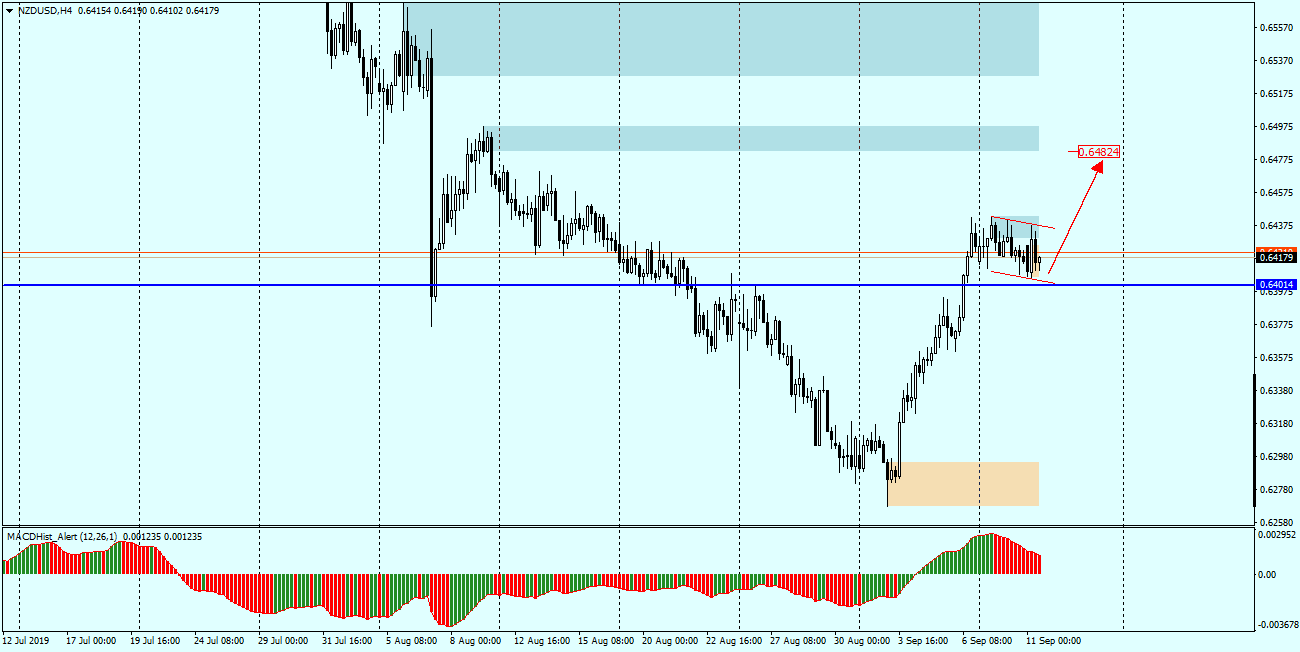

NZDUSD – popular “kiwi” is in the correction phase after more than 6 weeks of declines. Currently, the price is in the short-term consolidation, which has taken the form of a bearish flag. The support of this consolidation, i.e. the lower limit of the flag, is close to the important horizontal support 0.6400.

We can assume that in this case we have a confluence of support levels, and their crossing is a point of confluence, whose defeat could lead to the completion of the correction and return to declines, and the reflection upwards will indicate the continuation of the correction.

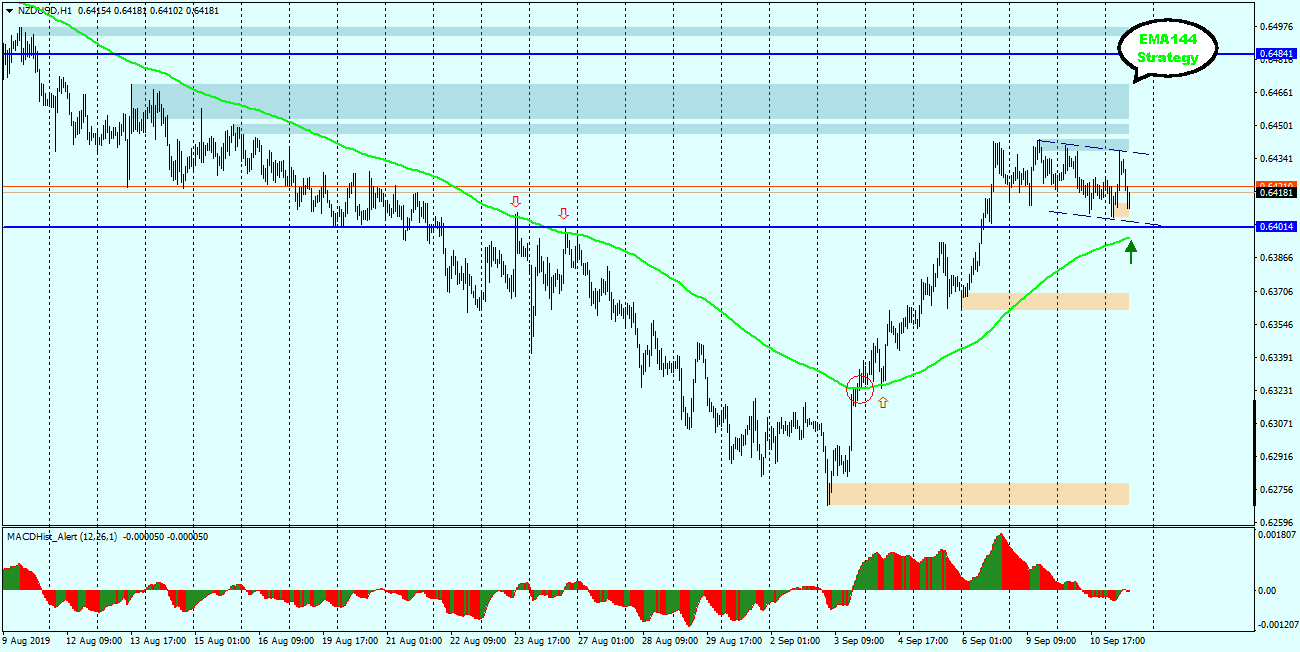

Looking at chart H1 in terms of the EMA144 strategy, we can see that previously the price quite accurately respected this average as a dynamic resistance, and after defeating it as a support. The quotations are already close to the moving average, which, in accordance with the assumptions of the strategy mentioned above, gives us a signal to take the BUY position, because the average now serves as a support. Only when the average and the level of 0.6400 are overcome can the growth scenario be negated, therefore our SL should be in the area of the last local minimum of 0.6360, and TP in the nearest supply zone of 0.6480.