Today at 12:30 GMT, as on every first Friday of the month we got to know the latest data on the US labor market. Payrolls positively surprised. Will better data help the weak dollar?

July report of the Bureau of Labor Statistics is wery positive. Positively surprising are not only non farming payrolls, but also data on the unemployment rate, trade balance or increase in hourly pay.

Better data and a good revision

The main report of the data pack published at 12:30 GMT is of course non farming payrolls. These turned out to be double optimistic. On the one hand, the July value of the index has beaten market forecasts (209,000 in July versus 183,000 estimated) and on the other hand, we are witnessing a major revision of the previous reading. June payrolls amounted to 222 thousand. As we have already thought, but as many as 231,000.

Also positively surprises the secondary payrolls – manufacturing payrolls. The number of new employeed in the industrial sector in July amounted to 16 thousand. Against forecasts of just five thousand.

Unemployment rate and wage growth in line with forecasts

The market was expecting an hourly wage increase of 0.3% versus June. Forecasts were correct and July is the third consecutive month that salaries in the United States have increased. After a last month rise in the unemployment rate to 4.4%, this indicator returns to 4.3%.

The balance completes the positive tone of the publication

In parallel with the BLS publication, we also learned about the change in US trade balance in June this year. Also, this data turned out to be positive for the dollar, as US deficit in foreign trade fell to $ 43.6 billion,forecasts pointed to a drop to $ 45 billion only.

Dollar gains but with some reserve

Today’s data has proved to be very positive and certainly will not serve as a pretext to delay possible Fed rates hike this fall. In spite of this, the dollar’s demand response is far from the outbreak of euphoria with which we usually deal with such important macroeconomic publications.

