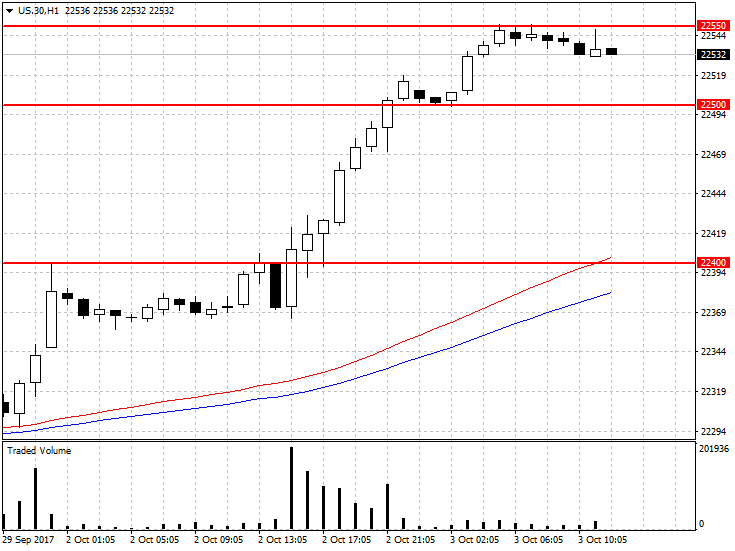

DOW JONES

The US.30 graph shows strong demand pressure and new historic highs. Price tested psychological level of resistance 22550 points. Now we observe response of the supply side. It is worth noting that the falls are accompanied by small volumes. Increased demand, coupled with an increase in volume will likely lead to breakdown of the aforementioned resistance. The support is around 22500 points. Breaking it can lead to a greater sell of. Support area confirmed by the volume is around 22400 points.

OIL WTI

US WTI quotations were in the support zone of 50.00-50.50 USD. There is an increased demand in these areas and bullish VSA formation. The absence of the lower low and setting of the higher high will increase the chance for more demand pressure and growth to vicinity of the next resistance at $ 51.50. Breaking the psychological level of $ 50.00 will open the way for further declines.

More market analysis and comments can be found at Noble Markets. Take a look at the broker’s portfolio entering the world of FX / CFD investment.

More market analysis and comments can be found at Noble Markets. Take a look at the broker’s portfolio entering the world of FX / CFD investment.

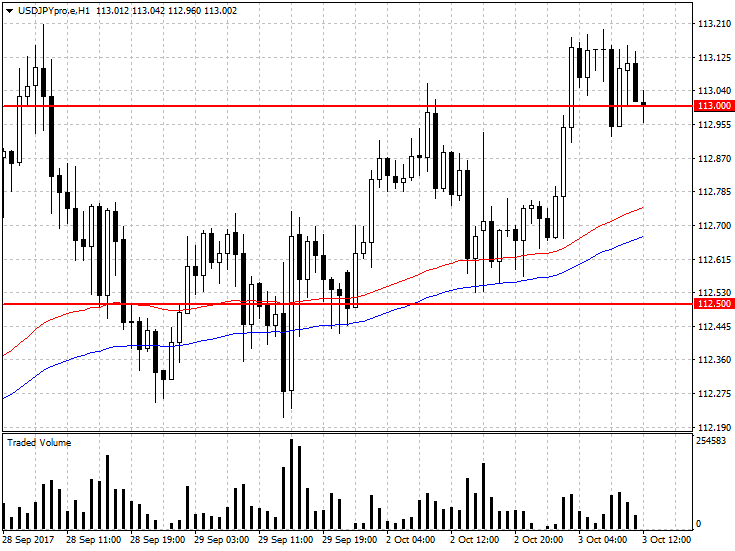

USDJPY

You can see that USDJPY is in consolidation. The price is currently around the upper limit of the formation. Growth was characterized by growing volume and increased chance of breaking resistance at 113.00. The bullish VSA formation along with the rejection of the lower levels will confirm the dominance of the bulls on the chart. Declines confirmed by volume may lead to test support 112,50.