“Search, Analyse, Trade” is a series of analyses for Price Action and Elliott Waves. Its detailed step-by-step description can be found over here. I invite you to today’s review of selected currency pairs and potential trading opportunities.The analyses are based on the Dukascopy sentiment that can be seen here.

“Search, Analyse, Trade” is a series of analyses for Price Action and Elliott Waves. Its detailed step-by-step description can be found over here. I invite you to today’s review of selected currency pairs and potential trading opportunities.The analyses are based on the Dukascopy sentiment that can be seen here.

EURUSD

The gains generated by rebound from support have reached supply zone, thus creating the right arm of the hypothetical RGR formation. Initially, the level has been rejected by Pin Bar, and from this point on, we are observing declines. If the recent increase is a C-wave of irregular correction, the drops should increase in strength and soon we will wittnes test of the neck line. However, if the growth is a wave 1A, we will see another attempt to attack the recently rejected resistance zone.

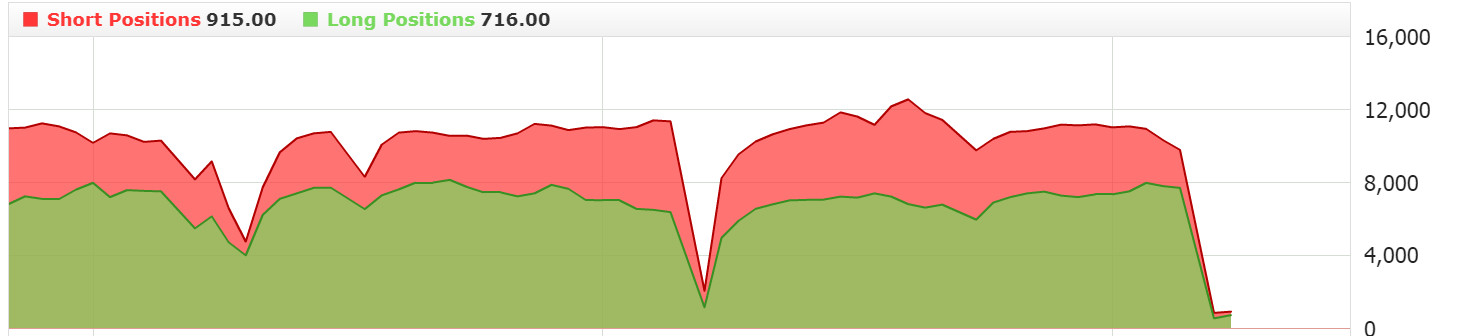

The sentiment graph clearly stands for growth. I counted on its change at the re-test of the resistance zone and planned opening a short. Unfortunately, there is no such possibility, so I remain on the side.

GBP/USD has breached local resistance zone and reached 1.3340, which is within the supply zone from the weekly chart. The level has been rejected. The upward movement seen from the low is so strong that it should be a 1A wave, and consequently the correction should see another growth impulse. This scenario seems more likely than the one that pair falls immediately to the trend line.

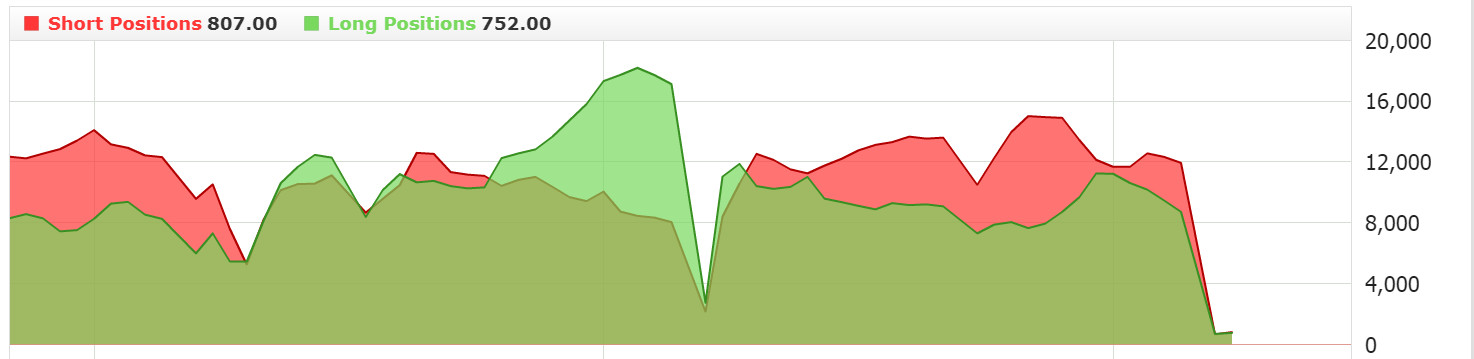

The sentiment remains neutral. We see the decline of both long and short positions. Because of the recent uptrend momentum I do not plan short from these levels and stay on the side.

The sentiment remains neutral. We see the decline of both long and short positions. Because of the recent uptrend momentum I do not plan short from these levels and stay on the side.

USD/JPY is trying to get out from consolidation in which it remains for two weeks. On the H4 chart just above the important support zone was an Inside Bar. Breaking down from it will mean that the zone is over and should accelerate and deepen the declines. Movement towards 110,700 will then become very probable. Defence of support should allow pair to return to growth or to continue consolidation.