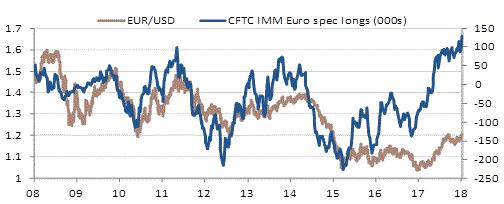

CFTC data show another jump to a new multi-year high in long Euro positions on the IMM, trumping Friday’s jobs data. It’s hard to argue against the proposition that the market is long, and very bullish of the Euro.

CFTC data show another jump to a new multi-year high in long Euro positions on the IMM, trumping Friday’s jobs data. It’s hard to argue against the proposition that the market is long, and very bullish of the Euro.

A pause seems reasonable after the failure to break clearly through EUR/USD 1.21. That said, yield differentials are moving the euro’s way and the US data do nothing to support the idea of a more aggressive Fed or of a range-break in Treasuries.

EUR/USD and CFTC positioning – another surge in EUR longs

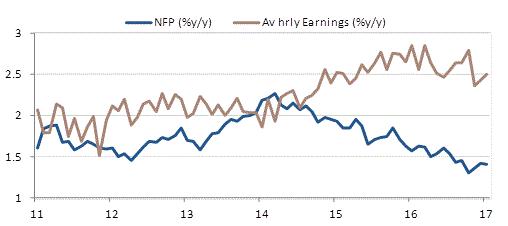

As for those jobs figures…Employment growth has slowed to 1.4% y/y, which is going to slow the pace at which the unemployment rate falls but is still enough to support decent GDP growth. Wage growth remains as absent as ever. Plus ca change…

Job growth slowing, wage growth slow and steady. Nothing new here

The only currencies better than the dollar today are the CAD and MYR which speaks to the oil price and pictures of extreme cold in the US. The Bank of Canada has a rate decision next week, feeding overexcitement Oil prices need to keep current levels but we’ll need to se 10-year real yields in Canada get above those in the US too, if we’re going to stage a test of USD/CAD 1.20.

Probability of a rate hike at Jan 17 BOC meting

Get simmilar commentaries on your mail>>>

The US sees consumer credit today, small business optimism tomorrow, but attention is reserved for CPI and retail sales on Friday. The Eurozone has consumer and business confidence data today, unemployment tomorrow the ECB ‘account’ on Thursday; The UK has a cabinet re-shuffle today, industrial production tomorrow and trade on Wednesday; Chinese CPI data are due Wednesday.