Do you trade data? Check out the benefits of vanilla options >>>

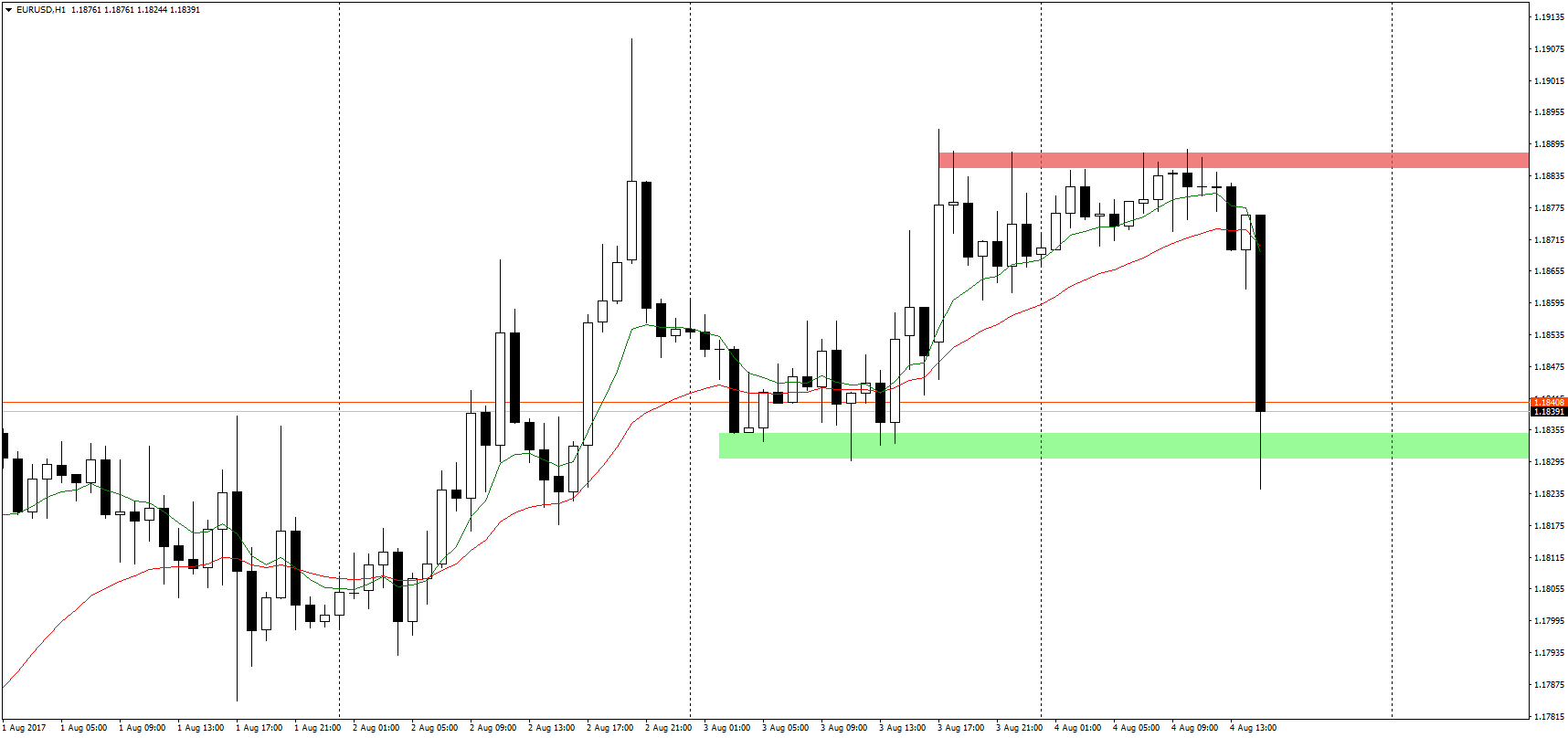

EUR/USD, which has been consolidating around the 1.1875 level for past few hours, is clearly dropping as seen on H1 chart. Declines reached local low falling 50 pips:

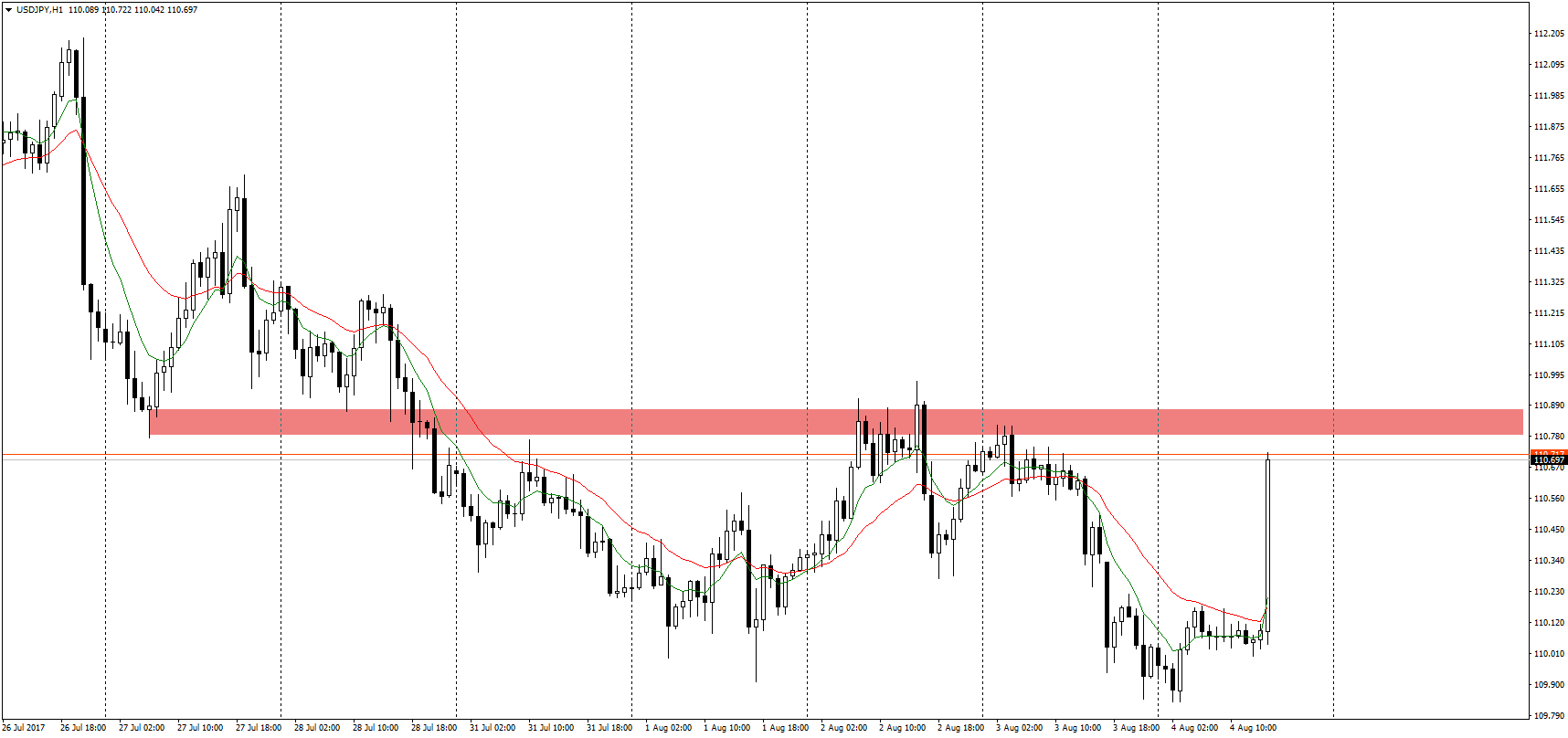

The similar size moves also appeared on the USD/JPY chart:

USD/CAD meanwhile establishes new highs. Growth is also on the weekly chart, which has a good chance of closing up with a clear demand candle after five weeks of uninterrupted declines: