Latest RBNZ monetary policy decisions + today’s weaker than expected labors market data lead to NZD sale and it was the number one info during the Asian session. It may give some investing opportunities. Let’s start today’s price action potential setups preview. Our team prepared 4 currency pairs – AUD/JPY, AUD/USD, EUR/CAD and NZD/USD.

Latest RBNZ monetary policy decisions + today’s weaker than expected labors market data lead to NZD sale and it was the number one info during the Asian session. It may give some investing opportunities. Let’s start today’s price action potential setups preview. Our team prepared 4 currency pairs – AUD/JPY, AUD/USD, EUR/CAD and NZD/USD.

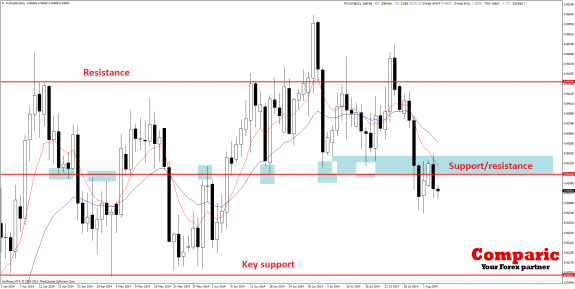

AUD/JPY:

Australian dollar against Japanese yen rebounds from support which is quite strong – it stopped downward movements many times in the past. We should seek price action buy signals here and open positions with TP in the vicinity of the 96.10 resistance.

AUD/USD:

Aussie rejected the resistance (earlier support) showing that now is not the best time for increases. There is still lack of clear purchase or sell signals, so for now it will be the best to just stay and watch – waiting for key support zone challenge and buying opportunities.

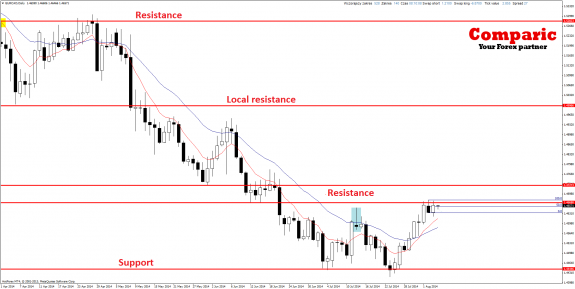

EUR/CAD:

Cross gave selling signal in the last week. Yesterday it was possible to open the position starting from 50% of latest candle retracement – now the candle is even higher which gives us really good RR ratio for short position. Goal in this transaction is located around 200 pips lower. Trend clearly downward, thus short positioning looks like a great idea.

NZD/USD:

There is a dynamic downward correction on Kiwi. Trend is however still upward, so we can count on rebound. In the case of clearer purchase signal on current levels we should think about buying.