Before another #SuperThursday HSBC analytic, Brent Donnelly prepared six unrelated thought about the current state of the market. Take a look and decide if he’s right…

Before another #SuperThursday HSBC analytic, Brent Donnelly prepared six unrelated thought about the current state of the market. Take a look and decide if he’s right…

Thought 1

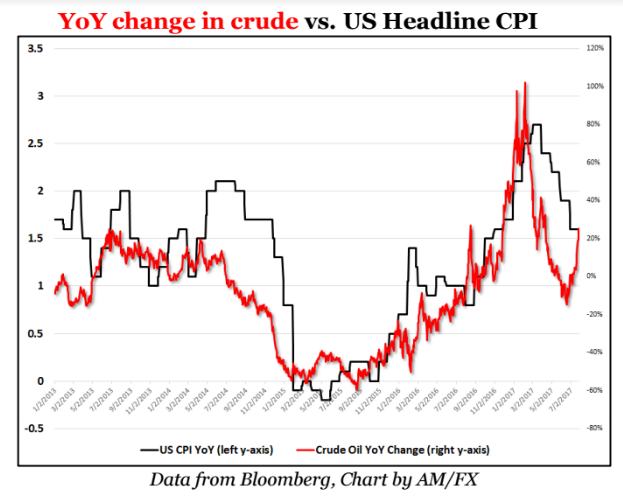

I find the market is really bad at anticipating turns in inflation even though you can forecast them almost perfectly just by looking at the base effect from oil. As the YoY change in crude oil is now around +25%, it is reasonable to expect headline inflation to base here and start slowly rising again soon. There are no guarantees in life but basic math works strongly in favor of those expecting inflation to rebound. The market was asleep at the wheel on this in February/March as it took yields to the highs just as the inevitable base effect was about to push headline inflation lower. Side note: Any central bank targeting headline inflation needs to seriously re-evaluate their mandate.

Thought 2

This article is an excellent round up of the current state of the Canadian real estate

market. The main takeaway is that the foreign buyer tax impact is likely temporary but

recent OSFI rule changes may have a more lasting impact. Here is the relevant quote: OSFI said it plans to require home buyers who do not need mortgage insurance – those with down payments greater than 20 per cent of the purchase price – to prove they could still afford their mortgages if interest rates were two percentage points higher than the rate they are offered by their bank.

The more stringent stress testing requirement could have a major impact on the real estate sector because uninsured buyers account for a larger proportion of all real estate sales in Canada.

Thought 3

In case you missed it: Here’s an epic working paper from the ECB on central bank communication and forward guidance. Eight authors on this one.

Thought 4

I leave tomorrow for my annual pilgrimage to Camp Kotok and then I’m on a family

trip to Canada after that. As always, I will write up a summary of my thoughts after Camp

Kotok. In case you have never heard of it, here is a quick background on the event:

https://www.wsj.com/articles/bright-lights-of-finance-head-to-low-key-camp-1407425447. That’s me playing poker at 0:42 in the video.

Thought 5

There are a few voices out there speculating that Draghi will deliver something DOVISH at Jackson Hole. With the rise in the euro, low Eurozone inflation and the recent fall in European equities, it’s possible. When the event was initially announced, the assumption was that President Draghi would lay out the taper and normalization schedule but the range of possible outcomes has started to widen.

Thought 6

I will be on a panel at this event in November: https://finance.knect365.com/global-

derivatives-trading-risk-management-usa/. Usually when I read the program for this type of event, it sounds pretty boring; but this event sounds really interesting.

Would you like to get more content like that? Try FxWatcher for free!

I am on a panel called: FX Volatility panel discussing the impact of large events and changes in the market with Saeed Amen (quanty guy, ex-Lehman) and Fred Goodwin (Senior Macro Strategy at State Street). See you there? 😉