In September, GBP was the best performing G10 currency on the back of the step up in hawkish commentary from the BoE. In our view the recent rate hike warnings from the MPC are rooted in the outlook for GBP.

In September, GBP was the best performing G10 currency on the back of the step up in hawkish commentary from the BoE. In our view the recent rate hike warnings from the MPC are rooted in the outlook for GBP.

The stabilising of sterling therefore suggests that the BoE’s verbal interventions have thus far been a policy success which could potentially reduce medium-term inflationary risks. However, the better tone of the pound was on the back of market expectations that the BoE would hike rates as soon as November. If the MPC backs away from this position, Governor Carney may again face accusations that he is behaving as an ‘unreliable boyfriend’ and the Bank could face a credibility issue. However, if the Bank makes the unusual decision of hiking rates at a time when there are clear signs of a slowing economy, the Bank’s credibility may also be questioned. This would imply the support that the BoE has recently afforded the pound could prove to be short-lived.

The Office of Nationals Statistic reported last Friday that there was a slowdown in household spending in Q2, driven by a decline in the purchase of motor vehicles. Going forward, this sector is likely to more broadly feel the impact of the sustained increase in the CPI inflation rate and the resultant downward pressure on real wages. This is a sizeable risk to economic growth going forward.

Get similar commentaries daily. Check FxWatcher>>>

Simultaneously levels of household debt in the UK are at elevated levels meaning that many households will not be able to increase borrowing further to buoy their expenditure. Not only does this bode poorly for overall consumption in an environment of falling real wages, but it also suggests that an increase in BoE interest rates is likely to be felt as a double whammy by many households. The implication is that the BoE are unlikely to be able to hike interest rates very far in months ahead. Although a BoE rate hike in November or in February may remove some downside potential for sterling, if the market assumes that the BoE are then likely to sit on their hands for an extended period, the pound is unlikely to see much sustained support. Indeed, once political uncertainty is layered on top of UK growth concerns, we see scope for the value of GBP to soften medium-term.

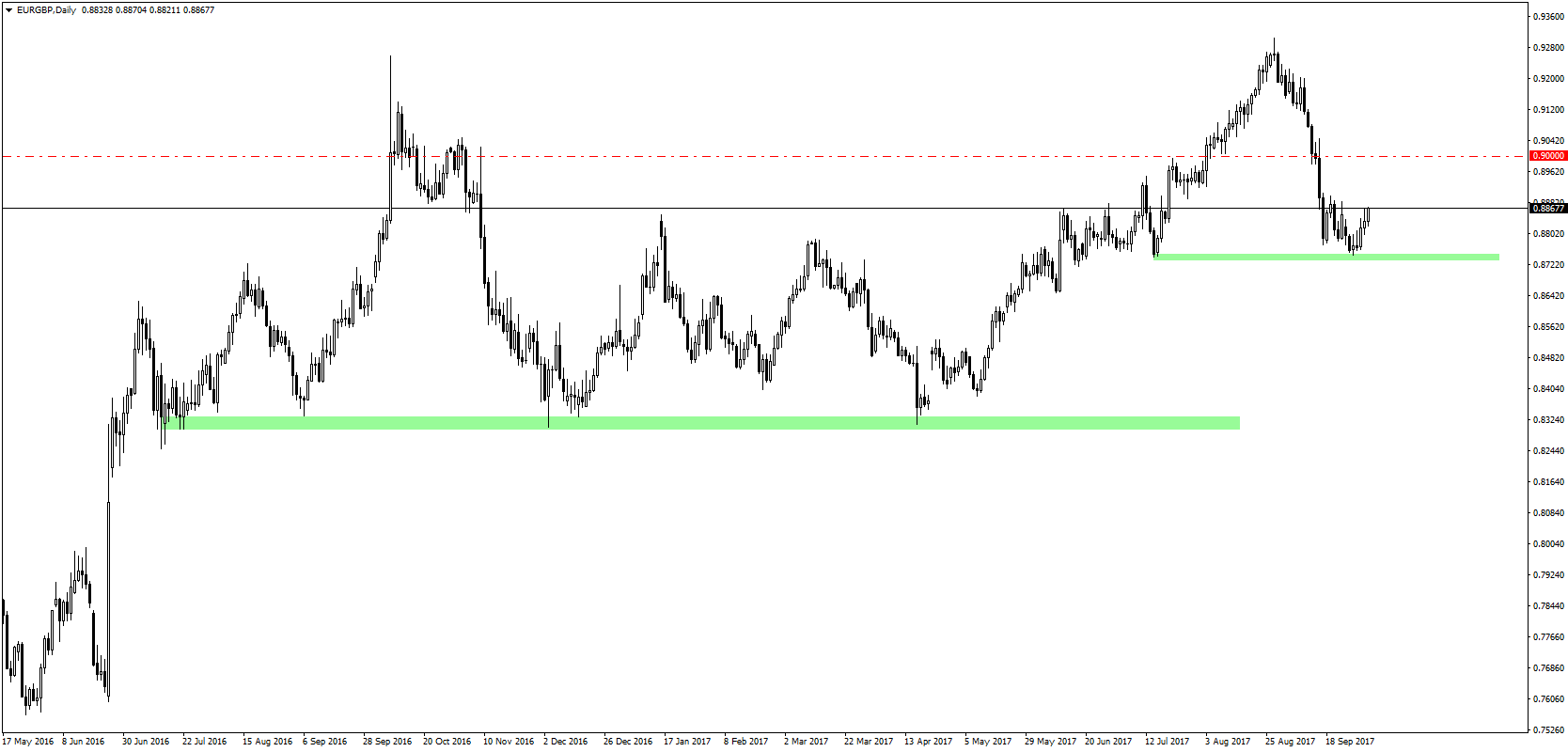

We see EUR/GBP as slipping back towards the 0.90 area around year end and pushing towards 0.95 next summer. These forecasts assume that the pace of Brexit talks remain slow and that UK firms continue to put contingencies for a hard Brexit into position.

We see EUR/GBP as slipping back towards the 0.90 area around year end and pushing towards 0.95 next summer. These forecasts assume that the pace of Brexit talks remain slow and that UK firms continue to put contingencies for a hard Brexit into position.