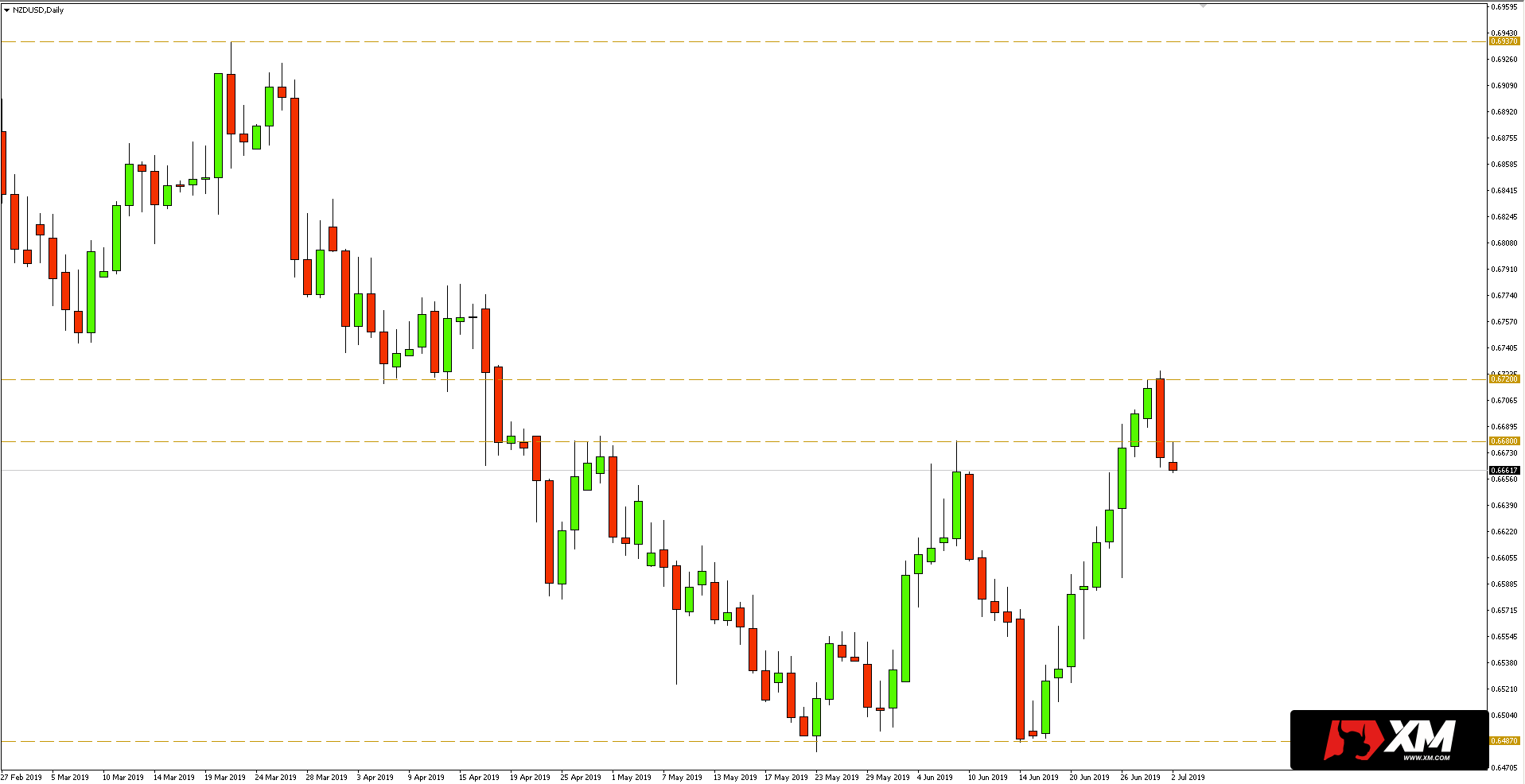

The NZD/USD currency pair quotations have declined since the positive key resistance test at 0.6937. The dynamic decline led to a support rate of around 0.6487, which effectively limited the ambitions of the sellers.

As can be seen in the daily chart below, after the second rebound from the above mentioned support, the New Zealand dollar to greenback quotations have been gaining for 9 consecutive sessions, and the result of the increases was a higher peak, which puts into question the potential for further decreases.

Yesterday, however, the sellers returned to the market, who successfully tested their resistance at 0.6720, and the closing of the day took place under the level of 0.6680. On the chart there was a bearish engulfing, which gives a chance to rebound.

On the one hand, therefore, we have a dynamic growth and the establishment of a higher summit, which calls into question the earlier falls. On the other side – bearish outside bar on resistance in line with the dominant direction of quotation movement.

Therefore, it is quite possible that the outside bar formation will be used by traders playing to weaken NZDUSD. However, they should be aware that an outside bar pattern after such a strong upward movement can only cause a slight rebound, after which the buyers will attack the resistance at 0.6720 again .

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities