Last weekend, a G20 meeting was held in Osaka. It is a strange project, because theoretically it is supposed to bring together the world’s largest economies plus the European Union…. and yet Germany, France, the UK and Italy have their own separate representatives in the heads of finance ministers. But it is not the members that we are concerned about today, but whether and how the news from Osaka had and can have an impact on forex and exchange rates.

Looking at the charts, we can see that the information about the meeting of the Presidents of the United States and China and the hope of hanging up the trade war inspired the markets with optimism. At least at the beginning of the week, on most currency pairs and gold, we noted gaps in the quotations. This was particularly noticeable in GOLD and JPY, which usually react most violently to changes in market sentiment.

Today’s RBA decision was also expected by the market, and a 0.25 point drop in interest rates did not surprise the market, and after a temporary drop of 25 pips, the AUD dollar is slowly gaining in value against other currencies, including USD.

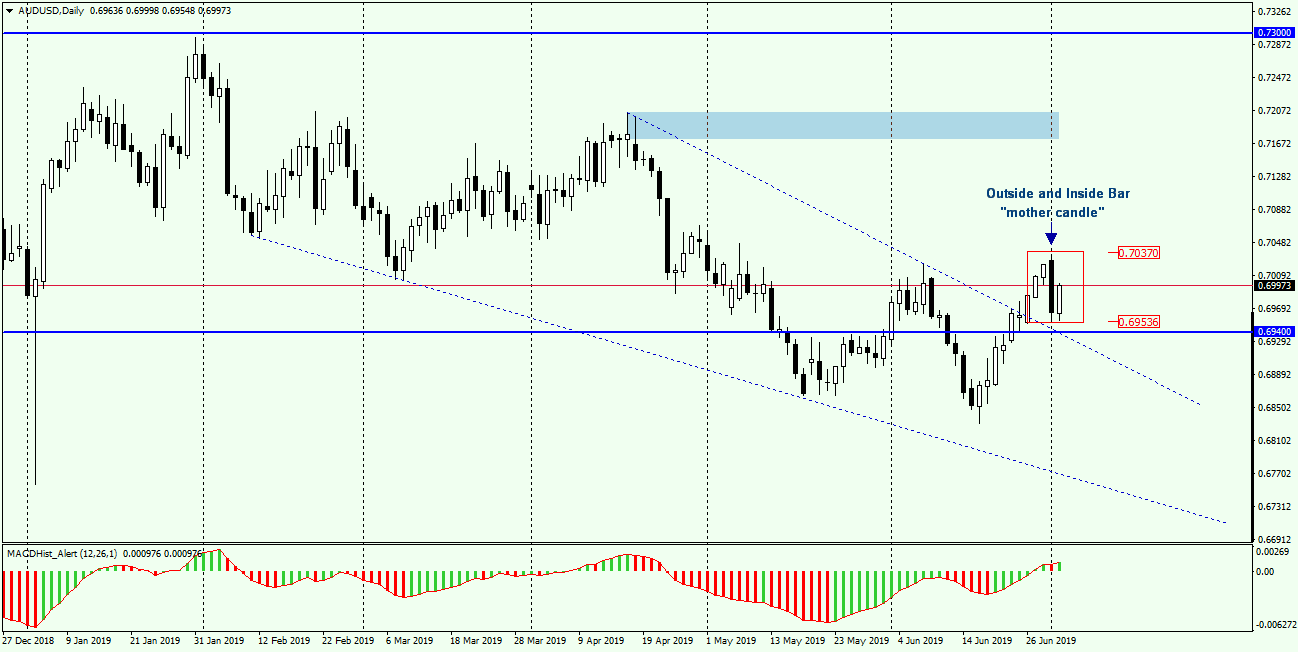

So let’s look at the daily chart above and try to do an analysis to determine the likely scenario for the next few days. Yesterday’s daily candle included the previous two in its range, creating an Outside Bar. Today’s candle is still within the “mother” candle, creating Inside Bar formation. Recently, we had a similar situation – that is, a “double pack” on EURAUD – described here.

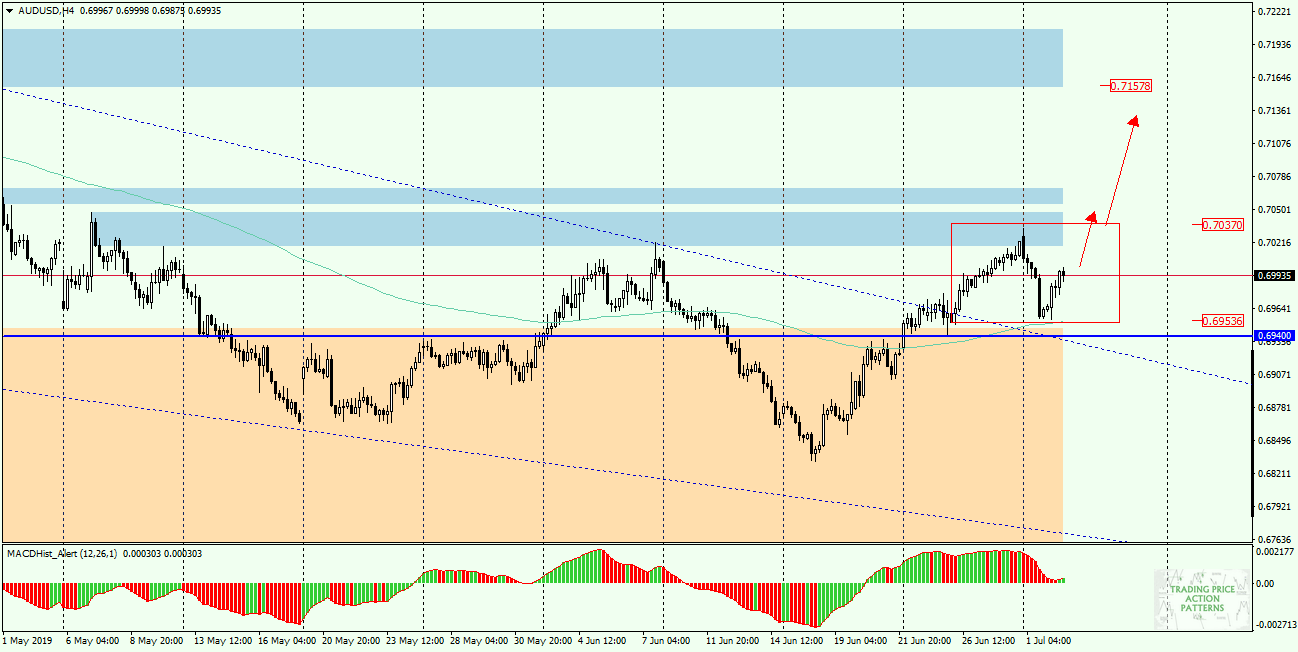

Going to the chart on H4 – we can try to determine the limits in which the price can move in the near future. It is likely that the top of the formation will be broken, where the target can be quite close supply zone 0.7050, and if the demand wins, it can push the price to the next zone, which is another 100p higher. This is how it looks at the moment theoretically… But you should bear in mind the Wednesday (03.07) ISM Non-Manufacturing PMI readings for the USA and payrolls that await us on Friday at 14:30. Especially the second data may turn the market and direct the quotes in the least expected direction.