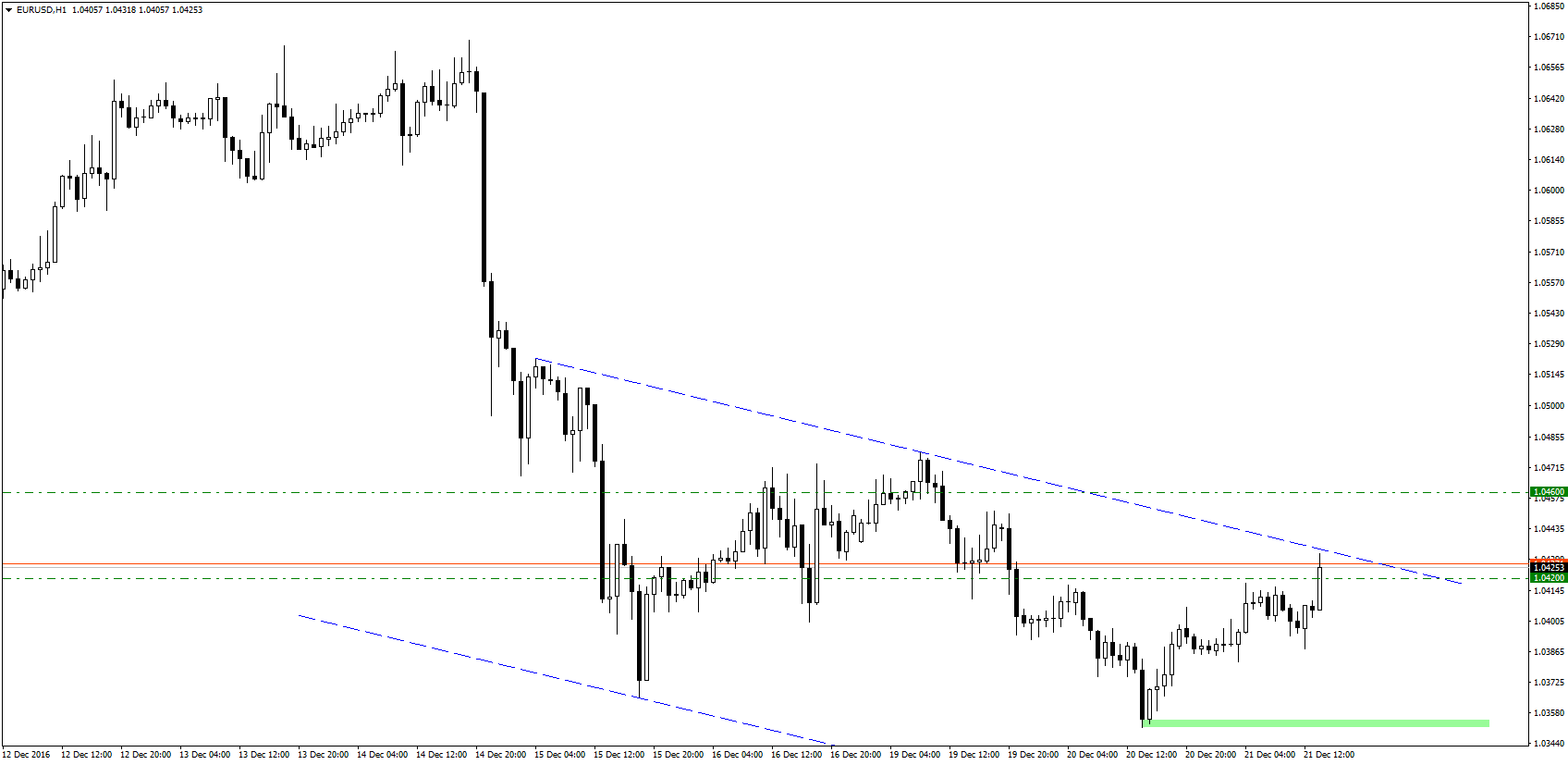

EURUSD

As the USD gained momentum against developed market currencies, EURUSD traded down to a new multi-year low of 1.0352. However, with a lack of follow-through and momentum at stretched levels, it remains to be seen whether the pair can extend further. We see little in terms of meaningful support until 1.0250, ahead of the important 1.01-0.99 support region.

Resistance lies at 1.0420-1.0460, with 1.0600-1.0650 further above. Long term the move down through the 1.0450 region is arguably the last in the cycle from the 1.6020 highs set back in 2008. If this is the case the market should not breakdown through the 1.01-0.99 region. Such a move would expose a deeper rift in the EUR and risk a move towards 0.90.

Resistance lies at 1.0420-1.0460, with 1.0600-1.0650 further above. Long term the move down through the 1.0450 region is arguably the last in the cycle from the 1.6020 highs set back in 2008. If this is the case the market should not breakdown through the 1.01-0.99 region. Such a move would expose a deeper rift in the EUR and risk a move towards 0.90.

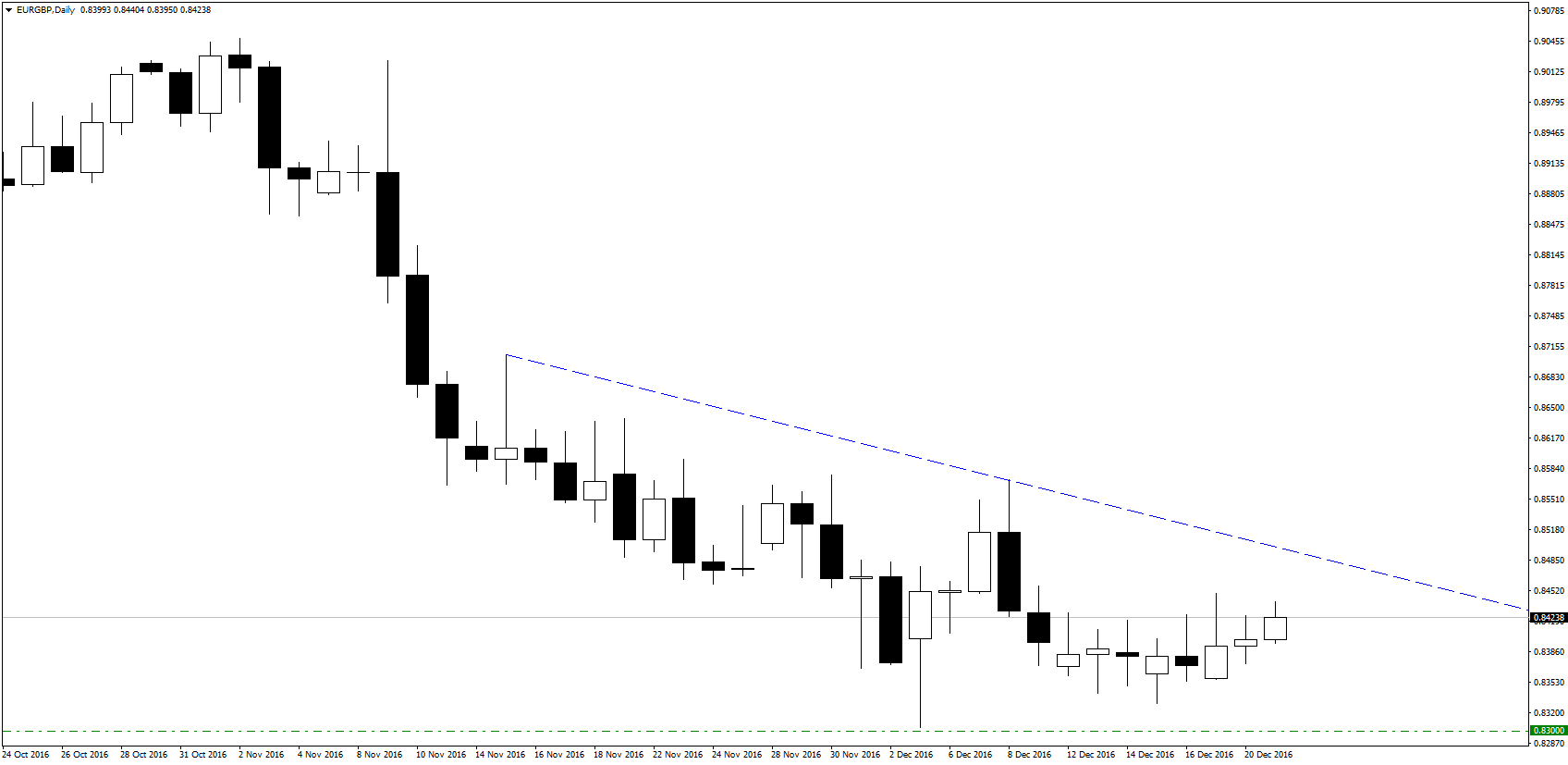

EURGBP

With both EURUSD and GBPUSD finding themselves under pressure and trading through notable levels at 1.0367 and 1.2330 respectively, EURGBP continues develop in a relatively tight range. Overall, the trend remains downward, however, short-term momentum studies have stalled, suggesting there is scope for further consolidation. 0.8300-0.8250 is still important medium-term support and, while over, we are looking for signs of a base developing. However, at this stage a rally back through 0.8550-0.8600 is needed to add conviction to this view.

A range bound outlook is our base case scenario, while a decline through 0.8250 would call that into question, bringing an immediate risk of a deeper setback towards 0.80-0.7950. It would also drive a reassessment of our longer-term analysis that we can still see a re-test of the 0.9800 highs set back in 2008.

A range bound outlook is our base case scenario, while a decline through 0.8250 would call that into question, bringing an immediate risk of a deeper setback towards 0.80-0.7950. It would also drive a reassessment of our longer-term analysis that we can still see a re-test of the 0.9800 highs set back in 2008.