“Search, Analyse, Trade” is a series of Price Action and Elliott Waves analyses. Its detailed step-by-step description can be found over here. I invite you to today’s review of selected currency pairs and potential trading opportunities. The analyses are based on the Dukascopy sentiment that you can get here.

“Search, Analyse, Trade” is a series of Price Action and Elliott Waves analyses. Its detailed step-by-step description can be found over here. I invite you to today’s review of selected currency pairs and potential trading opportunities. The analyses are based on the Dukascopy sentiment that you can get here.

EUR/USD has been stuck in consolidation just under the recent support. Fakey formed in conjunction with Outside Bars, which rejected the supply zone. All indications are that the last low will be defeated and we will see a move towards 1.1480. The last wave will be completed in this way and at these levels it should be decided whether it is a C wave ending the straight correction or a 1/3 wave. In the second case we will see a test of 1.1450 level.

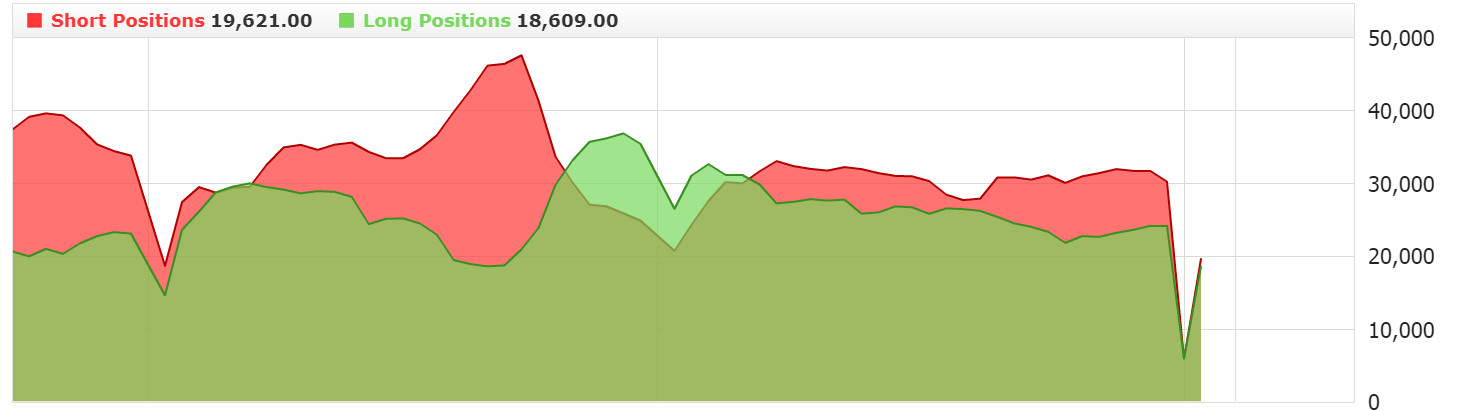

Not much happens on the sentiment graphs which is slowly returning to the Friday levels. The levels on which pair is currently also do not encourage to open new positions. I stand by and observe the charts.

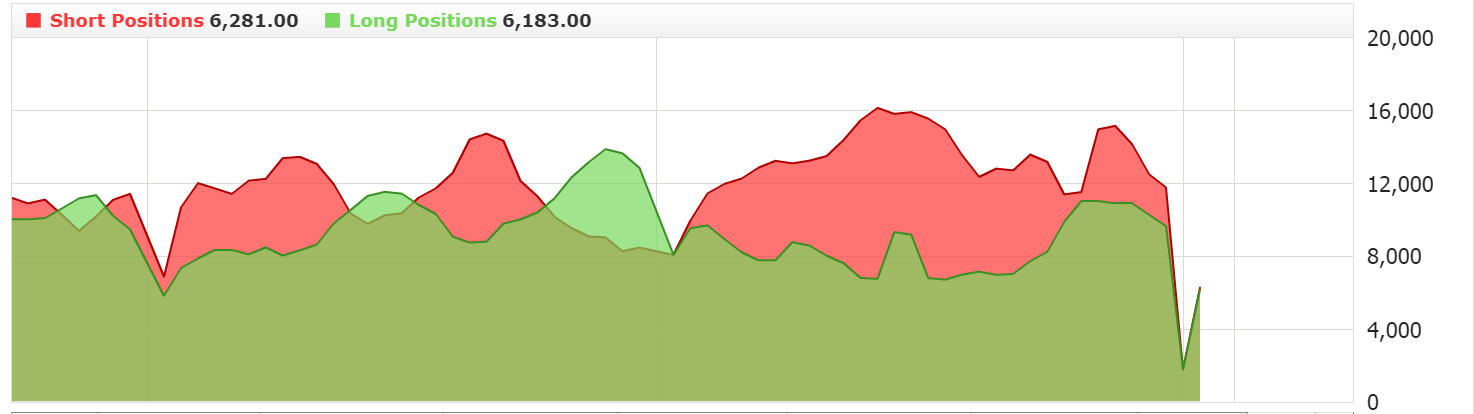

Nothing new happens on the daily chart of GBP/USD. Currently, the pair tests the lower limit of Inside Bar from the weekly chart and the trend line. A strong Pin Bar was created on the weekly chart, but only after the above levels will be broken we will have a signal of continuation of the downtrend towards the 1.2850 level.

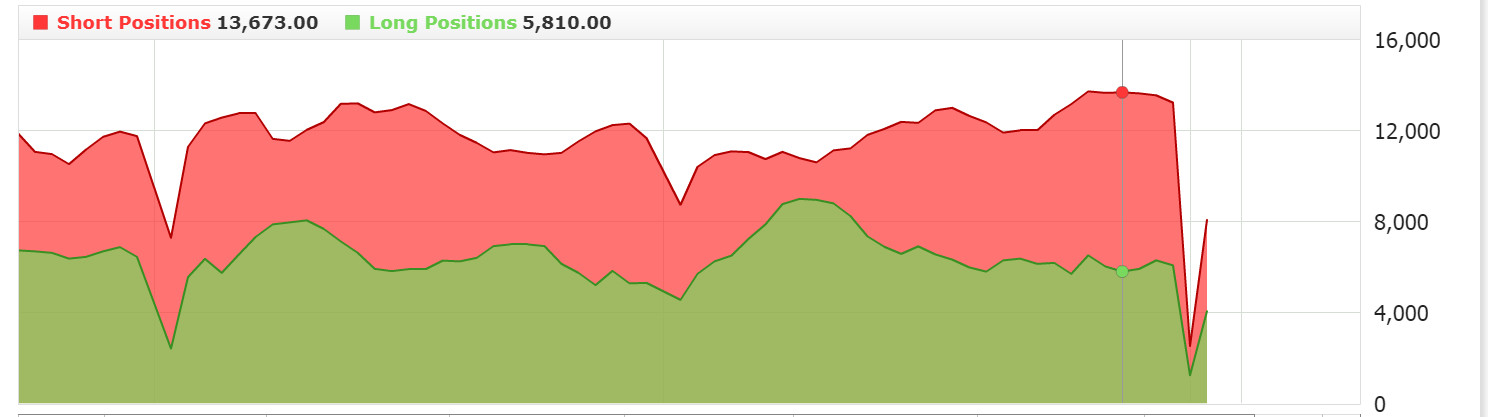

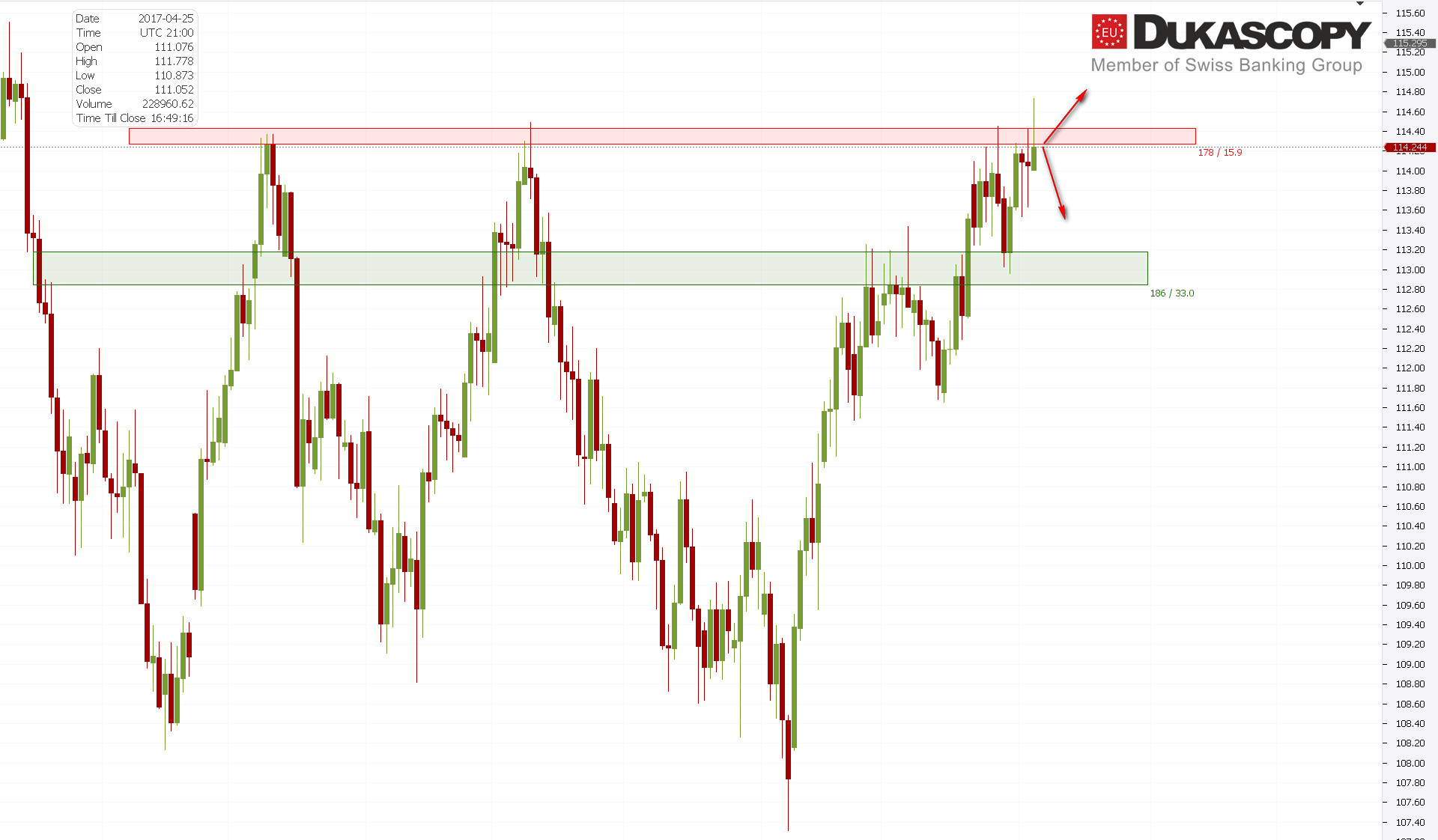

Once again the USD/JPY pair is trying to overcome the key resistance zone. The last two bullish Pin Bars promissed an attack of the zone, but so far unsuccessful. If resistance is again rejected, there should be more supply pressure and, as a result, a deeper correction. Breaking the level opens the way to 115,500.

Once again the USD/JPY pair is trying to overcome the key resistance zone. The last two bullish Pin Bars promissed an attack of the zone, but so far unsuccessful. If resistance is again rejected, there should be more supply pressure and, as a result, a deeper correction. Breaking the level opens the way to 115,500.